Technological Innovations

Technological advancements in pigment production and application techniques are significantly influencing the Iron Oxide Pigments Market. Innovations such as improved synthesis methods and enhanced dispersion technologies are enabling manufacturers to produce pigments with superior performance characteristics. For instance, advancements in nanotechnology have led to the development of iron oxide pigments with enhanced color stability and durability. This has resulted in a broader range of applications, particularly in high-performance coatings and specialty products. The market is projected to expand as these technologies become more widely adopted, potentially increasing the market size by an estimated 4% annually. Additionally, the integration of automation in production processes is likely to enhance efficiency and reduce costs, further driving market growth.

Sustainability Initiatives

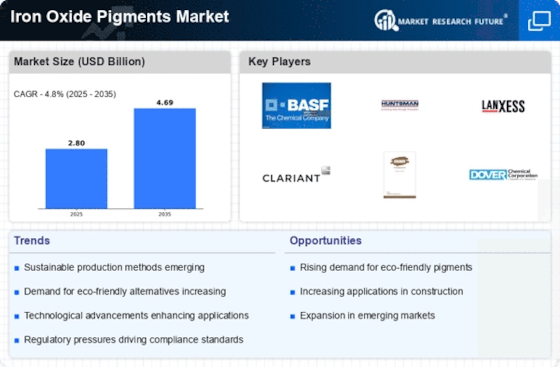

The increasing emphasis on sustainability within various industries appears to be a pivotal driver for the Iron Oxide Pigments Market. As manufacturers seek eco-friendly alternatives, iron oxide pigments, known for their non-toxic and biodegradable properties, are gaining traction. This shift is evidenced by a growing number of companies adopting sustainable practices, which has led to a projected increase in demand for these pigments. The market is expected to witness a compound annual growth rate of approximately 5% over the next few years, driven by the rising preference for sustainable materials in construction, coatings, and plastics. Furthermore, regulatory frameworks promoting environmentally friendly products are likely to bolster the market, as industries strive to comply with stringent environmental standards.

Rising Demand in Construction

The construction sector's robust growth is a crucial driver for the Iron Oxide Pigments Market. As urbanization accelerates and infrastructure projects proliferate, the demand for high-quality pigments in construction materials is on the rise. Iron oxide pigments are favored for their excellent color retention and UV stability, making them ideal for use in concrete, masonry, and roofing applications. Recent data indicates that the construction industry is expected to grow at a rate of 6% annually, which directly correlates with the increasing consumption of iron oxide pigments. This trend is further supported by the growing preference for colored concrete and decorative finishes, which are becoming increasingly popular in modern architecture. Consequently, the market for iron oxide pigments is likely to experience substantial growth as construction activities continue to expand.

Expanding Applications in Coatings

The expanding applications of iron oxide pigments in the coatings industry are driving significant growth in the Iron Oxide Pigments Market. These pigments are widely used in architectural, industrial, and automotive coatings due to their excellent opacity, lightfastness, and weather resistance. The coatings market is projected to grow at a compound annual growth rate of around 5% over the next few years, with iron oxide pigments playing a vital role in enhancing the performance and aesthetic appeal of coatings. Additionally, the trend towards high-performance coatings, which require durable and long-lasting pigments, is likely to further boost demand. As manufacturers continue to innovate and develop new formulations, the reliance on iron oxide pigments in coatings is expected to increase, thereby propelling market growth.

Consumer Preference for Natural Colors

The growing consumer preference for natural and earthy colors is emerging as a significant driver for the Iron Oxide Pigments Market. As consumers become more discerning about color choices in various products, including paints, cosmetics, and textiles, the demand for iron oxide pigments, which offer a range of natural hues, is likely to rise. This trend is particularly evident in the home decor and fashion industries, where there is a marked shift towards organic and sustainable products. Market analysis suggests that the demand for natural pigments could increase by approximately 5% annually, as brands seek to align with consumer values and preferences. Consequently, the iron oxide pigments market is poised to benefit from this shift, as manufacturers respond to the growing desire for products that reflect a more natural aesthetic.