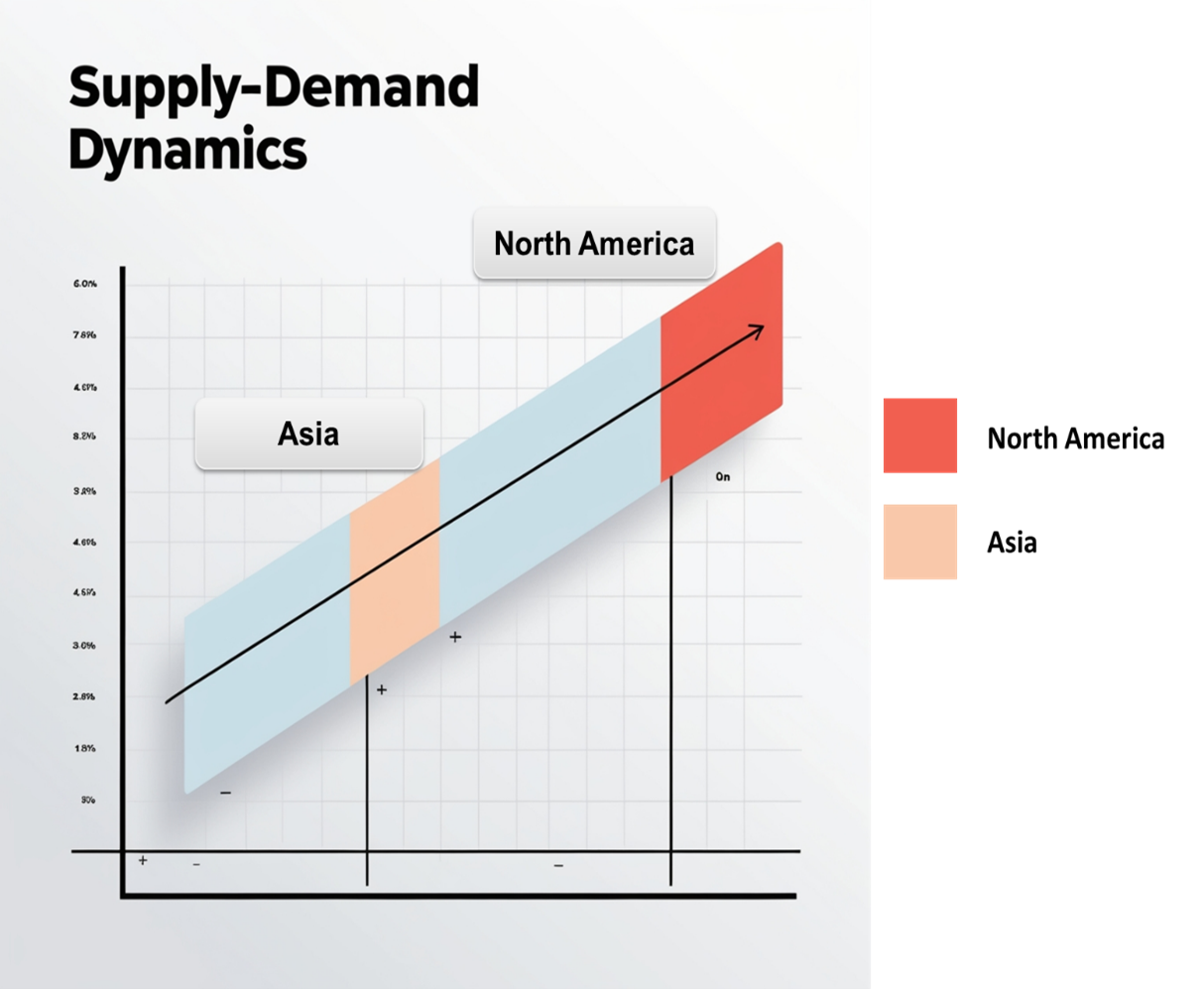

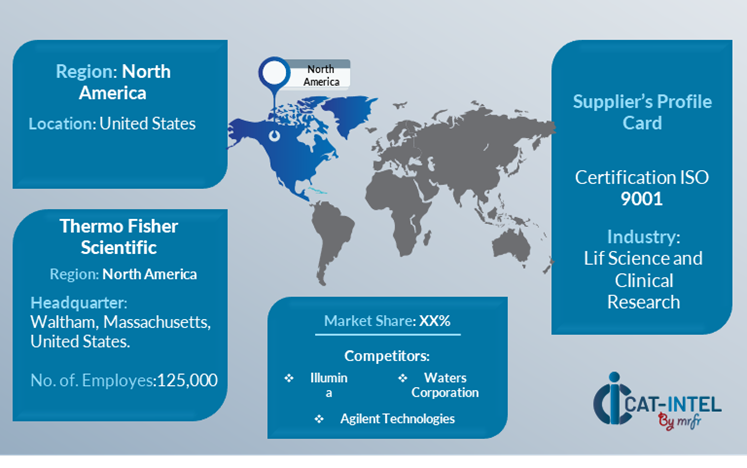

The global Base Oil - Group II market is witnessing substantial growth, driven by the increasing demand across automotive, industrial, and marine sectors. With enhanced lubricating properties and lower volatility, Group II base oils are becoming the preferred choice for applications requiring improved performance and environmental compliance. Our report provides a comprehensive analysis of emerging procurement trends, emphasizing cost-saving strategies, the shift toward sustainable production processes, and innovations within the lubricants industry. Future procurement challenges, such as supply chain volatility and stringent regulations, are addressed, underscoring the significance of digital tools for efficient forecasting and resource management to help clients adapt in this evolving market landscape. Additionally, we address future procurement challenges and emphasize the importance of digital procurement tools in accurately forecasting market needs to keep clients ahead in this dynamic landscape. Strategic sourcing and procurement management play a crucial role in streamlining the procurement process for Base Oil- group II development. As competition intensifies, companies are leveraging market intelligence solutions and procure analytics to optimize their supply chain management systems. The outlook for the Base Oil - Group II market is positive, with several growth trends and projections shaping the market through 2032 Growth Rate 4.7% Growth Drivers: Recent reports indicate that the Base Oil - Group II market is facing rising costs, largely driven by fluctuations in raw material prices and refining costs. Market analyses offer cost forecasts and insights on procurement savings, helping organizations manage price volatility while maintaining product quality. Leveraging insights from these reports allows stakeholders to adopt cost-saving strategies, optimize procurement processes, and ensure steady access to quality base oils amid fluctuating market conditions. To stay ahead in the Base Oil - Group II market, companies are optimizing procurement strategies, leveraging spend analysis solutions for vendor spend analysis, and enhancing supply chain efficiency through supply market intelligence. Procurement category management and strategic sourcing are becoming vital in achieving cost-effective procurement and ensuring timely availability of essential raw materials for base oil production. By utilizing detailed supplier performance data and market insights, companies can improve supplier relationships, manage cost volatility, and ensure a reliable supply of high-quality base oils. The Base Oil - Group II market is seeing steady price growth in 2024, driven by increased demand in sectors such as automotive lubricants and manufacturing. Regional supply challenges, including factory closures and shipping delays, have exacerbated price fluctuations, particularly in the Asia-Pacific and Middle Eastern markets. The market is also affected by geopolitical tensions and rising crude oil costs, which influence logistics and pricing across major ports. With demand expected to rise due to industrial growth and ongoing geopolitical risks, the pricing outlook remains upward, though regional variations may occur. Companies are advised to adjust procurement strategies to secure long-term contracts and mitigate cost volatility. Optimizing procurement in the base oil market can lead to substantial cost savings while improving operational efficiency. Strategic partnerships and bulk purchasing can reduce raw material costs, while advancing refining technologies can increase yield and decrease waste. Collaboration with logistics providers can streamline distribution, reducing transportation and inventory costs. Additionally, energy-efficient refining processes help lower operational costs, while embracing automation and digitization can reduce labor expenses. Consolidating suppliers and using predictive maintenance technology for production equipment can minimize downtime and prevent costly repairs. Overall, these procurement strategies not only enhance profitability but also contribute