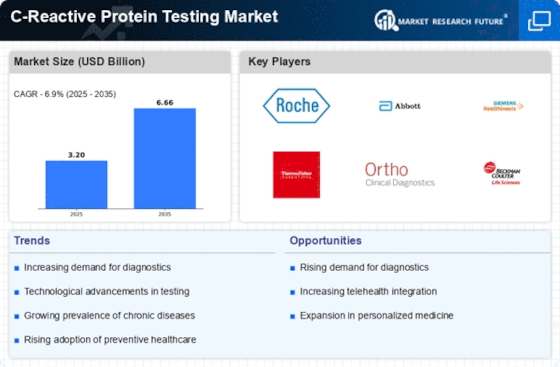

Leading market companies are extensively spending R&D on increasing their product lines, which will help the market of C reactive protein testing grow even more. Important market developments include new product releases, contractual agreements, acquisitions and mergers, greater investments, and collaboration with other organizations. The C reactive protein testing industry must produce cost-effective merchandise to flourish and thrive in a more competitive and increasing market climate.

Manufacturing locally to reduce operating costs is an effective business strategy manufacturers use in the worldwide C reactive protein testing industry to serve clients and expand the market sector. The C reactive protein testing industry has provided some of the most important benefits recently. LumiraDx, Trivitron Healthcare's, and other major competitors in the market of C reactive protein testing are seeking to improve market demand by investing in R&D efforts.

A next-generation point-of-care diagnostics business called LumiraDx is revolutionizing community-based healthcare. Since its establishment in 2014, LumiraDx has produced and sold a revolutionary diagnostic Platform that enables a wide range of tests with point-of-care performance that is on par with a lab's.

Governments and top healthcare organizations use LumiraDx diagnostic testing systems in clinics, urgent care centers, doctor's offices, pharmacies, schools, and workplaces to screen, diagnose, and monitor wellness and illness. On the LumiraDx Platform, LumiraDx offers more than 30 tests for infectious illnesses, cardiovascular diseases, diabetes, and coagulation disorders available or under development.

Additionally, LumiraDx offers a wide range of quick, precise, and reasonably priced COVID-19 testing options from the lab to the point of need.

In January LumiraDx announced the C-reactive protein (CRP) Test CE Marking. The LumiraDx CRP Test measures C-reactive protein quantitatively and provides findings in four minutes. It is a tiny, portable, fully automated microfluidic immunoassay test. CRP testing offers crucial information to diagnose and assess infection and inflammation.

Trivitron Healthcare's history as a medical technology firm offering cost-effective solutions has been a fascinating source of inspiration for many healthcare professionals since 1997. Hospitals, private healthcare practitioners, independent clinics and laboratories, long-term care facilities, renal care centers, and other structures offering healthcare solutions are the target markets for Trivitron's goods. Trivitron, a leader in the industry, is continually looking for new technical advancements to provide better clinical advantages at a reduced price.

In June 2021, In order to simplify COVID-19 diagnosis in remote, urban, and rural areas of India, Trivitron Healthcare created a mobile laboratory. The local lab offers RT-PCR assays, fast antigen tests, CLIA/Elisa IgG and IgM antibody tests, and CLIA/Elisa tests for inflammatory indicators, including D-Dimer, CRP and IL-6.