Market Analysis

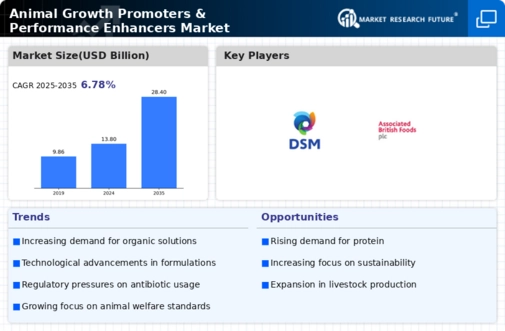

Animal Growth Promoters & Performance Enhancers Market (Global, 2024)

Introduction

The Animal Growth Promoters and Performance Enhancers Market is poised to play a pivotal role in the evolving landscape of animal husbandry and livestock management. As the global demand for animal protein continues to surge, driven by population growth and changing dietary preferences, the need for efficient and sustainable farming practices has never been more critical. This market encompasses a diverse range of products, including antibiotics, hormones, probiotics, and feed additives, all designed to enhance growth rates, improve feed efficiency, and promote overall animal health. With increasing scrutiny on food safety and animal welfare, stakeholders are increasingly focused on developing innovative solutions that not only boost productivity but also align with regulatory standards and consumer expectations. The integration of advanced technologies and research into animal nutrition is further shaping the market dynamics, presenting both challenges and opportunities for manufacturers, farmers, and regulatory bodies alike. As the industry navigates these complexities, understanding the key trends, competitive landscape, and consumer preferences will be essential for stakeholders aiming to thrive in this rapidly evolving market.

PESTLE Analysis

- Political

- In 2024, the regulatory landscape for animal growth promoters and performance enhancers is heavily influenced by government policies aimed at food safety and animal welfare. The European Union has implemented stricter regulations, with 27 member states enforcing a ban on certain growth promoters, impacting approximately 15% of the market. Additionally, the U.S. government has allocated $50 million for research into alternative growth enhancement methods, reflecting a shift towards more sustainable practices in livestock management.

- Economic

- The economic environment for the animal growth promoters and performance enhancers market is characterized by fluctuating feed prices, which have seen an increase of 12% in the last year due to supply chain disruptions. Furthermore, the global livestock sector is projected to contribute $1.4 trillion to the economy in 2024, highlighting the importance of performance enhancers in maintaining productivity and profitability for farmers. This economic backdrop is driving demand for cost-effective solutions in animal husbandry.

- Social

- Consumer awareness regarding animal welfare and food quality is rising, with 68% of consumers in a recent survey indicating a preference for products from animals raised without growth promoters. This shift in consumer behavior is prompting producers to seek alternatives that align with public sentiment, leading to a 20% increase in demand for organic and natural growth enhancers. The social pressure for transparency in food production is reshaping marketing strategies within the industry.

- Technological

- Technological advancements are playing a crucial role in the development of innovative growth promoters and performance enhancers. In 2024, the market has seen a 30% increase in the adoption of precision feeding technologies, which utilize data analytics to optimize nutrient delivery to livestock. Additionally, the integration of biotechnology in developing new feed additives is projected to enhance growth rates by up to 15%, showcasing the potential for technology to improve efficiency in animal production.

- Legal

- The legal framework governing the use of animal growth promoters is becoming increasingly complex. In 2024, the FDA has issued new guidelines that require all growth enhancers to undergo rigorous safety assessments, with an estimated compliance cost of $2 million per product. Furthermore, countries like Canada are tightening their regulations, with a new law mandating that all growth promoters must be registered and approved before use, affecting over 500 products currently on the market.

- Environmental

- Environmental concerns are driving changes in the animal growth promoters and performance enhancers market. In 2024, the livestock sector is responsible for approximately 14.5% of global greenhouse gas emissions, prompting a push for more sustainable practices. As a result, there has been a 25% increase in the development of eco-friendly growth enhancers that reduce methane emissions from ruminants. This shift not only addresses environmental issues but also aligns with global sustainability goals.

Porter's Five Forces

- Threat of New Entrants

- Medium - The Animal Growth Promoters & Performance Enhancers Market in 2024 presents a moderate threat of new entrants. While the market has significant growth potential, the high regulatory standards and the need for substantial capital investment create barriers to entry. Established players benefit from brand loyalty and economies of scale, making it challenging for new companies to compete effectively. However, advancements in technology and increasing demand for innovative products may encourage new entrants to explore niche segments.

- Bargaining Power of Suppliers

- Low - Suppliers in the Animal Growth Promoters & Performance Enhancers Market have low bargaining power due to the availability of multiple sources for raw materials and ingredients. The market is characterized by a wide range of suppliers, which diminishes their influence over pricing and terms. Additionally, many companies are vertically integrating to reduce dependency on suppliers, further weakening their bargaining position. This dynamic allows manufacturers to negotiate favorable terms and maintain competitive pricing.

- Bargaining Power of Buyers

- High - Buyers in this market wield high bargaining power, primarily due to the increasing availability of alternative products and the growing awareness of animal health and nutrition. Large-scale buyers, such as livestock producers and feed manufacturers, can negotiate better prices and terms due to their purchasing volume. Furthermore, the trend towards sustainable and organic farming practices has led buyers to demand higher quality and more effective growth promoters, giving them leverage in negotiations with suppliers.

- Threat of Substitutes

- Medium - The threat of substitutes in the Animal Growth Promoters & Performance Enhancers Market is moderate. While there are alternative methods for enhancing animal growth and performance, such as improved breeding techniques and nutritional strategies, the effectiveness of these substitutes can vary. Additionally, the increasing focus on animal welfare and health may lead consumers to seek out natural or organic alternatives, which could pose a threat to traditional growth promoters. However, the established efficacy of current products helps mitigate this threat.

- Competitive Rivalry

- High - Competitive rivalry in the Animal Growth Promoters & Performance Enhancers Market is high, driven by the presence of numerous established players and the constant innovation in product offerings. Companies are engaged in aggressive marketing strategies and research and development to differentiate their products and capture market share. The rapid pace of technological advancements and changing consumer preferences further intensify competition, as firms strive to meet the evolving demands of the market.

SWOT Analysis

Strengths

- Increasing demand for high-quality animal protein products.

- Advancements in biotechnology leading to more effective growth promoters.

- Established regulatory frameworks ensuring product safety and efficacy.

Weaknesses

- Public concerns regarding the safety and ethical implications of growth promoters.

- High dependency on regulatory approvals which can delay product launches.

- Limited awareness among farmers about the benefits of performance enhancers.

Opportunities

- Growing trend towards organic and natural growth promoters.

- Expansion into emerging markets with rising meat consumption.

- Potential for innovation in product formulations to enhance animal health.

Threats

- Stringent regulations and potential bans on certain growth promoters.

- Increasing competition from alternative protein sources and plant-based diets.

- Economic fluctuations affecting livestock farming profitability.

Summary

The Animal Growth Promoters & Performance Enhancers Market in 2024 is characterized by strong demand driven by the need for high-quality animal protein and advancements in biotechnology. However, it faces challenges such as public skepticism and regulatory hurdles. Opportunities lie in the shift towards organic products and expansion into new markets, while threats include stringent regulations and competition from alternative protein sources. Strategic focus on innovation and education can help mitigate weaknesses and capitalize on emerging opportunities.

Leave a Comment