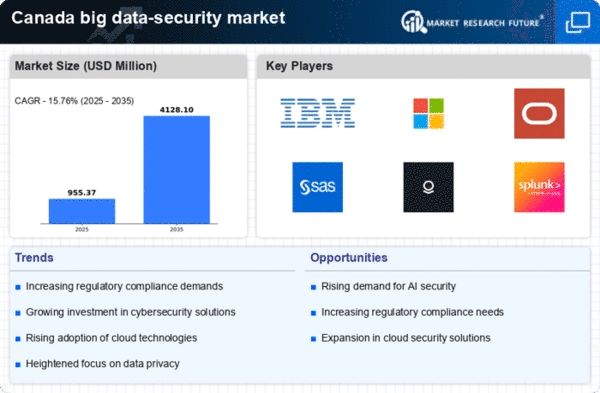

Regulatory Landscape

The evolving regulatory landscape in Canada significantly influences the big data-security market. With stringent data protection laws, such as the Personal Information Protection and Electronic Documents Act (PIPEDA), organizations are compelled to adopt comprehensive security measures. Compliance with these regulations is not merely a legal obligation but also a strategic necessity to maintain consumer trust. The market is witnessing a shift as companies invest in compliance-driven security solutions, which are projected to account for approximately 25% of total security spending in the coming years. This regulatory pressure drives innovation and the development of advanced security technologies, as businesses strive to meet compliance requirements while safeguarding their data assets. Consequently, the big data-security market is likely to expand as organizations seek to align their security strategies with regulatory mandates.

Rising Cyber Threats

The increasing frequency and sophistication of cyber threats is a primary driver for the big data-security market. In Canada, organizations are facing a surge in cyberattacks, with reports indicating a rise of over 30% in incidents over the past year. This alarming trend compels businesses to invest in robust security measures to protect sensitive data. The big data-security market is expected to grow as companies seek advanced solutions to mitigate risks associated with data breaches and ransomware attacks. As a result, the demand for innovative security technologies, such as machine learning and artificial intelligence, is likely to escalate, further propelling market growth. Organizations are prioritizing cybersecurity budgets, with many allocating upwards of 15% of their IT budgets to security solutions, reflecting the critical need for enhanced protection in the face of evolving threats.

Increased Data Generation

The exponential growth of data generation in Canada is a critical driver for the big data-security market. With the proliferation of IoT devices and digital transactions, organizations are now handling vast amounts of data, which presents unique security challenges. It is estimated that data generation in Canada will increase by over 40% in the next five years, necessitating advanced security solutions to protect this data. As businesses recognize the importance of securing their data assets, investments in big data-security technologies are likely to rise. This trend indicates a shift towards proactive security measures, as organizations aim to prevent data breaches before they occur. The big data-security market is expected to benefit from this surge in data generation, as companies seek to implement comprehensive security frameworks to manage and protect their growing data volumes.

Adoption of Cloud Technologies

The rapid adoption of cloud technologies in Canada is a significant driver for the big data-security market. As businesses increasingly migrate their operations to the cloud, the need for robust security measures to protect sensitive data stored in cloud environments becomes paramount. Reports indicate that over 70% of Canadian organizations are utilizing cloud services, creating a pressing demand for security solutions tailored to cloud infrastructures. This trend is expected to fuel the growth of the big data-security market, as companies seek to implement effective security protocols to safeguard their data against potential breaches. Furthermore, the integration of cloud security solutions is projected to represent a substantial portion of the overall security market, with estimates suggesting it could reach $3 billion by 2026. This shift towards cloud adoption necessitates a reevaluation of security strategies, driving innovation and investment in the big data-security market.

Emerging Technologies and Innovations

The emergence of new technologies and innovations is reshaping the big data-security market in Canada. Technologies such as artificial intelligence, machine learning, and blockchain are being integrated into security solutions, enhancing their effectiveness in combating cyber threats. The market is witnessing a growing interest in these advanced technologies, with investments in AI-driven security solutions projected to increase by 20% annually. This trend reflects a broader recognition of the need for adaptive and intelligent security measures that can respond to evolving threats. As organizations seek to leverage these technologies, the big data-security market is likely to experience significant growth. The integration of innovative solutions not only improves security posture but also enables organizations to gain insights from their data, further driving the demand for sophisticated security technologies.