Top Industry Leaders in the 3D Sensor Market

*Disclaimer: List of key companies in no particular order

The Competitive Landscape of the 3D Sensor Market

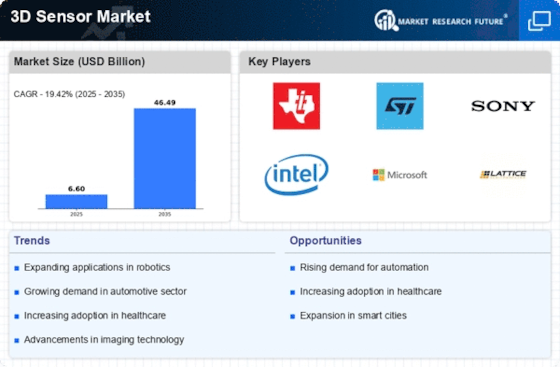

The 3D sensor market is burgeoning, fueled by advancements in technology and its diverse applications across industries. This explosive growth makes understanding the competitive landscape crucial for both established players and aspiring entrants.

Some of the 3D Sensor companies listed below:

- Sony Corporation

- Microsoft Corporation

- Intel Corporation

- Qualcomm Technolgoies Inc.

- STMicroelectronics

- Texas Instruments

- Microchip Technology Inc.

- Infineon Technologies AG

- Occipital Inc.

Strategies Adopted by Leaders

- Technological Prowess: Companies like Intel, Infineon, and Sony invest heavily in R&D, pushing the boundaries of accuracy, range, and resolution. They develop cutting-edge technologies like Time-of-Flight (ToF) and structured light for enhanced performance.

- Application Focus: Players cater to specific industry needs. For instance, PMD Technologies excels in automotive LiDAR sensors, while Occipital focuses on VR/AR applications. This specialization allows for deeper market penetration and tailored solutions.

- Ecosystem Integration: Some players like SoftKinetic (owned by Sony) integrate their 3D sensors with game engines and software platforms, creating seamless user experiences. This fosters adoption and brand loyalty.

- Cost-Effectiveness: Budget-conscious brands like PMD and STMicroelectronics offer affordable 3D sensors, catering to price-sensitive segments like consumer electronics and robotics.

Critical Factors for Market Share Analysis

-

Sensor Type: Different technologies cater to specific needs. ToF sensors excel in outdoor applications, while structured light is better suited for indoor use. Analyzing market share by sensor type reveals industry trends and dominant players.

-

Application Segment: The market encompasses diverse applications like autonomous vehicles, robotics, consumer electronics, and healthcare. Understanding market share by segment helps identify growth opportunities and key players in each space.

-

Regional Variations: Regional demand patterns significantly impact market share. North America remains the largest market, while Asia Pacific is expected to exhibit the fastest growth due to its burgeoning middle class and rapid technological advancements.

-

End-User Segments: Catering to the needs of different end-user segments (OEMs, integrators, end users) is crucial. OEMs require bulk sensors with specific integrations, while end users prioritize ease of use and affordability.

New and Emerging Companies

-

Vayyar Imaging: This Israeli company develops radio-based 3D imaging sensors that work through walls and clothing, offering unique applications in security and healthcare.

-

Orbbec: This Chinese company specializes in high-performance, low-cost ToF sensors, targeting price-sensitive applications like mobile phones and AR/VR devices.

- Blickfeld: This German startup focuses on LiDAR sensors for autonomous vehicles, offering high-resolution and long-range capabilities at competitive prices.

Industry Developments:

June 2023- Samsung has lately unveiled 3D ToF sensors at the 2023 VLSI Symposium event. One sensor features on-chip ISP and comes with a 2-stack process technology. It has a 65nm BSI layer and a 28nm CMOS area. The best part of this sensor is it can measure a distance of about 5 meters in a 60fps frame rate. This is basically a low-power chip with a power consumption of just 188mW. It is used in modern VR/AR headsets. These devices can use multiple such sensors for measuring nearby areas, hand gestures, and objects for operating AR/VR headsets.

April 2023- Newsight Imaging Ltd., leading semiconductor innovator creating proprietary 3D machine vison sensors, the spectral vision chips & systems has lately launched a novel member of MT LiDAR reference design family. This latest reference design allows 3D mapping through a single scan with the 480 depth points that support 20um-1mm depth resolution with the capability of attaining hundreds of frames every second thus making it apt for ongoing production & structure inspection control.

November 2022- Hypersen, a leading chromatic confocal technology supplier has released its latest Coaxial 3D line confocal sensor for the worldwide measurement and inspection market. This new 3D sensor provides a high precision and effective 3D inspection solution for the measurement & defects detection issues in the domains of aviation, automobile, metal, new energy, consumer electronics, and semiconductors. The specialty of this sensor is that it solves the shadowing issue while measuring targets with steep slopes, holes, and protruding components.