Market Trends

Introduction

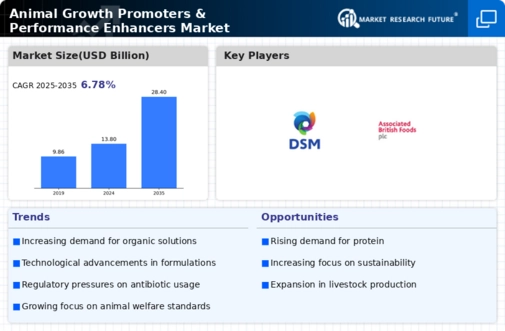

As we enter 2024, the Animal Growth Promoters & Performance Enhancers Market is poised for significant evolution, driven by a confluence of macro factors including technological advancements, regulatory pressures, and shifting consumer behaviors. Innovations in biotechnology and feed additives are enhancing the efficacy and safety of growth promoters, while increasing scrutiny from regulatory bodies is pushing for more sustainable and responsible usage practices. Concurrently, consumers are becoming more health-conscious and demanding transparency in animal husbandry, prompting stakeholders to adapt their strategies accordingly. These trends are not only reshaping product development and marketing approaches but are also critical for ensuring compliance and maintaining competitive advantage in a rapidly changing landscape.

Top Trends

-

Increased Regulatory Scrutiny

Governments worldwide are tightening regulations on the use of growth promoters, particularly antibiotics, in livestock. For instance, the European Union has implemented strict guidelines limiting antibiotic use, leading to a 20% reduction in their application in animal farming. This shift is pushing companies to innovate alternative solutions, such as probiotics and prebiotics, to comply with regulations while maintaining productivity. The operational impact includes increased R&D investments to develop compliant products. -

Shift Towards Natural Ingredients

There is a growing consumer demand for natural and organic products, prompting companies to focus on plant-based growth promoters. For example, Cargill has expanded its portfolio to include natural feed additives, responding to a market trend where 60% of consumers prefer products without synthetic additives. This trend is driving operational changes as companies reformulate products and invest in sourcing sustainable ingredients, potentially leading to a more eco-friendly industry landscape. -

Technological Advancements in Animal Nutrition

The integration of technology in animal nutrition, such as precision feeding and data analytics, is revolutionizing the market. Companies like Alltech are utilizing AI to optimize feed formulations, resulting in improved feed efficiency by up to 15%. This technological shift enhances operational efficiency and reduces waste, indicating a future where data-driven decisions become standard practice in livestock management. -

Focus on Animal Welfare

Animal welfare is becoming a critical concern, influencing purchasing decisions and regulatory frameworks. The World Animal Protection organization reports that 70% of consumers are willing to pay more for products from farms that prioritize animal welfare. This trend is prompting companies to adopt welfare-friendly practices, which may lead to higher operational costs but can enhance brand loyalty and market differentiation. -

Rise of Alternative Proteins

The demand for alternative protein sources, such as insect meal and algae, is gaining traction as a sustainable option for animal feed. Industry leaders like Novus International are exploring these alternatives, which can reduce reliance on traditional feed sources. This shift could lead to significant changes in supply chains and sourcing strategies, as companies adapt to incorporate these innovative ingredients into their products. -

Sustainability Initiatives

Sustainability is becoming a core focus for many companies in the animal growth promoters market. Initiatives to reduce carbon footprints and improve resource efficiency are being adopted, with companies like BASF committing to sustainable practices. Reports indicate that 80% of consumers prefer brands that demonstrate environmental responsibility, pushing companies to align their operations with sustainability goals, which may reshape market dynamics. -

Increased Investment in R&D

The competitive landscape is driving increased investment in research and development to create innovative growth promoters. Companies are allocating up to 10% of their revenue to R&D, focusing on developing effective and safe alternatives to traditional enhancers. This trend is expected to foster innovation, leading to the introduction of new products that meet evolving consumer and regulatory demands. -

Globalization of Supply Chains

The globalization of supply chains is influencing the sourcing and distribution of animal growth promoters. Companies are increasingly looking to international markets for raw materials, which can enhance product availability and reduce costs. However, this trend also introduces complexities related to logistics and compliance with varying regulations across regions, necessitating strategic partnerships and robust supply chain management. -

Consumer Education and Transparency

There is a growing emphasis on consumer education regarding animal nutrition and growth promoters. Companies are investing in transparency initiatives, providing detailed information about product ingredients and sourcing. Research shows that 75% of consumers are more likely to trust brands that openly share their practices, prompting businesses to enhance their communication strategies, which can lead to improved customer relationships and brand loyalty. -

Integration of Biotechnology

Biotechnology is playing an increasingly important role in the development of performance enhancers. Companies are leveraging genetic engineering and fermentation technologies to create more effective products. For instance, Zoetis has introduced genetically modified feed additives that improve growth rates significantly. This trend is likely to accelerate as advancements in biotechnology continue to emerge, potentially transforming the market landscape.

Conclusion: Navigating Competitive Dynamics in 2024

The Animal Growth Promoters & Performance Enhancers Market in 2024 is characterized by intense competitive dynamics and significant fragmentation, with both legacy and emerging players vying for market share. Regional trends indicate a growing demand for sustainable and ethically sourced products, compelling vendors to adapt their strategies accordingly. Legacy players are leveraging established relationships and brand loyalty, while emerging companies are focusing on innovation and agility to capture niche segments. Key capabilities such as AI-driven analytics, automation in production processes, and a commitment to sustainability will be critical in determining market leadership. Vendors must prioritize flexibility in their offerings to respond to evolving consumer preferences and regulatory landscapes, ensuring they remain competitive in this rapidly changing environment.

Leave a Comment