Consumer Awareness and Preferences

Consumer awareness regarding vehicle safety features is increasingly shaping the Occupant Classification System Market. As individuals become more informed about the benefits of advanced safety systems, their preferences are shifting towards vehicles equipped with occupant classification technologies. This heightened awareness is likely to drive demand, as consumers prioritize safety in their purchasing decisions. Market Research Future indicates that nearly 60% of consumers consider safety features as a top priority when selecting a vehicle. Consequently, manufacturers are responding to this trend by integrating occupant classification systems into their designs, which is expected to bolster market growth. The alignment of consumer preferences with safety innovations is a pivotal driver for the industry.

Regulatory Compliance and Standards

Regulatory frameworks play a crucial role in shaping the Occupant Classification System Market. Governments worldwide are increasingly implementing stringent safety regulations that mandate the inclusion of occupant classification systems in new vehicle models. For instance, regulations concerning airbag deployment based on occupant size and weight have become more prevalent. This regulatory push is expected to drive market growth, as manufacturers must comply with these standards to ensure vehicle safety and avoid penalties. The market is anticipated to expand as compliance becomes a necessity rather than an option, with estimates suggesting a compound annual growth rate of around 7% over the next five years. Thus, adherence to regulatory requirements is a significant factor influencing the adoption of occupant classification systems.

Rising Demand for Enhanced Safety Features

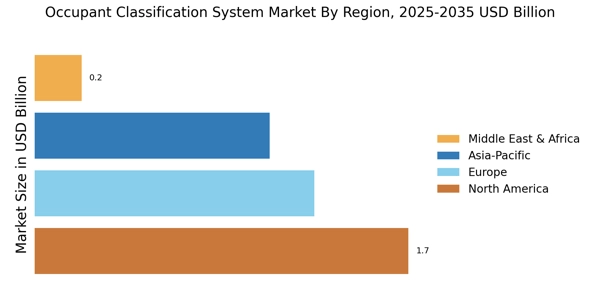

The increasing emphasis on safety in vehicles is a primary driver for the Occupant Classification System Market. As consumers become more aware of the importance of safety features, manufacturers are compelled to integrate advanced occupant classification systems into their vehicles. This trend is reflected in the growing market, which is projected to reach a valuation of approximately USD 2 billion by 2026. The integration of these systems not only enhances passenger safety but also aids in the development of more sophisticated airbag deployment strategies, thereby reducing the risk of injury during accidents. Consequently, the demand for occupant classification systems is likely to continue its upward trajectory as safety regulations become more stringent and consumer expectations evolve.

Integration with Smart Vehicle Technologies

The integration of occupant classification systems with smart vehicle technologies is emerging as a key driver in the Occupant Classification System Market. As vehicles become increasingly connected and autonomous, the need for sophisticated occupant classification systems that can interact with other smart technologies is paramount. This integration enhances the overall functionality of vehicles, allowing for improved safety and user experience. The market is projected to grow as manufacturers seek to develop vehicles that not only classify occupants but also adapt to their needs in real-time. This trend is indicative of a broader shift towards smarter, more responsive vehicle systems, which is likely to propel the demand for occupant classification technologies in the coming years.

Technological Innovations in Sensor Technologies

Technological advancements in sensor technologies are significantly influencing the Occupant Classification System Market. Innovations such as pressure sensors, weight sensors, and advanced algorithms are enhancing the accuracy and reliability of occupant classification systems. These technologies enable vehicles to better assess the presence and characteristics of occupants, leading to improved safety measures. The market is witnessing a surge in the adoption of these advanced systems, with projections indicating a potential market growth of 8% annually. As manufacturers strive to incorporate cutting-edge technologies into their vehicles, the demand for sophisticated occupant classification systems is expected to rise, thereby driving the overall market forward.