Bicycle Size

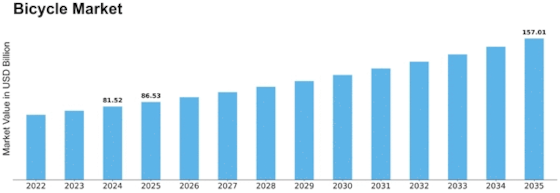

Bicycle Market Growth Projections and Opportunities

The diversity of factors affecting the bicycle market reflects its dynamic nature. An important factor is consumer preferences. The recent years have been characterized by the growth of demand for bicycles as environmental and health-friendly modes of transport, owing to greater interest in living sustainably and healthy. This shift in consumer behavior has led manufacturers to create different beautiful bikes that meet varied needs. Economic factors also play a central role in the bicycle market. Consumers’ spending capacity is greatly influenced by the macroeconomic status of a region. Individuals invest more in recreational and alternative modes of transportation during periods when the economy is doing well which increases bike sales. On the contrary, when there is an economic recession, consumers might choose alternative cheaper ways of travelling that may result in a sharp drop in bicycle sales. This sensitivity to the economic situation shows that market for bicycle is cyclical. Another powerful factor is the government regulation and initiatives. A number of governments around the world have policies designed to foster sustainable traveling, including bicycle infrastructure investments and incentives for bikes. These programs not only promote bicycle use but also, they are created beneficial conditions for manufacturers. On the other hand, regulatory hurdles or lack of support can hamper market development and innovation. The nature of the bicycle market landscape is also determined by technological developments. Traditional bicycles were transformed into advanced means of transportation with the integration of modern technologies like electric-assist systems and smart functions. These innovations are not only consumer-led by the need for improved performance but also to alleviate lifestyle demands of connectedness and convenience. Urbanization and awareness of environmental issues also play a role in changing the dynamics of bicycle market. While cities are becoming increasingly more crowded and environmental issues grow, bicycles become an appropriate means of reducing traffic bottlenecks by eliminating carbon emissions. This transformation to a more environmentally conscious system of transportation helps the bicycle market, which in turn forces manufacturers to change and meet emerging societal demands. The bicycle market is also greatly influenced by fierce competition forces in the industry. Both well-established brands and emerging players in the market combine here, stimulating innovation while maintaining healthy competition. Major market players often dictate standards and trends in the industry, influencing customer’s expectations on what to expect from such products as well determine where or how an entire market is going. Additionally, the partnerships and strategic alliances that are formed between manufacturers and suppliers.

Leave a Comment