Increasing Consumer Demand for Vehicles

The automotive finance market is experiencing a notable surge in consumer demand for vehicles, driven by a combination of factors including economic recovery and changing consumer preferences. In the UK, the demand for new and used vehicles has risen, with sales figures indicating a growth of approximately 10% in the last year. This increase in demand is likely to stimulate the automotive finance market, as consumers seek financing solutions to acquire vehicles. The availability of various financing options, such as personal contract purchases (PCP) and hire purchase agreements, further supports this trend. As consumers become more discerning, they are likely to explore financing options that offer flexibility and affordability, thereby enhancing the overall growth potential of the automotive finance market.

Rising Interest Rates and Their Effects

Rising interest rates are poised to have a profound impact on the automotive finance market, as they influence borrowing costs for consumers. In the UK, the Bank of England has indicated a trend towards increasing interest rates to combat inflation, which could lead to higher monthly payments for financed vehicles. This situation may deter some consumers from pursuing financing options, potentially slowing down vehicle sales. However, it could also encourage consumers to seek more competitive financing solutions, such as fixed-rate loans or longer repayment terms. As the market adjusts to these economic changes, finance providers may need to innovate their offerings to remain attractive to consumers. The interplay between interest rates and consumer behaviour will likely shape the future landscape of the automotive finance market.

Shift Towards Sustainable Financing Options

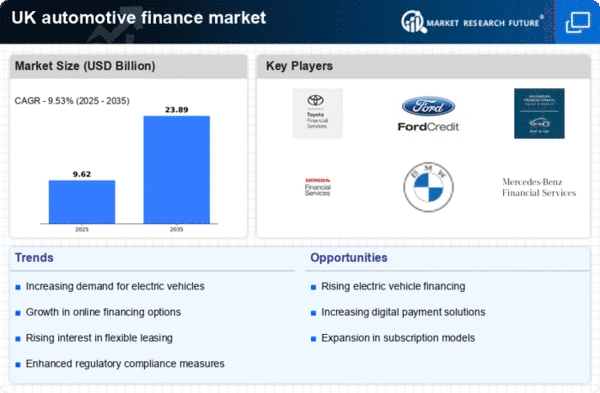

The automotive finance market is witnessing a shift towards sustainable financing options, reflecting the growing consumer awareness of environmental issues. As more consumers opt for electric and hybrid vehicles, finance providers are adapting their offerings to accommodate this trend. In the UK, the demand for electric vehicles (EVs) has surged, with sales increasing by over 30% in the past year. This shift is prompting finance companies to develop tailored financing solutions that incentivize the purchase of environmentally friendly vehicles. Such initiatives may include lower interest rates for EV financing or special leasing options. As sustainability becomes a priority for consumers, the automotive finance market is likely to evolve, aligning its products with the values of a more environmentally conscious customer base.

Regulatory Changes Impacting Financing Practices

Regulatory changes are significantly influencing the automotive finance market, as new policies and guidelines emerge to enhance consumer protection and promote fair lending practices. In the UK, the Financial Conduct Authority (FCA) has implemented measures aimed at ensuring transparency in financing agreements, which may lead to increased consumer confidence in the market. These regulations are likely to encourage more consumers to explore financing options, thereby expanding the customer base for finance providers. Additionally, compliance with these regulations may necessitate changes in the operational practices of lenders, potentially leading to increased costs. However, the long-term benefits of a more transparent and consumer-friendly market could outweigh these initial challenges, fostering growth in the automotive finance market.

Technological Advancements in Financing Solutions

Technological advancements are reshaping the automotive finance market, introducing innovative financing solutions that cater to the evolving needs of consumers. The integration of digital platforms and mobile applications has streamlined the financing process, making it more accessible and user-friendly. In the UK, the adoption of online financing applications has increased, with reports indicating that over 60% of consumers prefer to apply for financing digitally. This shift not only enhances customer experience but also allows finance providers to reach a broader audience. Moreover, the use of data analytics enables lenders to assess creditworthiness more accurately, potentially reducing risk and improving loan approval rates. As technology continues to evolve, it is likely to play a pivotal role in driving growth within the automotive finance market.