Regulatory Framework and Support

The regulatory landscape surrounding autonomous vehicles is evolving, which plays a crucial role in shaping the Autonomous Ride Sharing Fleet Market. Governments are increasingly recognizing the potential benefits of autonomous ride-sharing solutions, leading to the establishment of supportive regulations. For instance, several regions have initiated pilot programs to test autonomous vehicles in real-world scenarios, providing valuable data for future legislation. The establishment of clear guidelines and safety standards is expected to enhance public trust and encourage adoption. As of 2025, it is estimated that over 20 countries have implemented or are in the process of developing regulations specifically for autonomous ride-sharing services. This regulatory support is likely to create a more favorable environment for investment and innovation in the Autonomous Ride Sharing Fleet Market.

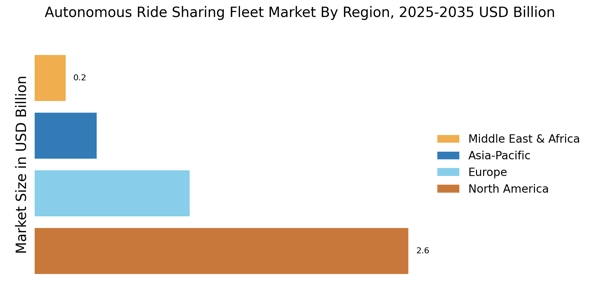

Urbanization and Traffic Congestion

The ongoing trend of urbanization is a significant driver for the Autonomous Ride Sharing Fleet Market. As urban populations continue to grow, cities face increasing challenges related to traffic congestion and inadequate public transportation systems. Autonomous ride-sharing services present a viable solution to alleviate these issues by providing efficient and flexible transportation options. Data suggests that urban areas with high population density could see a reduction in traffic congestion by up to 25% with the widespread adoption of autonomous ride-sharing fleets. This potential for improved mobility is likely to encourage city planners and policymakers to integrate autonomous services into their transportation strategies. Consequently, the Autonomous Ride Sharing Fleet Market stands to benefit from the increasing demand for innovative solutions to urban mobility challenges.

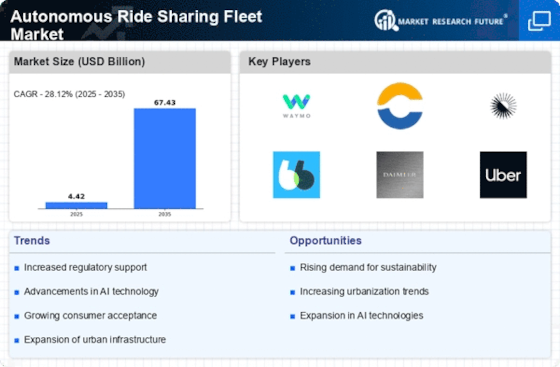

Investment and Funding Opportunities

Investment in the Autonomous Ride Sharing Fleet Market is on the rise, driven by the potential for high returns and technological advancements. Venture capital firms and traditional automotive companies are increasingly allocating funds to develop autonomous ride-sharing technologies. In 2025, it is estimated that investments in this sector could exceed $50 billion, reflecting a growing confidence in the market's future. This influx of capital is likely to accelerate research and development efforts, leading to faster deployment of autonomous fleets. Additionally, partnerships between technology firms and automotive manufacturers are becoming more common, further enhancing innovation. As funding opportunities expand, the Autonomous Ride Sharing Fleet Market is poised for significant growth, attracting new players and fostering competition.

Consumer Demand for Sustainable Transportation

There is a growing consumer demand for sustainable transportation solutions, which significantly influences the Autonomous Ride Sharing Fleet Market. As environmental concerns rise, individuals are increasingly seeking alternatives to traditional vehicle ownership. Autonomous ride-sharing services, which often utilize electric vehicles, align with this demand by offering eco-friendly transportation options. Recent studies indicate that approximately 60% of consumers express a preference for using shared autonomous electric vehicles over conventional taxis. This shift in consumer behavior is likely to drive the expansion of autonomous fleets, as companies strive to meet the expectations of environmentally conscious users. The integration of sustainability into the business model of the Autonomous Ride Sharing Fleet Market may also attract partnerships with governments and organizations focused on reducing carbon emissions.

Technological Advancements in Autonomous Vehicles

The Autonomous Ride Sharing Fleet Market is experiencing rapid technological advancements that enhance vehicle capabilities. Innovations in artificial intelligence, machine learning, and sensor technologies are driving the development of more sophisticated autonomous systems. These advancements enable vehicles to navigate complex urban environments, improving safety and efficiency. According to recent data, the integration of advanced driver-assistance systems (ADAS) is projected to increase the operational efficiency of autonomous fleets by up to 30% by 2026. Furthermore, the development of 5G technology is expected to facilitate real-time data exchange, allowing for better route optimization and traffic management. As these technologies mature, they are likely to attract more investments and foster growth within the Autonomous Ride Sharing Fleet Market.