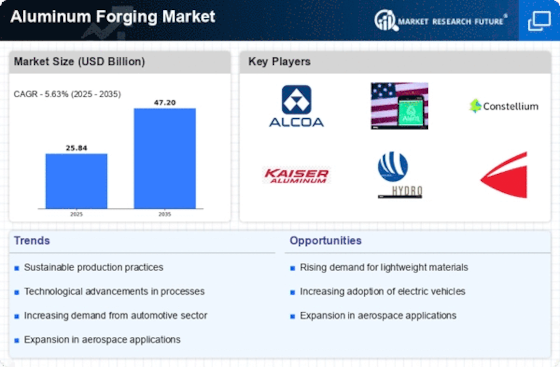

Automotive Industry Evolution

The automotive industry is undergoing a transformation, with a shift towards electric vehicles (EVs) and lightweight materials. The Aluminum Forging Market is poised to capitalize on this trend, as aluminum components are essential for improving vehicle efficiency and performance. In 2025, the demand for aluminum forgings in the automotive sector is projected to reach 800,000 tons, driven by the need for lighter vehicles that consume less energy. This evolution is further supported by regulatory pressures for emissions reductions, making aluminum forgings a preferred choice for manufacturers aiming to meet stringent standards.

Rising Demand in Aerospace Sector

The aerospace sector is experiencing a notable increase in demand for lightweight and durable materials, which positions the Aluminum Forging Market favorably. Aluminum forgings are preferred for their strength-to-weight ratio, making them ideal for aircraft components. In 2025, the aerospace industry is projected to require approximately 1.5 million tons of aluminum forgings, reflecting a growth rate of around 5% annually. This trend is driven by the need for fuel-efficient aircraft and the ongoing development of new models. As manufacturers seek to enhance performance while reducing weight, the Aluminum Forging Market is likely to benefit significantly from this demand surge.

Infrastructure Development Projects

Infrastructure development projects are gaining momentum, leading to increased consumption of aluminum forgings. Governments and private entities are investing heavily in construction, transportation, and energy sectors, which require robust materials. The Aluminum Forging Market is expected to see a rise in demand as aluminum forgings are utilized in bridges, railways, and energy infrastructure. In 2025, the market could witness a growth of approximately 4% due to these projects. The emphasis on sustainable construction practices further enhances the appeal of aluminum, as it is recyclable and lightweight, aligning with modern engineering requirements.

Growing Focus on Lightweight Materials

The growing focus on lightweight materials across various industries is driving the Aluminum Forging Market. Lightweight materials contribute to energy efficiency and performance improvements, particularly in sectors such as aerospace, automotive, and construction. As industries strive to reduce their carbon footprint, aluminum forgings are increasingly favored for their recyclability and strength. In 2025, the market is expected to grow by around 5% as companies prioritize the use of aluminum in their products. This trend is indicative of a broader shift towards sustainable practices, further solidifying the position of aluminum forgings in the market.

Technological Innovations in Forging Processes

Technological innovations in forging processes are enhancing the capabilities of the Aluminum Forging Market. Advanced techniques such as precision forging and computer-aided design are improving the quality and efficiency of aluminum forgings. These innovations allow for the production of complex shapes and designs that were previously challenging to achieve. As manufacturers adopt these technologies, the market is likely to experience a boost in productivity and a reduction in waste. In 2025, the adoption of these advanced processes could lead to a market growth rate of approximately 6%, as companies seek to optimize their operations and meet rising demand.