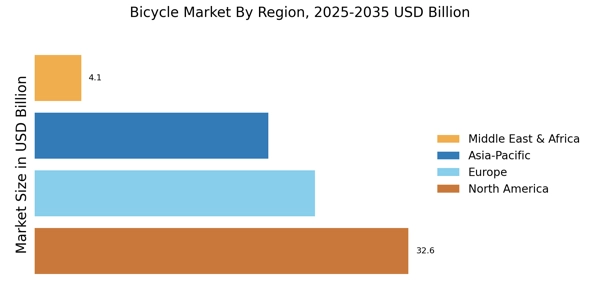

North America : Market Leader in Cycling

North America is the largest market for bicycles, holding approximately 40% of the global share. The region benefits from a growing trend towards sustainable transportation and increased health consciousness among consumers. Regulatory support for cycling infrastructure and safety initiatives further drives demand. The U.S. leads this market, followed closely by Canada, which contributes around 10% to the overall market share. Moreover, the US Bicycle Market is witnessing strong momentum as consumers increasingly adopt bicycles for commuting, fitness, and recreational activities, positioning the United States as a key growth hub in the regional cycling industry. The competitive landscape is robust, featuring key players like Trek Bicycle Market Corporation, Specialized Bicycle Market Components, and Cannondale Bicycle Market Corporation. These companies are innovating with electric bicycles and high-performance models to cater to diverse consumer preferences. The presence of established brands and a strong retail network enhances market accessibility, ensuring continued growth in the region.

Europe: Emerging Cycling Hub

Europe is the second-largest market for bicycles, accounting for approximately 30% of the global share. The region is witnessing a surge in cycling popularity, driven by environmental concerns and government initiatives promoting cycling as a sustainable mode of transport. Countries like Germany and the Netherlands are at the forefront, with significant investments in cycling infrastructure and policies aimed at reducing carbon emissions. Germany, in particular, continues to strengthen its position in the bicycle industry, supported by rising demand for premium bikes, strong manufacturing capabilities, and a growing shift toward electric bicycles. Leading countries in this market include Germany, France, and the Netherlands, with a competitive landscape featuring brands like Bianchi and Scott Sports. The European market is characterized by a strong emphasis on quality and innovation, with a growing demand for electric bicycles. The presence of various local and international players fosters healthy competition, ensuring a diverse range of products for consumers. The European Commission emphasizes the importance of cycling in urban mobility strategies, stating that "Cycling is a key element in achieving sustainable urban transport."

Asia-Pacific: Rapid Growth and Innovation

The Asia-Pacific region is experiencing rapid growth in the bicycle industry, holding approximately 25% of the global share. This growth is fueled by increasing urbanization, rising disposable incomes, and a growing awareness of health and fitness. Countries like China and Japan are leading this trend, with significant investments in cycling infrastructure and a shift towards eco-friendly transportation options. China is the largest market in the region, followed by Japan and India, with a competitive landscape that includes major players like Giant Manufacturing Co. Ltd. and Merida Industry Co. Ltd. Additionally, India is emerging as a key growth area in the bicycle sector, driven by rising urban mobility needs and increasing adoption of bicycles for both fitness and daily commuting. The market is characterized by a diverse range of products, from traditional bicycles to high-tech electric models. The presence of both domestic and international brands enhances competition, driving innovation and catering to the evolving preferences of consumers. The region's focus on sustainability aligns with global trends, promoting cycling as a viable alternative to motorized transport.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is an emerging market for bicycles, holding approximately 5% of the global share. The growth is driven by increasing urbanization, a rising middle class, and government initiatives promoting cycling as a sustainable transport option. Countries like South Africa and the UAE are leading this trend, with investments in cycling infrastructure and awareness campaigns aimed at encouraging cycling for health and leisure. South Africa is the largest market in the region, followed by the UAE, with a competitive landscape that includes both local and international brands. The presence of key players like Fuji Bikes and Kona Bicycle Market Company is notable, as they cater to the growing demand for cycle industry. The region's potential for growth is significant, with increasing interest in cycling as a recreational activity and a means of transportation, supported by favorable government policies and initiatives.