Expansion of End-User Industries

The expansion of end-user industries, including electronics, automotive, and healthcare, is a crucial driver for the Carbonyl Iron Powder Market. As these sectors continue to grow, the demand for high-quality materials like carbonyl iron powder is expected to rise correspondingly. For instance, the electronics industry, which has been growing at a rate of approximately 5% annually, increasingly relies on carbonyl iron powder for producing magnetic components and other critical parts. This trend is mirrored in the automotive sector, where the shift towards electric vehicles necessitates advanced materials. Consequently, the Carbonyl Iron Powder Market is poised for growth, driven by the increasing requirements of these diverse end-user applications.

Growth in Renewable Energy Sector

The renewable energy sector is emerging as a significant driver for the Carbonyl Iron Powder Market. With the global push towards sustainable energy solutions, carbonyl iron powder is increasingly being used in the production of high-performance batteries and energy storage systems. The market for energy storage is projected to expand at a compound annual growth rate of over 20% in the coming years, which could substantially increase the demand for carbonyl iron powder. This material's ability to enhance the efficiency and longevity of energy storage solutions positions it as a critical component in the transition to renewable energy. As such, the Carbonyl Iron Powder Market is likely to benefit from this growing trend, aligning with global sustainability goals.

Rising Demand in Healthcare Applications

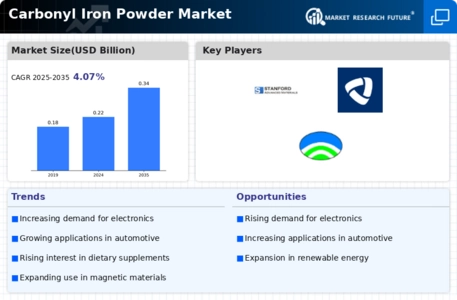

The healthcare sector is increasingly recognizing the potential of the Carbonyl Iron Powder Market, particularly in the formulation of iron supplements and pharmaceuticals. Carbonyl iron powder is favored for its high bioavailability and safety profile, making it a preferred choice for dietary supplements aimed at addressing iron deficiency. The Carbonyl Iron Powder Market is projected to reach USD 3 billion by 2025, with carbonyl iron powder playing a pivotal role in this growth. As awareness of nutritional deficiencies rises, the demand for high-quality iron supplements is expected to surge, thereby driving the Carbonyl Iron Powder Market. This trend underscores the material's versatility and its critical role in improving public health outcomes.

Increasing Applications in Automotive Industry

The automotive sector is witnessing a notable rise in the utilization of Carbonyl Iron Powder Market due to its unique properties, such as high purity and fine particle size. These characteristics make it an ideal choice for manufacturing components like magnetic materials and fuel cells. As the automotive industry increasingly focuses on enhancing fuel efficiency and reducing emissions, the demand for advanced materials like carbonyl iron powder is likely to grow. In 2023, the automotive segment accounted for approximately 25% of the overall carbonyl iron powder consumption, indicating a robust market presence. This trend is expected to continue, driven by the ongoing shift towards electric vehicles and the need for lightweight materials, thereby propelling the Carbonyl Iron Powder Market further.

Technological Innovations in Manufacturing Processes

Technological advancements in the production of carbonyl iron powder are significantly influencing the Carbonyl Iron Powder Market. Innovations such as improved atomization techniques and enhanced purification processes are leading to higher quality products with better performance characteristics. These advancements not only increase the efficiency of production but also reduce costs, making carbonyl iron powder more accessible to various industries. As manufacturers adopt these new technologies, the market is likely to see an influx of high-performance carbonyl iron powders, catering to diverse applications. This evolution in manufacturing processes is expected to bolster the Carbonyl Iron Powder Market, fostering growth and competitiveness.