Consumer Demand for Sustainability

In recent years, there has been a marked increase in consumer awareness regarding environmental issues, which significantly influences the Remote Automotive Exhaust Sensing Market. Consumers are increasingly favoring vehicles that demonstrate lower emissions and better fuel efficiency. This shift in consumer preferences is prompting automotive manufacturers to integrate advanced exhaust sensing technologies into their vehicles. The market data indicates that vehicles equipped with remote sensing capabilities are more appealing to environmentally conscious consumers, leading to higher sales. As sustainability becomes a key purchasing criterion, the Remote Automotive Exhaust Sensing Market is poised for growth, as manufacturers strive to meet the evolving expectations of their customer base.

Integration of Advanced Technologies

The Remote Automotive Exhaust Sensing Market is benefiting from the rapid integration of advanced technologies such as IoT and AI. These technologies enable real-time data collection and analysis, enhancing the accuracy and efficiency of emissions monitoring. The incorporation of IoT devices allows for seamless communication between vehicles and monitoring systems, facilitating proactive maintenance and compliance checks. Market analysis suggests that the adoption of AI-driven analytics can significantly improve the predictive capabilities of exhaust sensing systems, leading to better performance and reduced emissions. As automotive manufacturers increasingly embrace these technologies, the Remote Automotive Exhaust Sensing Market is likely to witness substantial growth, driven by the demand for smarter, more efficient vehicles.

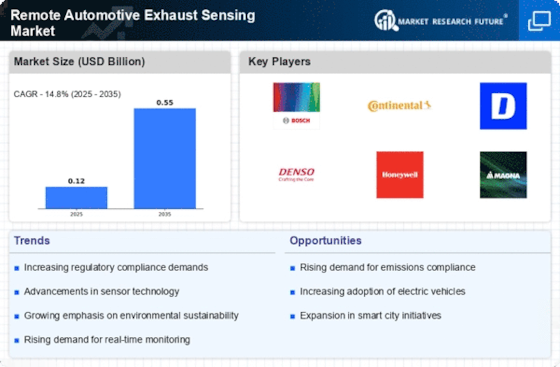

Regulatory Compliance and Innovation

The Remote Automotive Exhaust Sensing Market is experiencing a surge in demand due to stringent regulatory frameworks aimed at reducing vehicular emissions. Governments worldwide are implementing more rigorous standards for emissions testing, which necessitates advanced sensing technologies. This regulatory pressure compels automotive manufacturers to adopt remote sensing solutions that ensure compliance with environmental regulations. The market is projected to grow as manufacturers invest in innovative technologies to meet these standards. For instance, the introduction of real-time monitoring systems allows for immediate detection of emissions violations, thereby enhancing compliance. As regulations evolve, the Remote Automotive Exhaust Sensing Market is likely to expand, driven by the need for continuous innovation in emissions monitoring and reporting.

Rising Fuel Prices and Economic Factors

Economic factors, particularly rising fuel prices, are influencing the Remote Automotive Exhaust Sensing Market. As fuel costs escalate, consumers are more inclined to seek vehicles that offer better fuel efficiency and lower emissions. This trend compels manufacturers to invest in advanced exhaust sensing technologies that optimize engine performance and reduce fuel consumption. Market data indicates that vehicles equipped with effective exhaust sensing systems can achieve significant improvements in fuel efficiency, making them more attractive to cost-conscious consumers. Consequently, the Remote Automotive Exhaust Sensing Market is expected to grow as manufacturers respond to economic pressures by enhancing their vehicle offerings with innovative exhaust sensing solutions.

Technological Advancements in Sensor Technology

The Remote Automotive Exhaust Sensing Market is significantly influenced by ongoing technological advancements in sensor technology. Innovations in sensor design and materials are leading to more accurate and reliable exhaust measurements. These advancements enable the development of compact, cost-effective sensors that can be easily integrated into various vehicle models. The market is witnessing a trend towards miniaturization and increased sensitivity of exhaust sensors, which enhances their performance in real-world conditions. As automotive manufacturers seek to improve the reliability of emissions data, the demand for advanced sensor technologies is likely to rise. This trend suggests a promising future for the Remote Automotive Exhaust Sensing Market, as manufacturers prioritize the integration of cutting-edge sensor solutions.