Rising Demand for Advanced Therapeutics

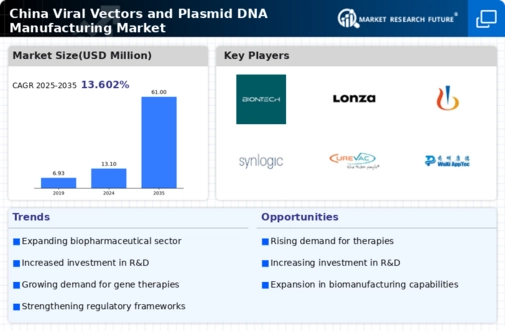

The viral vectors-and-plasmid-dna-manufacturing market in China is experiencing a notable surge in demand for advanced therapeutics. This trend is largely driven by the increasing prevalence of genetic disorders and chronic diseases, which necessitate innovative treatment solutions. As of 2025, the market is projected to grow at a CAGR of approximately 15%, reflecting a robust interest in gene therapies and personalized medicine. The Chinese government has been actively promoting research and development in biotechnology, which further fuels this demand. Consequently, manufacturers are compelled to enhance their production capabilities to meet the rising expectations for high-quality viral vectors and plasmid DNA. This evolving landscape indicates a promising future for the market, as stakeholders seek to capitalize on the growing need for effective therapeutic options.

Surge in Investment from Private Sector

The viral vectors-and-plasmid-dna-manufacturing market in China is benefiting from a surge in investment from the private sector. Venture capital firms and private equity investors are increasingly recognizing the potential of biotechnology, particularly in the realm of gene therapy and personalized medicine. This influx of capital is enabling companies to expand their research and development efforts, as well as enhance their manufacturing capabilities. As of 2025, it is projected that private investments in the sector could reach upwards of $1 billion, significantly bolstering the market's growth trajectory. This trend indicates a strong confidence in the future of the viral vectors-and-plasmid-dna-manufacturing market, as stakeholders seek to capitalize on emerging opportunities in the biotechnology landscape.

Growing Collaboration Between Academia and Industry

The viral vectors-and-plasmid-dna-manufacturing market in China is witnessing a growing trend of collaboration between academic institutions and industry players. This synergy is fostering innovation and accelerating the development of new therapies. Universities and research organizations are increasingly partnering with biotech companies to translate scientific discoveries into viable products. Such collaborations often lead to the sharing of resources, expertise, and technology, which can significantly enhance the efficiency of the manufacturing process. As of 2025, it is estimated that partnerships in this sector could lead to a 20% increase in the number of clinical trials involving gene therapies. This collaborative environment is likely to drive advancements in the market, as both parties work together to address the challenges associated with viral vector and plasmid DNA production.

Increased Regulatory Support for Biotech Innovations

Regulatory support is emerging as a crucial driver for the viral vectors-and-plasmid-dna-manufacturing market in China. The government has been implementing policies aimed at streamlining the approval processes for biopharmaceuticals, which is encouraging investment in the biotechnology sector. Recent initiatives have focused on providing clearer guidelines for the development and commercialization of gene therapies, thereby reducing the time and costs associated with bringing new products to market. This supportive regulatory environment is expected to enhance the competitiveness of domestic manufacturers, allowing them to better navigate the complexities of compliance. As a result, the market is likely to experience accelerated growth, with an increasing number of innovative therapies entering the pipeline.

Technological Advancements in Manufacturing Processes

Technological advancements play a pivotal role in shaping the viral vectors-and-plasmid-dna-manufacturing market in China. Innovations in production techniques, such as improved transfection methods and enhanced purification processes, are enabling manufacturers to produce higher yields of viral vectors and plasmid DNA with greater efficiency. These advancements not only reduce production costs but also enhance the quality and safety of the final products. As a result, companies are increasingly investing in state-of-the-art manufacturing facilities to leverage these technologies. The integration of automation and digitalization in manufacturing processes is also expected to streamline operations, thereby increasing overall productivity. This trend suggests that the market is likely to witness a transformation in production capabilities, ultimately benefiting the development of novel therapeutics.