Influence of Dietary Trends

Dietary trends, such as the rise of high-protein diets, are significantly influencing the protein ingredients market in China. As consumers increasingly adopt diets that emphasize protein intake for weight management and muscle building, the demand for protein-rich products is surging. This trend is evident in the popularity of protein bars, shakes, and fortified foods, which are becoming staples in many households. The protein ingredients market is responding to this shift by expanding its product offerings to include a variety of protein sources, catering to diverse dietary preferences. Market analysis indicates that the high-protein diet trend could contribute to a growth rate of approximately 7% in the protein ingredients market over the next few years, reflecting the changing dietary habits of the population.

Growing Health Consciousness

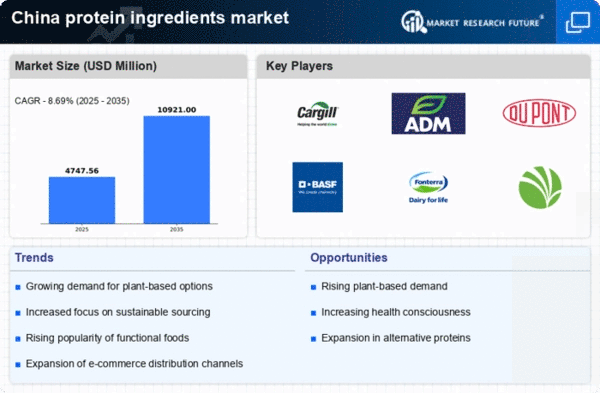

The increasing awareness of health and wellness among consumers in China is driving the protein ingredients market. As individuals become more health-conscious, they seek products that offer nutritional benefits, including high protein content. This trend is reflected in the rising demand for protein-rich foods and supplements, which are perceived as essential for maintaining a balanced diet. According to recent data, the protein ingredients market in China is projected to grow at a CAGR of approximately 8% from 2025 to 2030. This growth is indicative of a broader shift towards healthier eating habits, with consumers prioritizing protein intake for muscle maintenance and overall health. The protein ingredients market is thus witnessing a surge in product innovation, with manufacturers developing diverse protein sources to cater to this evolving consumer preference.

Rising Demand for Sustainable Sourcing

Sustainability has emerged as a critical factor influencing the protein ingredients market in China. Consumers are increasingly concerned about the environmental impact of their food choices, prompting a shift towards sustainably sourced protein ingredients. This trend is reflected in the growing popularity of plant-based proteins, which are perceived as more environmentally friendly compared to traditional animal-based sources. The protein ingredients market is adapting to this demand by investing in sustainable sourcing practices and developing innovative products that align with eco-conscious consumer preferences. Recent studies suggest that the market for sustainable protein ingredients could grow by 15% over the next five years, indicating a strong shift towards environmentally responsible consumption patterns.

Expansion of the Sports Nutrition Sector

The burgeoning sports nutrition sector in China is significantly impacting the protein ingredients market. With a growing number of fitness enthusiasts and athletes, there is an increasing demand for protein supplements and functional foods that support athletic performance and recovery. The protein ingredients market is responding to this trend by offering specialized products that cater to the nutritional needs of active individuals. Market data indicates that the sports nutrition segment is expected to account for a substantial share of the overall protein ingredients market, with an estimated growth rate of 10% annually. This expansion is driven by the rising popularity of fitness activities and the increasing participation in sports, leading to a heightened focus on protein intake among consumers.

Technological Advancements in Protein Extraction

Technological innovations in protein extraction and processing are playing a pivotal role in shaping the protein ingredients market in China. Advances in extraction techniques, such as enzymatic hydrolysis and membrane filtration, are enhancing the efficiency and quality of protein ingredients. These technologies enable manufacturers to produce high-purity protein isolates and concentrates that meet the diverse needs of consumers. The protein ingredients market is likely to benefit from these advancements, as they facilitate the development of new products with improved nutritional profiles. Furthermore, the integration of technology in production processes is expected to reduce costs and increase the availability of protein ingredients, thereby driving market growth.