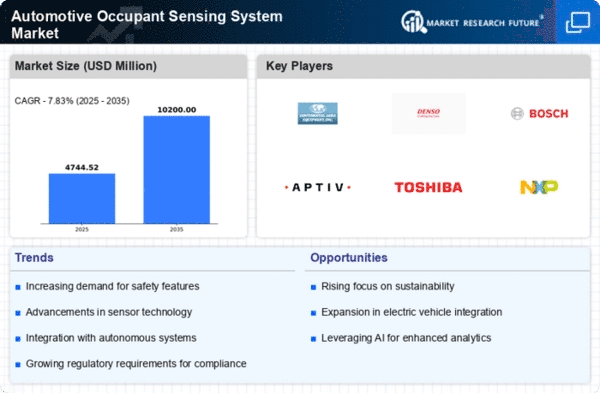

Market Growth Projections

The Automotive Occupant Sensing System Sector is poised for substantial growth, with projections indicating a rise from 2.9 USD Billion in 2024 to 5.39 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 5.81% from 2025 to 2035, driven by various factors such as increasing safety regulations, technological advancements, and rising consumer awareness. The market's expansion reflects the automotive industry's ongoing commitment to enhancing passenger safety and comfort through innovative occupant sensing technologies.

Growing Consumer Awareness

Consumer awareness regarding vehicle safety features is a crucial driver for the Vehicle Occupant Sensing System Market. As individuals become more informed about the benefits of occupant sensing systems, they increasingly demand vehicles equipped with these technologies. This trend is particularly evident in regions with high vehicle ownership rates, where consumers prioritize safety features when making purchasing decisions. Consequently, automotive manufacturers are compelled to integrate advanced occupant sensing systems into their models to meet consumer expectations, thereby propelling market growth. This shift in consumer behavior is likely to sustain the market's upward trajectory.

Technological Advancements

Technological innovations play a pivotal role in the expansion of the Global Automotive Occupant Sensing System Sector. The integration of advanced sensors and artificial intelligence enhances the accuracy and reliability of occupant detection systems. For example, the development of pressure-sensitive mats and advanced imaging technologies allows for more precise identification of passenger characteristics. This technological evolution not only improves safety but also contributes to the overall user experience. As these technologies continue to evolve, the market is expected to grow significantly, with projections indicating a rise to 5.39 USD Billion by 2035.

Increasing Safety Regulations

The Global Automotive Occupant Sensing System Industry is experiencing growth driven by stringent safety regulations imposed by governments worldwide. These regulations mandate the installation of advanced safety features in vehicles, including occupant sensing systems that detect the presence and weight of passengers. For instance, the National Highway Traffic Safety Administration in the United States has established guidelines that require such systems to enhance airbag deployment strategies. As a result, the market is projected to reach 2.9 USD Billion in 2024, reflecting the increasing emphasis on passenger safety and compliance with regulatory standards.

Rising Demand for Luxury Vehicles

The Automotive Occupant Sensing System Landscape is also influenced by the rising demand for luxury vehicles, which often come equipped with advanced safety features, including occupant sensing systems. Luxury car manufacturers are increasingly incorporating these technologies to enhance passenger comfort and safety. For instance, brands like Mercedes-Benz and BMW are integrating sophisticated occupant sensing systems that not only improve airbag deployment but also provide additional features such as personalized seating adjustments. This trend is expected to contribute to the market's growth, as luxury vehicle sales continue to rise, further driving the adoption of advanced occupant sensing technologies.

Focus on Reducing Vehicle Emissions

The Automotive Occupant Sensing System Industry is witnessing growth due to the automotive sector's focus on reducing vehicle emissions. By optimizing airbag deployment based on occupant detection, manufacturers can enhance vehicle efficiency and safety, aligning with global sustainability goals. This optimization is particularly relevant as governments worldwide implement stricter emissions regulations, encouraging manufacturers to adopt technologies that improve overall vehicle performance. As a result, the market is likely to experience a compound annual growth rate of 5.81% from 2025 to 2035, reflecting the industry's commitment to sustainability and safety.