Growing Health Consciousness

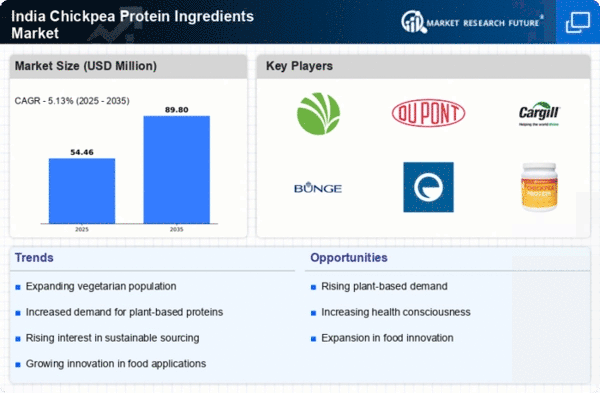

The increasing awareness of health and wellness among consumers in India appears to be a significant driver for the chickpea protein-ingredients market. As individuals become more informed about the nutritional benefits of plant-based proteins, the demand for chickpea protein is likely to rise. Chickpeas are known for their high protein content, containing approximately 20-25 g of protein per 100 g. This shift towards healthier eating habits is reflected in the growing market, which is projected to expand at a CAGR of around 8% over the next five years. Consumers are actively seeking alternatives to animal-based proteins, and chickpea protein-ingredients are emerging as a preferred choice due to their health benefits and versatility in various food applications.

Rising Popularity of Functional Foods

The trend towards functional foods is influencing the chickpea protein-ingredients market in India. Consumers are increasingly seeking foods that offer health benefits beyond basic nutrition, and chickpea protein fits this demand. Rich in fiber, vitamins, and minerals, chickpeas are perceived as a superfood, which enhances their appeal. The market for functional foods is expected to grow at a CAGR of 7% over the next few years, providing a favorable environment for chickpea protein-ingredients. As food manufacturers incorporate chickpea protein into various products, such as snacks and beverages, the market is likely to expand, catering to health-conscious consumers looking for nutritious options.

Expansion of Vegan and Vegetarian Diets

The rise of vegan and vegetarian diets in India is a notable driver for the chickpea protein-ingredients market. With a significant portion of the population adhering to plant-based diets, the demand for chickpea protein is likely to increase. Chickpeas serve as an excellent source of protein for those avoiding animal products, providing essential amino acids and nutrients. The market for chickpea protein-ingredients is projected to grow as food manufacturers develop innovative products catering to consumers following plant-based diets. Recent estimates suggest that the vegan food market in India could reach $10 billion by 2025, indicating a substantial opportunity for chickpea protein-ingredients to capture a share of this expanding market.

Government Support for Pulses Cultivation

Government initiatives aimed at promoting pulses cultivation in India are likely to bolster the chickpea protein-ingredients market. With policies encouraging farmers to grow pulses, including chickpeas, the supply chain for chickpea protein is expected to strengthen. This support not only enhances the availability of raw materials but also contributes to price stability in the market. The Indian government has set ambitious targets for increasing pulse production, which could lead to a projected increase in chickpea availability by 15% over the next few years. As a result, the chickpea protein-ingredients market may benefit from improved supply dynamics, enabling manufacturers to meet the growing consumer demand for plant-based protein.

Sustainability and Environmental Concerns

Sustainability is becoming increasingly important in the food industry, and this trend is influencing the chickpea protein-ingredients market. As consumers in India express concerns about the environmental impact of their food choices, plant-based proteins like chickpeas are gaining traction. The cultivation of chickpeas requires less water and land compared to animal farming, making them a more sustainable option. This shift towards sustainable food sources is likely to drive growth in the chickpea protein-ingredients market, as brands align their products with eco-friendly practices. The market is expected to see a rise in demand for chickpea protein-ingredients, potentially increasing by 10% in the coming years as consumers prioritize sustainability in their purchasing decisions.