Aging Population and Chronic Diseases

Italy's demographic shift towards an aging population is significantly impacting the catheters active-implantable-cdmo market. With an increasing number of elderly individuals, the prevalence of chronic diseases such as cardiovascular conditions and diabetes is on the rise. Reports indicate that nearly 25% of the Italian population is over 65 years old, leading to a higher demand for medical devices, including catheters. This demographic trend necessitates the development of specialized catheters that cater to the unique needs of older patients. As healthcare systems adapt to these changes, the catheters active-implantable-cdmo market is likely to experience substantial growth driven by the need for effective management of chronic health issues.

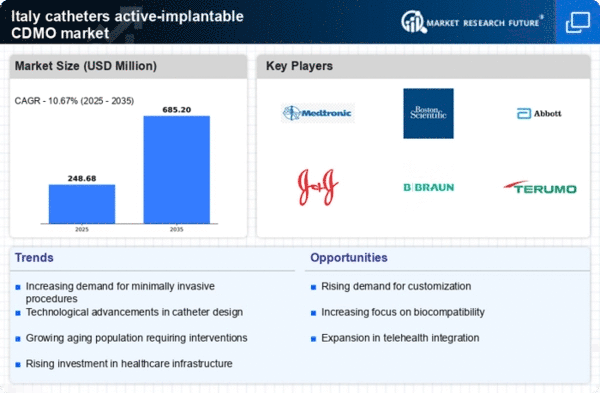

Investment in Healthcare Infrastructure

The Italian government's commitment to enhancing healthcare infrastructure is a pivotal driver for the catheters active-implantable-cdmo market. Recent initiatives have focused on upgrading medical facilities and expanding access to advanced medical technologies. With an investment of approximately €2 billion allocated for healthcare improvements, the market is poised for growth. This financial support is expected to facilitate the adoption of innovative catheter technologies, thereby improving patient outcomes. Furthermore, as hospitals and clinics modernize their equipment, the demand for high-quality catheters is likely to increase, further propelling the catheters active-implantable-cdmo market.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is reshaping the catheters active-implantable-cdmo market. Innovations such as telemedicine, artificial intelligence, and data analytics are being increasingly utilized to enhance patient care and streamline medical processes. In Italy, healthcare providers are adopting these technologies to improve the efficiency of catheter-related procedures. This integration not only enhances the accuracy of diagnoses but also optimizes the management of catheter usage. As a result, the demand for technologically advanced catheters is expected to rise, driving growth in the catheters active-implantable-cdmo market. The potential for improved patient outcomes through these innovations is likely to further stimulate market expansion.

Growing Awareness of Health and Wellness

There is a notable increase in health consciousness among the Italian population, which is influencing the catheters active-implantable-cdmo market. As individuals become more aware of the importance of preventive healthcare, there is a corresponding rise in the utilization of medical devices, including catheters. This trend is supported by educational campaigns and initiatives aimed at promoting health and wellness. Consequently, healthcare providers are more inclined to recommend advanced catheter solutions for various medical conditions. The catheters active-implantable-cdmo market is likely to benefit from this heightened awareness, as patients seek out effective and reliable medical devices to manage their health.

Rising Demand for Minimally Invasive Procedures

The increasing preference for minimally invasive procedures in Italy is driving the catheters active-implantable-cdmo market. Patients and healthcare providers are gravitating towards techniques that reduce recovery time and minimize surgical risks. This trend is reflected in the growing number of procedures performed, with estimates suggesting a rise of approximately 15% annually. As a result, manufacturers are compelled to innovate and enhance their product offerings to meet the evolving needs of healthcare professionals. The demand for advanced catheter technologies, which facilitate these procedures, is likely to bolster the market further. Consequently, the catheters active-implantable-cdmo market is positioned to benefit from this shift towards less invasive treatment options.