to sustainability goals in the base oil market. The Base Oil - Group II market is expanding, driven by demand across sectors like automotive, industrial, and marine industries. Technological advancements in refining processes are also shaping supply trends, while environmental regulations and market competition are influencing both cost structures and availability. Demand Factors: Supply Factors: The image shows growing demand for Base oil group ll in both North America and Asia, with potential price increases and increased competition. North America, especially the U.S., plays a central role in the Base Oil - Group II market, with the following key drivers: North America remains a key hub base oil-group II innovation and growth The supplier penetration in the Base Oil - Group II market is substantial, with a growing number of global and regional players contributing to the production and distribution of high-quality base oils. These suppliers play a crucial role in the overall market dynamics, impacting pricing, innovation, and availability. The market is highly competitive, with suppliers ranging from major multinational oil companies to specialized refiners focusing on advanced processing technologies for Group II base oils. Currently, the supplier landscape is characterized by significant consolidation among top-tier multinational oil companies, which dominate the market share. However, emerging refiners and regional players are also expanding their footprint by focusing on sustainable and high-performance base oils to meet evolving demand. Some of the key suppliers in the Base Oil - Group II market include: Key Development: procurement category significant development Development Description Impact on Market Rising Demand for High-Performance Oils Increased adoption of Group II oils in automotive and industrial lubricants due to their superior viscosity and stability. Drives growth in the base oil market as manufacturers prioritize higher-quality oils. Advancements in Refining Technologies New refining processes (e.g., hydrocracking) are improving the production of high-quality Group II oils with lower sulfur content and enhanced oxidative stability. Helps meet stringent environmental regulations and enhances the competitive edge for suppliers. Environmental Regulations and Sustainability Focus Growing emphasis on reducing emissions and improving fuel economy has accelerated the demand for low-sulfur, high-performance oils. Drives innovation in Group II oil formulations to meet tighter environmental standards and improve sustainability. Procurement Attribute/Metric Details Market Sizing The Base Oil - Group II market is projected to grow from USD 20.75 billion in 2024 to USD 45 billion by 2032, with a CAGR of 4.7% (2024-2032). Procurement Technology Adoption Rate 40% of organizations are adopting advanced filtration and refining technologies to improve the quality and efficiency of Group II base oils. Top Procurement Strategies for 2024 Focus on increasing operational efficiency, sustainability in production, optimizing raw material sourcing, and expanding supply chain resilience. Procurement Process Automation 30% of manufacturers have automated aspects of their production processes, especially in refining and packaging Group II base oils. Procurement Challenges Major challenges include fluctuating crude oil prices, ensuring consistent quality standards, and maintaining supply chain stability amidst geopolitical tensions. Key Suppliers Key suppliers include ExxonMobil, Chevron, Royal Dutch Shell, Phillips 66, and Sinopec. These companies dominate the market with large-scale refineries and robust distribution networks. Key Regions Covered North America, Europe, Asia-Pacific, and the Middle East, with a specific focus on the U.S., China, India, and the UAE due to high consumption and manufacturing activities in the automotive and industrial sectors. Market Drivers and Trends Growth driven by increased demand from the automotive sector, stringent emissions standards, and rising demand for high-performance lubricants. Notable trends include the shift towards sustainable and eco-friendly base oil production methods.Base Oil - Group II Market Overview

