Market Analysis

In-depth Analysis of Automotive Finance Market Industry Landscape

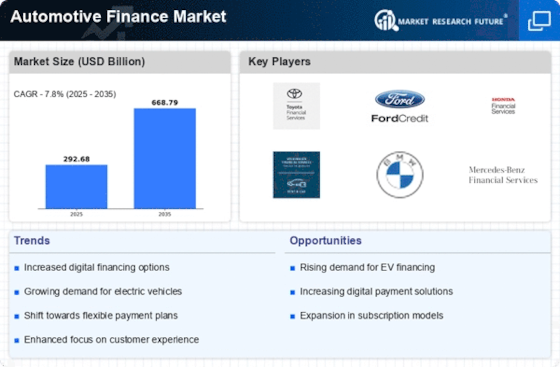

The Automotive Finance marketplace is a dynamic and complicated gadget that performs a critical position in helping the worldwide car industry. Comprising a complex network of suppliers, producers, distributors, and outlets, the marketplace dynamics of Automotive Finance are motivated by a myriad of factors. One key element is the continuous evolution of customer demand and choices, which drives the production and distribution strategies of automotive businesses. Globalization has drastically impacted the Automotive Finance market, as manufacturers increasingly source components and bring together automobiles in exceptional areas to optimize expenses. This has led to a surge in worldwide alternatives and necessitated efficient supply chain control to ensure the timely and fee-powerful shipping of parts and completed automobiles. The marketplace dynamics are, in addition, shaped by regulatory frameworks and exchange agreements that affect move-border transportation, tariffs, and customs methods, adding a layer of complexity. Technological advancements play a pivotal role in reworking the automotive finance landscape. The integration of virtual technologies such as IoT (Internet of Things), RFID (Radio-Frequency Identification), and telematics has better visibility and transparency throughout the delivery chain. Real-time monitoring of shipments, stock control, and predictive analytics have come to be vital to optimizing logistics operations, reducing lead times, and minimizing charges. The volatile nature of fuel expenses also contributes to the marketplace dynamics. Fluctuations in oil costs at once affect transportation prices, prompting logistics providers and automobile organizations to re-examine and optimize their routes and modes of transport continuously. The pursuit of fee efficiency is a perpetual venture within the automotive finance area, with businesses striving to stabilize the need for timely and reliable deliveries against the vital need to govern operational fees. Collaboration and partnerships are increasing numbers of typical in the automotive finance market. The complicated web of suppliers, manufacturers, and vendors necessitates close coordination and conversation to make certain seamless operations. Collaboration enables stakeholders to proportion statistics, pool resources, and optimize approaches, thereby improving general performance and lowering lead times. The formation of strategic alliances enables addressing the demanding situations posed by means of the global nature of the enterprise, fostering innovation and adaptability. In conclusion, the marketplace dynamics of the Automotive Finance industry are multifaceted, formed by using elements ranging from consumer possibilities and technological advancements to regulatory frameworks and environmental concerns. Navigating this complex panorama calls for a strategic and adaptive technique with an emphasis on collaboration, innovation, and sustainability. As the automotive industry continues to conform, so too will the demanding situations and possibilities within its logistics ecosystem, making agility and resilience key drivers of fulfillment in this dynamic market.

Leave a Comment