Growth of Online Automotive Financing Platforms

The rise of online automotive financing platforms is transforming the Automotive Finance Market, as consumers increasingly prefer the convenience of digital transactions. These platforms offer a streamlined process for obtaining financing, allowing consumers to compare rates and terms from multiple lenders without the need for in-person visits. As of 2025, it is estimated that online financing will account for nearly 50% of all automotive financing transactions, reflecting a significant shift in consumer behavior. This trend is further fueled by the increasing penetration of smartphones and internet access, enabling consumers to engage with financing options anytime and anywhere. Consequently, traditional lenders are compelled to enhance their digital offerings to remain competitive in the Automotive Finance Market, potentially leading to a more dynamic and accessible financing landscape.

Regulatory Changes Impacting Automotive Financing

The Automotive Finance Market is subject to evolving regulatory frameworks that can significantly impact financing practices. Recent legislative changes aimed at consumer protection and financial transparency are reshaping the landscape for automotive financing. For instance, regulations mandating clearer disclosure of loan terms and interest rates are becoming more prevalent, which may enhance consumer trust in financing agreements. As of 2025, it is anticipated that compliance with these regulations will require financial institutions to invest in more robust systems for monitoring and reporting. This shift could lead to increased operational costs but may also foster a more competitive environment as companies strive to differentiate themselves through superior customer service and transparency. Thus, the Automotive Finance Market must navigate these regulatory challenges while seeking opportunities for growth.

Technological Advancements in Automotive Financing

Technological innovations are significantly influencing the Automotive Finance Market, as advancements in artificial intelligence and machine learning enhance the efficiency of financing processes. These technologies enable lenders to assess creditworthiness more accurately and streamline loan approvals, reducing the time required for consumers to secure financing. In 2025, it is estimated that over 70% of automotive financing transactions will involve some form of digital technology, indicating a shift towards automation and data-driven decision-making. Additionally, the integration of blockchain technology is expected to improve transparency and security in transactions, fostering trust among consumers. As these technologies continue to evolve, the Automotive Finance Market is poised for transformation, potentially leading to more competitive rates and improved customer experiences.

Rising Consumer Demand for Flexible Financing Options

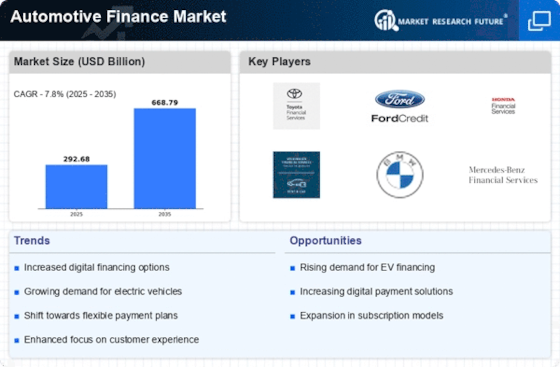

The Automotive Finance Market is experiencing a notable shift as consumers increasingly seek flexible financing solutions. This trend is driven by a growing preference for personalized payment plans that accommodate individual financial situations. As of 2025, approximately 60% of consumers express a desire for more adaptable financing options, such as lease-to-own agreements and subscription models. This demand is prompting financial institutions and automotive manufacturers to innovate their offerings, thereby enhancing customer satisfaction and loyalty. The rise of digital platforms further facilitates this trend, allowing consumers to compare financing options easily. Consequently, the Automotive Finance Market is likely to witness a surge in tailored financing products that cater to diverse consumer needs, potentially reshaping the competitive landscape.

Increased Focus on Sustainability in Automotive Financing

The Automotive Finance Market is witnessing a growing emphasis on sustainability, as consumers and manufacturers alike prioritize environmentally friendly practices. Financial institutions are increasingly offering green financing options that support the purchase of electric and hybrid vehicles. As of 2025, it is projected that the market for green automotive financing will expand by 25%, reflecting a shift in consumer preferences towards sustainable mobility solutions. This trend is further supported by government incentives aimed at promoting eco-friendly vehicles, which enhance the attractiveness of green financing options. Consequently, the Automotive Finance Market is likely to adapt by developing specialized financing products that align with sustainability goals, thereby appealing to environmentally conscious consumers.