Betaine Market Summary

As per Market Research Future analysis, the Betaine Market Size was estimated at 4.317 USD Billion in 2024. The Betaine industry is projected to grow from 4.546 USD Billion in 2025 to 7.619 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Betaine Market is experiencing robust growth driven by increasing health awareness and demand for natural ingredients.

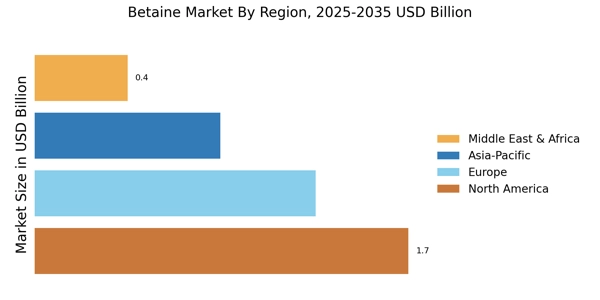

- The demand for natural ingredients in the Betaine Market is rising, particularly in North America, which remains the largest market.

- Asia-Pacific is emerging as the fastest-growing region, driven by expanding applications in personal care and food sectors.

- Natural Betaine Market continues to dominate the market, while synthetic Betaine Market is witnessing rapid growth due to technological advancements.

- Key market drivers include increasing health awareness and the growth in the animal feed sector, which are propelling demand across various applications.

Market Size & Forecast

| 2024 Market Size | 4.317 (USD Billion) |

| 2035 Market Size | 7.619 (USD Billion) |

| CAGR (2025 - 2035) | 5.3% |

Major Players

Givaudan (CH), BASF (DE), Evonik Industries (DE), Solvay (BE), Zhejiang Jianye Chemical (CN), American Crystal Sugar Company (US), DuPont (US), Kao Corporation (JP), Nutreco (NL)