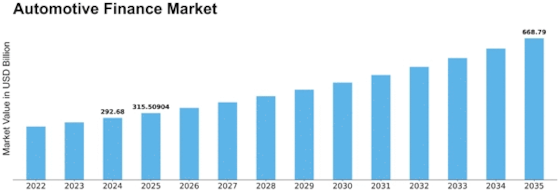

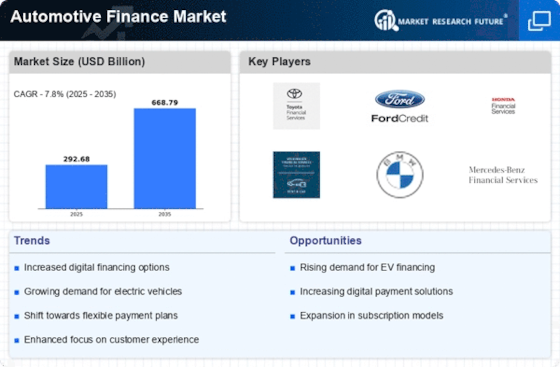

Automotive Finance Size

Automotive Finance Market Growth Projections and Opportunities

The automotive finance market, a critical aspect of the global delivery chain, is prompted by various market factors that shape its dynamics. One key issue is the continuous evolution of technology. Advancements in automation, records analytics, and synthetic intelligence have revolutionized logistics approaches, improving efficiency and lowering fees. As automotive producers and logistics providers adopt these technologies, the market experiences a shift towards smarter and more streamlined operations. Sustainability is emerging as a big marketplace factor in the Automotive Finance quarter. With a growing cognizance of environmental duty, agencies are compelled to adopt green practices. This includes using electric vehicles, optimizing course planning to lessen emissions, and incorporating sustainable packaging substances. As governments worldwide enforce stringent environmental policies, automotive finance players have to align their operations with green tasks to stay aggressive and meet evolving purchaser expectations. Geopolitical factors additionally exert a tremendous impact on the Automotive Finance marketplace. Trade tensions, political instability, and regulatory modifications can disrupt worldwide delivery chains. The imposition of price lists, adjustments in exchange agreements, or geopolitical conflicts can lead to shifts in production places and impact the glide of automotive goods throughout borders. Logistics vendors need to navigate those geopolitical challenges to ensure the easy movement of motors and additives, thereby maintaining the integrity of the delivery chain. Customer expectancies and choices contribute drastically to the market dynamics of Automotive Finance. As clients demand faster deliveries, real-time tracking, and flexible transportation options, logistics carriers ought to invest in technology and infrastructure to satisfy those expectations. The upward push of e-trade within the automobile aftermarket further amplifies the want for agile and customer-centric logistics answers. Lastly, regulatory compliance is a constant factor influencing the Automotive Finance market. As governments enact and put into effect rules associated with protection, emissions, and transportation, logistics vendors should make sure to adhere to those requirements. In the end, the Automotive Finance marketplace is a dynamic and interconnected atmosphere formed by numerous market factors. From technological improvements to monetary conditions, sustainability, geopolitical factors, consumer expectancies, collaboration, and regulatory compliance, each element plays a critical position in determining the trajectory of the Automotive Finance area. Successful navigation of these elements is important for logistics providers to thrive in an ever-evolving and aggressive market.

Leave a Comment