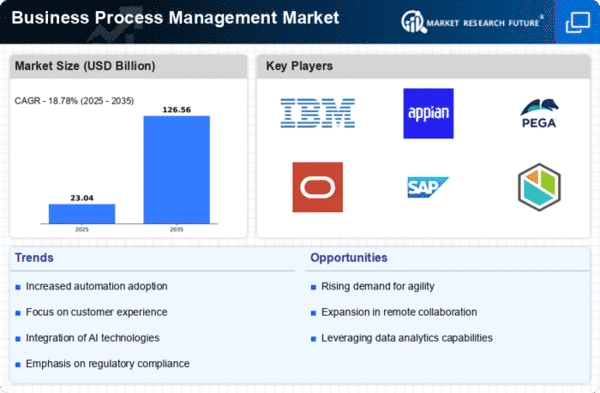

Top Industry Leaders in the Business Process Management Market

Competitive Landscape of Business Process Management Market

The Business Process Management (BPM) market is dynamic landscape is teeming with established players, emerging contenders, and a whirlwind of strategies all vying for a slice of the pie.

Key Players:

- IBM Corporation (U.S.

- Appian Corporation (U.S.)

- Software AG (Germany)

- Oracle Corporation (U.S.)

- Pegasystems Inc. (U.S.)

- Redhat, Inc. (U.S.)

- Open Text Corporation (Canada)

- Tibco Solution Inc. (U.S.)

- Verisae, Inc. (U.S.)

- Dell Emc (U.S.),

Strategies in Play:

- Product Diversification: Vendors are expanding their portfolios beyond traditional on-premise solutions, embracing cloud-based platforms, low-code/no-code options, and integration with emerging technologies like AI and RPA.

- Industry Specialization: Targeting specific verticals like healthcare, finance, or manufacturing with solutions tailored to their unique process needs and compliance requirements.

- Partnerships and Acquisitions: Collaboration is key, with established players partnering with niche players, consultancies, and technology providers to broaden reach and expertise. Acquisitions are also fueling consolidation and market share expansion.

- Customer Focus: Delivering exceptional customer experience through comprehensive support, training, and continuous product improvement is becoming a differentiator.

Market Share Analysis:

Understanding market share relies on several factors:

- Revenue & Customer Base: Size and growth of vendor revenue, along with the number and type of customers (large enterprises, SMEs) they serve, paint a picture of market dominance.

- Geographical Presence: Global reach across different regions plays a role, with vendors catering to specific regional regulatory environments and cultural nuances.

- Solution Strength: Product features, functionality, and user experience influence vendor choice. Integration with existing technologies and ease of deployment are crucial considerations.

- Brand Reputation & Market Perception: Established brands and vendors with strong track records hold an advantage, while innovative newcomers can disrupt the market with agile solutions.

New & Emerging Companies:

The BPM arena is a breeding ground for innovative startups like ProcessMaker, Bonzai, Thinkwise, and Flokzu. These players are challenging the status quo with:

- Cloud-Native Solutions: Built from the ground up for the cloud, these solutions offer better scalability, flexibility, and cost-effectiveness than legacy systems.

- Hyper-Focus on Specific Processes: They specialize in niche areas like customer onboarding, procurement, or finance automation, delivering deep functionality and industry-specific insights.

- AI-Powered Process Intelligence: Integrating AI capabilities for process mining, prediction, and automation is a key differentiator for these newcomers.

Investment Trends:

Companies are heavily investing in:

- Cloud Migration: Shifting customers to cloud-based BPM solutions is a priority, requiring investments in platform development, security, and scalability.

- AI & RPA Integration: Embedding AI for process optimization and decision-making, along with seamless integration with Robotic Process Automation tools, is fueling innovation.

- Low-Code/No-Code Tools: Empowering business users with easy-to-use tools for process automation and improvement is democratizing BPM and expanding the market reach.

- Customer Experience: Improving customer support, training, and user interfaces are crucial for customer retention and attracting new clients.

The BPM market is a dynamic battleground, with established players facing fresh challenges from agile startups and disruptive technologies. Understanding the competitive landscape, key players, and their strategies is crucial for navigating this exciting and rapidly evolving market.

Latest Company Updates:

- October 31 - November 2, 2023: BPM & Workflow Conference & Awards recognizes leading BPM vendors and showcases industry trends.

- December 2023: Forrester Research publishes a report titled "The Forrester Wave: Business Process Management Suites, Q4 2023," evaluating top BPM vendors.