Market Growth Projections

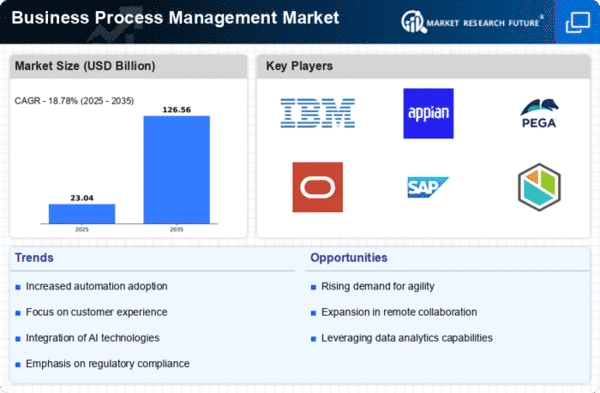

The Global Business Process Management Market Industry is poised for remarkable growth, with projections indicating a market value of 19.4 USD Billion in 2024 and an anticipated increase to 106.6 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 16.75% from 2025 to 2035, highlighting the increasing adoption of BPM solutions across various sectors. The market dynamics are influenced by factors such as technological advancements, the need for operational efficiency, and the growing emphasis on customer experience. These projections underscore the potential for BPM to reshape business operations in the coming years.

Focus on Operational Efficiency

Operational efficiency remains a pivotal driver in the Global Business Process Management Market Industry. Businesses are compelled to optimize their processes to remain competitive in an increasingly dynamic environment. By adopting BPM solutions, organizations can identify bottlenecks, enhance workflow, and reduce operational costs. This focus on efficiency is underscored by the anticipated growth trajectory, with the market expected to reach 106.6 USD Billion by 2035. Companies that prioritize BPM initiatives are likely to achieve significant improvements in productivity and customer satisfaction, thereby reinforcing the importance of BPM in contemporary business strategies.

Increasing Demand for Automation

The Global Business Process Management Market Industry is experiencing a notable surge in demand for automation solutions. Organizations are increasingly recognizing the need to streamline operations, reduce manual errors, and enhance efficiency. This trend is evidenced by the projected market value of 19.4 USD Billion in 2024, reflecting a growing inclination towards automated processes. Companies across various sectors are investing in BPM tools to facilitate real-time data analysis and improve decision-making. As automation technologies evolve, they are likely to drive further adoption, positioning the Global Business Process Management Market Industry for substantial growth.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning is transforming the Global Business Process Management Market Industry. These technologies enable organizations to analyze vast amounts of data, predict trends, and automate complex processes. As businesses seek to leverage these innovations, the BPM market is expected to witness accelerated growth. The anticipated compound annual growth rate of 16.75% from 2025 to 2035 suggests a robust expansion driven by technological advancements. Organizations that embrace these technologies are likely to enhance their operational capabilities and gain a competitive edge in the marketplace.

Regulatory Compliance and Risk Management

The necessity for regulatory compliance and effective risk management is a critical factor influencing the Global Business Process Management Market Industry. Organizations are under constant pressure to adhere to stringent regulations across various jurisdictions. BPM solutions facilitate compliance by automating documentation and reporting processes, thereby minimizing the risk of non-compliance. As regulatory frameworks evolve, the demand for BPM tools that can adapt to these changes is likely to increase. This trend not only enhances operational integrity but also positions organizations to mitigate risks effectively, further driving the growth of the Global Business Process Management Market Industry.

Growing Need for Enhanced Customer Experience

The emphasis on delivering superior customer experiences is a significant driver in the Global Business Process Management Market Industry. Companies are increasingly recognizing that customer satisfaction is paramount to their success. BPM solutions enable organizations to streamline customer interactions, personalize services, and respond swiftly to customer needs. As businesses strive to enhance their customer engagement strategies, the demand for BPM tools that facilitate these objectives is likely to rise. This focus on customer experience not only fosters loyalty but also contributes to the overall growth of the Global Business Process Management Market Industry.