Integration of Advanced Technologies

The integration of advanced technologies is a pivotal driver in the US Business Process Management Market. Technologies such as artificial intelligence, machine learning, and robotic process automation are being increasingly adopted to enhance BPM solutions. These technologies enable organizations to automate repetitive tasks, analyze data in real-time, and make informed decisions. For instance, the use of AI in BPM can lead to a 20% increase in process efficiency, as it allows for predictive analytics and better resource allocation. As businesses in the US continue to embrace digital transformation, the demand for BPM solutions that incorporate these advanced technologies is likely to rise. This trend not only improves operational efficiency but also positions organizations to respond swiftly to market changes, thereby driving growth in the US Business Process Management Market.

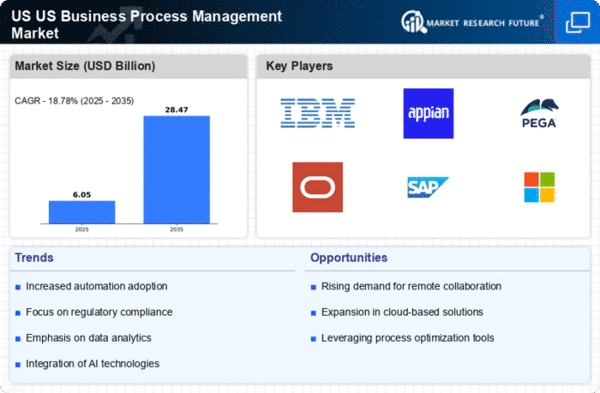

Shift Towards Cloud-Based BPM Solutions

The shift towards cloud-based BPM solutions is a prominent driver in the US Business Process Management Market. Organizations are increasingly adopting cloud technologies to enhance flexibility, scalability, and accessibility of BPM solutions. Cloud-based BPM allows for real-time collaboration and data sharing, which is essential for modern business operations. Recent statistics suggest that the cloud BPM market is projected to grow at a compound annual growth rate of 15% over the next five years. This trend is particularly appealing to small and medium-sized enterprises that may lack the resources for on-premise solutions. As businesses continue to recognize the benefits of cloud technology, the demand for cloud-based BPM solutions is likely to expand, further propelling the growth of the US Business Process Management Market.

Focus on Customer Experience Enhancement

Enhancing customer experience is becoming a central focus for organizations within the US Business Process Management Market. Companies are increasingly aware that streamlined processes directly impact customer satisfaction and loyalty. By implementing BPM solutions, organizations can improve service delivery times and personalize customer interactions. Data indicates that businesses that prioritize customer experience can see a revenue increase of up to 10% annually. This focus on customer-centric processes is likely to drive investments in BPM technologies, as organizations seek to create seamless experiences across various touchpoints. As the market evolves, the emphasis on customer experience is expected to remain a key driver, influencing the strategies of companies operating within the US Business Process Management Market.

Growing Demand for Operational Efficiency

The US Business Process Management Market is experiencing a notable surge in demand for operational efficiency. Organizations are increasingly recognizing the need to streamline processes to reduce costs and enhance productivity. According to recent data, companies that implement BPM solutions can achieve up to a 30% reduction in operational costs. This trend is driven by the competitive landscape, where businesses strive to maintain an edge through improved efficiency. Furthermore, the integration of BPM with emerging technologies such as artificial intelligence and machine learning is likely to enhance process optimization, thereby attracting more investments into the US Business Process Management Market. As organizations continue to seek ways to improve their operational frameworks, the demand for BPM solutions is expected to grow significantly.

Regulatory Compliance and Risk Management

Regulatory compliance and risk management are critical drivers in the US Business Process Management Market. With the increasing complexity of regulations across various sectors, organizations are compelled to adopt BPM solutions that ensure compliance and mitigate risks. The implementation of BPM can lead to a 25% reduction in compliance-related costs, as it streamlines reporting and documentation processes. Furthermore, as regulatory bodies continue to enforce stricter guidelines, the demand for BPM solutions that facilitate compliance is likely to grow. Companies that proactively address compliance issues through effective BPM strategies can not only avoid penalties but also enhance their reputation in the market. This focus on regulatory compliance is expected to significantly influence the growth trajectory of the US Business Process Management Market.