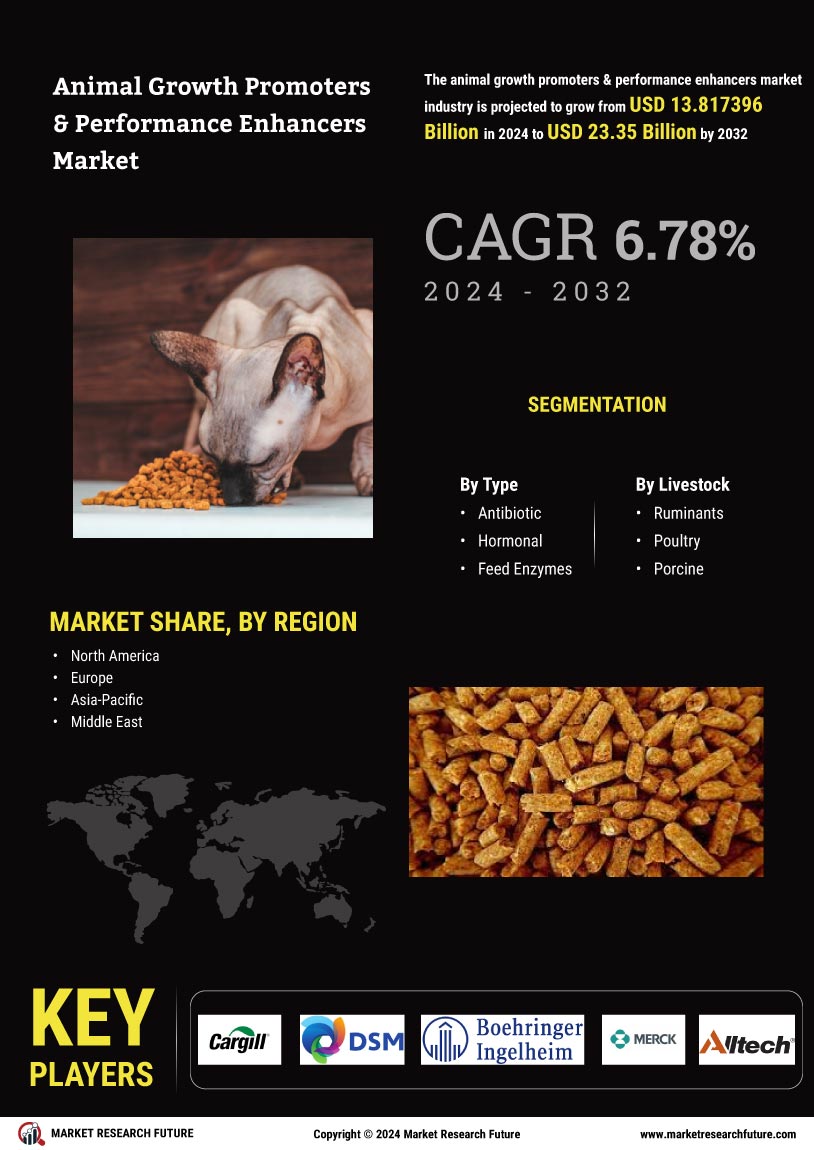

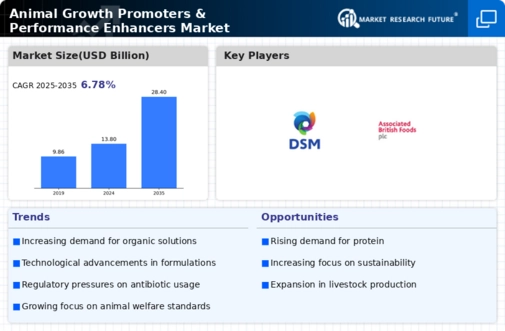

By region, the study provides market insights into Europe, North America, Asia-Pacific, and the Rest of the World. The North American animal growth promoters & performance enhancers market accounted for USD 5.45 billion in 2022 and will likely exhibit a significant CAGR growth in the study period. The high regional consumption of meat and dairy products and the growing demand for sustainable and efficient livestock production require advanced growth-promoting solutions. Farmers in North America seek to optimize animal health and productivity while ensuring the responsible use of antibiotics and maintaining high animal welfare standards.

The robust presence of key market players and innovative research initiatives in the region further contributes to the development and adoption of novel animal growth promoters and performance enhancers, catering to the specific needs of North American livestock producers.

Further, the major countries studied in the market report are The US, German, Canada, the UK, France, Spain, China, Italy, India, Australia, Japan, South Korea, and Brazil.

Figure 2: Animal Growth Promoters & Performance Enhancers Market Share By Region 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe animal growth promoters & performance enhancers market accounts for the second-largest market share. The stringent EU regulations on antibiotic usage in animal farming propel the demand for sustainable growth-promoting alternatives, such as probiotics, prebiotics, and phytogenics. Moreover, the increasing concerns over antimicrobial resistance and the need to reduce environmental impacts drive the adoption of eco-friendly growth promoters in livestock production. Further, the German animal growth promoters & performance enhancers market held the largest market share, and the UK animal growth promoters & performance enhancers market was the fastest-growing market in the European region.

The Asia-Pacific Animal Growth Promoters & Performance Enhancers Market is expected to grow at the fastest CAGR from 2023 to 2032. The growing regional population, rising disposable incomes, and dietary changes drive the demand for animal-based protein sources, stimulating the need for improved livestock production efficiency. With several countries focusing on modernizing their livestock production systems, the Asia Pacific market offers immense growth potential for companies developing innovative animal growth promoters and performance enhancers to support sustainable and efficient agriculture practices.

Moreover, China’s animal growth promoters & performance enhancers market held the largest market share, and the Indian animal growth promoters & performance enhancers market was the fastest-growing market in the Asia-Pacific region.

Recent News:

September 2023: The Department of Fisheries, India has authorized 732 artificial reef units for ten coastal states of India as a sub-activity of the "Integrated Modern Coastal Fishing Villages" component of the Centrally Sponsored Scheme (CSS), with the aim of fostering sustainable practices. With the technical assistance of the Fishery Survey of India (FSI) and the ICAR-Central Marine Fisheries Research Institute (CMFRI), the initiatives are currently being executed. The site selection processes for all states have been finalized, with the exception of Kerala and Maharashtra, which have concluded the tendering process for work execution.

As a result, the anticipated completion date for all initiatives is January 2024. It is anticipated that the implementation of sea ranching programs in all coastal states and the establishment of artificial reefs in coastal waters will serve as effective strategies to restore coastal fisheries and replenish fish inventories. In order to manage aquatic resources, including habitat enhancement, increase productivity, and rehabilitate and/or improve natural habitats, artificial reefs are technological interventions based on engineering.

Leave a Comment