Rising Demand for Water Infrastructure

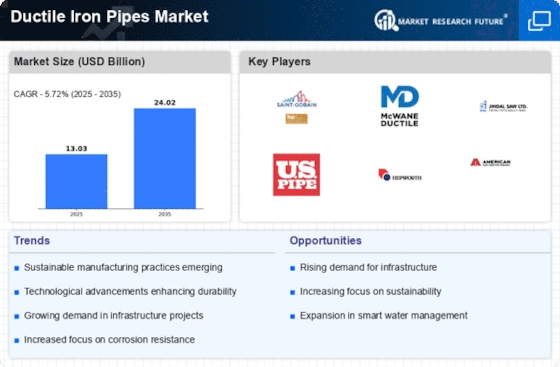

The Ductile Iron Pipes Market is experiencing a notable increase in demand due to the urgent need for improved water infrastructure. As urban populations grow, the necessity for reliable water supply systems becomes paramount. According to recent data, investments in water infrastructure are projected to reach substantial figures, with many regions allocating significant budgets for upgrades and replacements. Ductile iron pipes, known for their durability and resistance to corrosion, are increasingly favored for these projects. This trend is likely to continue as municipalities prioritize the modernization of aging water systems, thereby driving growth in the ductile iron pipes sector.

Increased Focus on Wastewater Management

The Ductile Iron Pipes Market is also benefiting from heightened awareness regarding wastewater management. Governments and organizations are increasingly recognizing the importance of effective wastewater treatment systems to protect public health and the environment. As a result, there is a growing investment in infrastructure that utilizes ductile iron pipes, which are well-suited for handling wastewater due to their strength and longevity. Recent statistics indicate that The Ductile Iron Pipes Market is expected to expand significantly, further propelling the demand for ductile iron pipes. This focus on sustainable wastewater management practices is likely to enhance the market landscape for ductile iron pipes.

Technological Innovations in Pipe Manufacturing

Technological advancements in the manufacturing processes of ductile iron pipes are transforming the Ductile Iron Pipes Market. Innovations such as improved casting techniques and enhanced quality control measures are leading to the production of pipes that offer superior performance and reliability. These advancements not only reduce production costs but also enhance the overall quality of the pipes, making them more appealing to consumers. As manufacturers adopt these technologies, the market is expected to witness a surge in the availability of high-quality ductile iron pipes, which could potentially increase market share and attract new customers.

Growing Awareness of Environmental Sustainability

The Ductile Iron Pipes Market is increasingly influenced by the growing awareness of environmental sustainability. As stakeholders become more conscious of the environmental impact of construction materials, ductile iron pipes are gaining traction due to their recyclability and lower carbon footprint compared to alternatives. This shift in consumer preference is prompting manufacturers to emphasize the sustainable attributes of ductile iron pipes in their marketing strategies. Furthermore, as sustainability becomes a key criterion in procurement processes, the demand for ductile iron pipes is likely to rise, aligning with global efforts to promote eco-friendly construction practices.

Regulatory Support for Infrastructure Development

The Ductile Iron Pipes Market is likely to benefit from supportive regulatory frameworks aimed at enhancing infrastructure development. Governments across various regions are implementing policies that encourage investment in water and wastewater infrastructure, which often includes the use of ductile iron pipes. These regulations may provide financial incentives or streamline approval processes for projects that utilize durable materials. As a result, the market for ductile iron pipes is expected to grow, driven by the favorable regulatory environment that promotes the adoption of reliable and long-lasting piping solutions.