Increasing Safety Regulations

The Automotive Component Forging Market is also being driven by the implementation of stringent safety regulations across various regions. Governments are mandating higher safety standards for vehicles, which necessitates the use of robust and reliable components. Forged parts are often preferred for their superior mechanical properties, which enhance the overall safety of vehicles. As manufacturers strive to comply with these regulations, the demand for high-quality forged components is expected to rise. This trend is likely to create a favorable environment for the Automotive Component Forging Market, as companies invest in advanced forging techniques to meet safety requirements and improve vehicle performance.

Growth of Electric Vehicle Market

The Automotive Component Forging Market is poised for growth due to the rapid expansion of the electric vehicle (EV) market. As automakers shift their focus towards electric mobility, the demand for specialized forged components tailored for EVs is increasing. These components, which include battery housings and structural parts, require high-performance materials that can withstand the unique stresses associated with electric powertrains. Recent estimates suggest that the EV market could reach a valuation of over 800 billion by 2027, creating substantial opportunities for the Automotive Component Forging Market. This trend indicates a shift in manufacturing priorities, with a growing emphasis on producing components that support sustainable transportation solutions.

Rising Demand for Fuel Efficiency

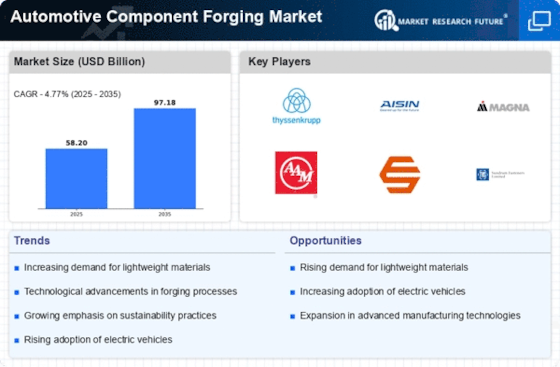

The Automotive Component Forging Market is experiencing a notable increase in demand for fuel-efficient vehicles. As consumers become more environmentally conscious, manufacturers are compelled to innovate and produce lighter components that enhance fuel economy. This trend is particularly evident in the production of forged components, which offer superior strength-to-weight ratios compared to traditional materials. According to recent data, the automotive sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years, driven largely by the need for improved fuel efficiency. Consequently, the Automotive Component Forging Market is likely to benefit from this shift, as forged parts are increasingly utilized in the design of advanced powertrains and lightweight structures.

Expansion of Automotive Production Facilities

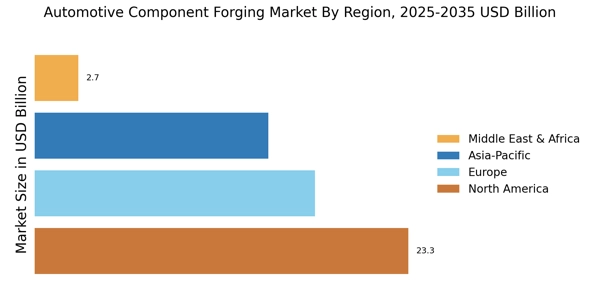

The Automotive Component Forging Market is benefiting from the expansion of automotive production facilities in various regions. As manufacturers seek to increase their production capacity and meet rising consumer demand, investments in new forging plants and technologies are becoming more prevalent. This expansion is often accompanied by the adoption of advanced manufacturing techniques, which enhance efficiency and reduce production costs. Recent data indicates that the automotive manufacturing sector is expected to grow steadily, with many companies planning to establish new facilities in emerging markets. This trend is likely to bolster the Automotive Component Forging Market, as increased production capabilities will drive demand for forged components across a wider range of applications.

Technological Advancements in Forging Processes

Technological advancements are significantly influencing the Automotive Component Forging Market. Innovations such as computer numerical control (CNC) machining and automated forging processes are enhancing production efficiency and precision. These technologies allow manufacturers to produce complex geometries with reduced waste, thereby lowering costs and improving product quality. Furthermore, the integration of artificial intelligence and machine learning in manufacturing processes is expected to optimize operations and reduce lead times. As a result, the Automotive Component Forging Market is likely to see an increase in the adoption of these advanced technologies, which could lead to a more competitive landscape and improved profitability for key players.