Key Trends and Sustainability Outlook

Overview of Market Intelligence Services for the Base Oil- group IIs Market

Procurement Intelligence for Base Oil - Group II market: Category Management and Strategic Sourcing

Pricing Outlook for Base Oil - Group II Market: Spend Analysis

Cost Breakdown for the Base Oil- group II market: Total cost of ownership TCO and Cost saving opportunity

Cost-Saving Opportunities: Negotiation Lever and Purchasing Negotiation Strategies

Supply and Demand Overview of the Base Oil- group IIs Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)"

Regional Demand-Supply Outlook: Base Oil - Group II Market

North America: Leading the Base Oil - Group II Market

Supplier Landscape: Supplier Negotiations and Strategies

Frequently Asked Questions (FAQ):

Our procurement intelligence services offer a comprehensive analysis of the global supplier landscape, identifying key suppliers in the Base Oil - Group II market. We provide spend analysis, supplier performance evaluations, and market intelligence to help you source base oil efficiently and cost-effectively.

We assist in evaluating the Total Cost of Ownership (TCO) for sourcing Base Oil - Group II by factoring in procurement costs, transportation, storage, and refining expenses. Our cost analysis services help ensure you understand the long-term financial impact of sourcing base oils.

We offer a detailed risk management framework that highlights potential supply chain disruptions, fluctuations in crude oil prices, regulatory challenges, and supplier reliability. Our solutions help mitigate risks associated with sourcing and ensure a stable supply of Base Oil - Group II.

