-

Executive summary

-

Market Introduction

-

Definition

-

Scope of the Study

- Research Objective

- Assumptions

- Limitations

-

Research Methodology

-

Overview

-

Data Mining

-

Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

-

Forecasting Model

-

Market Size Estimation

- Bottom-Up Approach

- Top-Down Approach

-

Data Triangulation

-

Validation

-

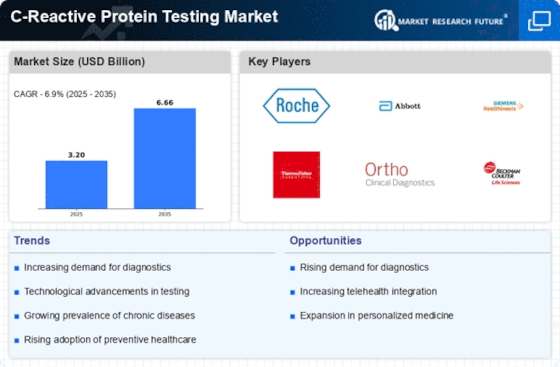

Market Dynamics

-

Overview

-

Drivers

-

Restraints

-

Opportunities

-

Market Factor Analysis

-

Value Chain Analysis

-

Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

GLOBAL C REACTIVE PROTEIN TESTING MARKET, BY Assay Type

-

Overview

-

Enzyme-linked immunosorbent assay (ELISA)

-

Chemiluminescence Immunoassay (CLIA)

-

Immunoturbidimetric assays

-

GLOBAL C REACTIVE PROTEIN TESTING MARKET, BY Application

-

Diabetes

-

Rheumatoid Arthritis

-

Cardiovascular Disease

-

Inflammatory Bowel Disease

-

Others

-

GLOBAL C REACTIVE PROTEIN TESTING MARKET, by Region

-

Overview

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World

- Middle East

- Africa

- Latin America

-

Competitive Landscape

-

Overview

-

Competitive Analysis

-

Market Share Analysis

-

Major Growth Strategy in the Global C reactive protein testing Market,

-

Competitive Benchmarking

-

Leading Players in Terms of Number of Developments in the Global C reactive protein testing Market,

-

Key developments and Growth Strategies

- New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales & Operating Income, 2022

- Major Players R&D Expenditure. 2022

-

Company ProfileS

-

Randox Laboratories Limited

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Merck KGAA (Millipore Sigma)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Quest Diagnostics Incorporated

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Abbott Laboratories

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Zoetis Inc. (Abaxis Inc.)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Thermo Fisher Scientific

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Danaher Corporation (Beckman Coulter Inc.)

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

HORIBA, LTD

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

F. Hoffmann-La Roche AG

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Laboratory Corporation of America Holdings

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Appendix

-

References

-

Related Reports LIST OF TABLES

-

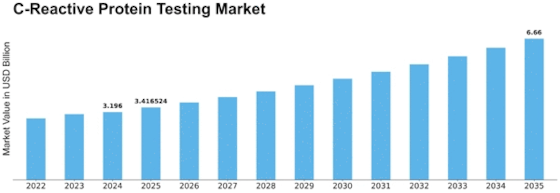

Global C reactive protein testing Market, Synopsis, 2018-2032

-

Global C reactive protein testing Market, Estimates & Forecast, 2018-2032 (USD BILLION)

-

GLOBAL C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

GLOBAL C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

North America: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

North America: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

US: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

US: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

Canada: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

Canada: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

Europe: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

Europe: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

germany: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

germany: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

FRANCE: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

FRANCE: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

italy: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

italy: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

spain: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

spain: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

UK: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

UK: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

rest of europe: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

rest of europe: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

Asia-Pacific: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

Asia-Pacific: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

japan: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

japan: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

japan: C REACTIVE PROTEIN TESTING MARKET, BY End User, 2018-2032 (USD BILLION)

-

china: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

china: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

india: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

TABLE 23

-

india: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

australia: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

australia: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

south korea: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

south korea: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

rest of asia-pacific: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

rest of asia-pacific: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

rest of the world: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

rest of the world: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

Middle east: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

Middle east: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

Africa: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

Africa: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION)

-

Latin america: C REACTIVE PROTEIN TESTING MARKET, BY Assay Type, 2018-2032 (USD BILLION)

-

Latin america: C REACTIVE PROTEIN TESTING MARKET, BY Application, 2018-2032 (USD BILLION) LIST OF FIGURES

-

Research Process

-

Market Structure for the Global C reactive protein testing Market

-

Market Dynamics for the Global C reactive protein testing Market

-

Global C reactive protein testing Market, Share (%), BY Assay Type, 2022

-

Global C reactive protein testing Market, Share (%), BY Application, 2022

-

Global C reactive protein testing Market, Share (%), by Region, 2022

-

north AMERICA: C REACTIVE PROTEIN TESTING MARKET, SHARE (%), BY REGION, 2022

-

Europe: C REACTIVE PROTEIN TESTING MARKET, SHARE (%), BY REGION, 2022

-

Asia-Pacific: C REACTIVE PROTEIN TESTING MARKET, SHARE (%), BY REGION, 2022

-

Rest of the world: C REACTIVE PROTEIN TESTING MARKET, SHARE (%), BY REGION, 2022

-

Global C reactive protein testing Market: Company Share Analysis, 2022 (%)

-

Randox Laboratories Limited: FINANCIAL OVERVIEW SNAPSHOT

-

Randox Laboratories Limited: SWOT ANALYSIS

-

MERCK KGAA (MILLIPORE SIGMA): FINANCIAL OVERVIEW SNAPSHOT

-

MERCK KGAA (MILLIPORE SIGMA): SWOT ANALYSIS

-

Quest Diagnostics Incorporated: FINANCIAL OVERVIEW SNAPSHOT

-

Quest Diagnostics Incorporated: SWOT ANALYSIS

-

Abbott Laboratories: FINANCIAL OVERVIEW SNAPSHOT

-

Abbott Laboratories: SWOT ANALYSIS

-

ZOETIS INC. (ABAXIS INC.).: FINANCIAL OVERVIEW SNAPSHOT

-

ZOETIS INC. (ABAXIS INC.).: SWOT ANALYSIS

-

Thermo Fisher Scientific: FINANCIAL OVERVIEW SNAPSHOT

-

Thermo Fisher Scientific: SWOT ANALYSIS

-

Danaher Corporation (Beckman Coulter Inc.): FINANCIAL OVERVIEW SNAPSHOT

-

Danaher Corporation (Beckman Coulter Inc.): SWOT ANALYSIS

-

HORIBA, LTD: FINANCIAL OVERVIEW SNAPSHOT

-

HORIBA, LTD: SWOT ANALYSIS

-

F. Hoffmann-La Roche AG: FINANCIAL OVERVIEW SNAPSHOT

-

F. Hoffmann-La Roche AG: SWOT ANALYSIS

-

Laboratory Corporation of America Holdings: FINANCIAL OVERVIEW SNAPSHOT

-

Laboratory Corporation of America Holdings: SWOT ANALYSIS

Leave a Comment