Innovation in Medical Technology

Innovation in medical technology is a crucial driver for the catheters active-implantable-cdmo market. The continuous development of advanced materials and designs enhances the functionality and safety of catheters. For instance, the introduction of biocompatible materials reduces the risk of infection and improves patient comfort. In 2025, the market for advanced catheter technologies is anticipated to grow by approximately 15%, driven by innovations such as smart catheters equipped with sensors for real-time monitoring. These advancements not only improve clinical outcomes but also attract investment from both public and private sectors. As a result, the catheters active-implantable-cdmo market is likely to benefit from increased research and development efforts, fostering a competitive landscape that prioritizes patient-centric solutions.

Increasing Healthcare Expenditure

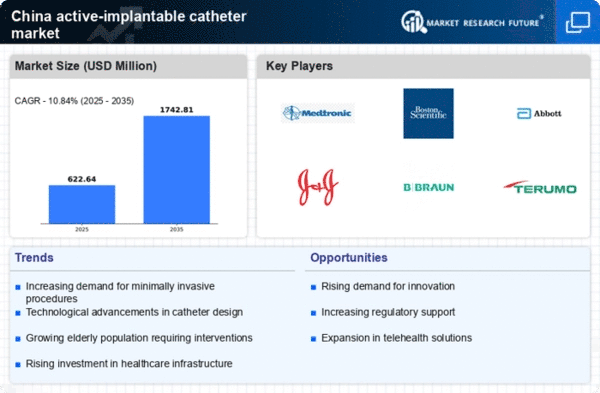

The rising healthcare expenditure in China is a pivotal driver for the catheters active-implantable-cdmo market. As the government allocates more funds towards healthcare, the demand for advanced medical devices, including catheters, is likely to increase. In 2025, healthcare spending in China is projected to reach approximately $1 trillion, reflecting a growth rate of around 10% annually. This financial commitment enables hospitals and healthcare facilities to invest in innovative catheter technologies, enhancing patient care and outcomes. Furthermore, the expansion of health insurance coverage is expected to facilitate access to these advanced devices, thereby propelling the catheters active-implantable-cdmo market forward. The combination of increased funding and improved access to healthcare services suggests a robust growth trajectory for this market segment.

Government Initiatives and Support

Government initiatives and support play a vital role in shaping the catheters active-implantable-cdmo market. The Chinese government has implemented various policies aimed at promoting the development and adoption of advanced medical technologies. Initiatives such as the Healthy China 2030 plan emphasize the importance of innovation in healthcare, encouraging local manufacturers to enhance their capabilities. Additionally, financial incentives and grants are provided to companies engaged in the production of medical devices, including catheters. This supportive environment fosters collaboration between public institutions and private enterprises, potentially leading to accelerated growth in the catheters active-implantable-cdmo market. As these initiatives continue to evolve, they are likely to create a more favorable landscape for market participants.

Rising Awareness of Patient Safety

Rising awareness of patient safety is increasingly influencing the catheters active-implantable-cdmo market. Healthcare providers and patients alike are becoming more cognizant of the risks associated with catheter use, such as infections and complications. This heightened awareness drives demand for safer, more reliable catheter options. In response, manufacturers are focusing on developing products that adhere to stringent safety standards and incorporate features that minimize risks. The market is expected to see a shift towards catheters designed with antimicrobial properties and enhanced usability. As patient safety becomes a priority in healthcare settings, the catheters active-implantable-cdmo market is likely to experience growth, reflecting the industry's commitment to improving patient outcomes.

Aging Population and Chronic Diseases

China's aging population is a significant factor influencing the catheters active-implantable-cdmo market. With over 250 million individuals aged 60 and above, the demand for medical interventions, including catheterization, is on the rise. Chronic diseases such as cardiovascular disorders and diabetes are prevalent among this demographic, necessitating the use of catheters for treatment and management. The World Health Organization indicates that by 2030, chronic diseases will account for approximately 70% of all deaths in China. This trend underscores the urgent need for effective medical devices, thereby driving the catheters active-implantable-cdmo market. As healthcare providers adapt to the needs of an aging population, the market for catheters is expected to expand significantly, reflecting the growing demand for specialized medical solutions.