Our Supplier Relationship Management (SRM) services guide you in establishing strong partnerships with Base Oil suppliers. We focus on improving collaboration, negotiating favorable terms, and ensuring consistent product quality while maintaining cost efficiency.

We provide a thorough breakdown of procurement best practices for the Base Oil - Group II market, including sourcing models, supplier categorization, pricing strategies, and contract management that ensure informed, strategic procurement decisions.

Digital transformation is crucial for streamlining Base Oil procurement processes. We offer solutions that incorporate automation and data analytics, enabling you to track supplier performance, monitor market trends, and optimize procurement strategies in real-time.

Our supplier performance management solutions help you assess and monitor suppliers of Base Oil - Group II, ensuring they meet quality, delivery, and compliance standards. This enables better decision-making and supplier retention, reducing procurement risks.

We provide insights into negotiation strategies, offering support in supplier negotiations to secure favorable pricing, volume discounts, and flexible payment terms. Our data-driven approach ensures your negotiations are backed by market intelligence.

We offer advanced market analysis tools that provide insights into global trends, supplier market share, and price forecasts for Base Oil - Group II. This data helps in understanding market conditions, identifying opportunities, and making more informed purchasing decisions.

Our procurement solutions include guidance on regulatory compliance in the Base Oil - Group II market. We help you navigate complex procurement processes, ensuring that all suppliers adhere to regulatory standards and meet quality specifications.

We offer strategies to mitigate supply chain disruptions by identifying backup suppliers, establishing contingency plans, and monitoring supply market outlooks. Our insights into the supplier landscape help you ensure a stable and continuous supply of Base Oil - Group II.

Through our supplier performance tracking tools, we help you monitor supplier quality, delivery timelines, and compliance. Regular supplier evaluations and performance reports provide transparency and help you optimize future procurement decisions.

We assist in identifying suppliers who implement sustainable practices in the refining process of Base Oil - Group II. Our services include sustainability assessments, ensuring that the suppliers you choose meet your environmental and ethical standards.

Our pricing analysis services allow you to compare Base Oil - Group II costs across different suppliers, ensuring you achieve competitive pricing. We analyze pricing trends, negotiation levers, and market dynamics to secure the best value for your organization.

We provide an in-depth analysis of market opportunities and risks, highlighting emerging trends in refining technologies and supply chain dynamics for Base Oil - Group II. Our insights help you stay ahead of the competition by identifying strategic procurement opportunities and potential risks in the market.

Table of Contents (ToC)

1. Executive Summary: Market Overview, Procurement Insights, and Negotiation Leverage

• Base Oil - Group II Market Overview

• Key Highlights

• Supply Market Outlook

• Demand Market Outlook

• Category Strategy Recommendations

• Category Opportunities and Risks

• Negotiation Leverage and Key Talking Points

• Impact of Macroeconomic Factors (e.g., COVID-19, Inflation)

2. Research Methodology: Procurement Intelligence, Market Analysis, and Spend Analysis Tools

• Definition and Scope

• Research Objectives for the Base Oil - Group II Market

• Data Sources and Approach

• Assumptions and Limitations

• Market Size Estimation and Forecast Methodology

3. Market Analysis and Category Intelligence

• Market Maturity and Trends

• Industry Outlook and Key Developments

• Drivers, Constraints, and Opportunities

• Regional Market Outlook within the Base Oil - Group II Market

• Procurement-Centric Five Forces Analysis

• Mergers and Acquisitions (M&As)

• Market Events and Innovations

4. Cost Analysis, Spend Analysis, and Pricing Insights

• Cost Structure Analysis

• Cost Drivers and Savings Opportunities

• Total Cost of Ownership (TCO) Analysis

• Pricing Analysis and Expected Savings

• Billing Rate Benchmarking

• Factors Influencing Pricing Dynamics

• Contract Pointers and SLAs

• Market Cost Performance Indicators

• Risk Assessment and Mitigation Strategies

• Spend Analytics and Cost Optimization

5. Supplier Analysis and Benchmarking

• Base Oil - Group II Supply Market Outlook

• Supply Categorization and Market Share

• Base Oil - Group II Material Supplier Profiles and SWOT Analysis

• Supplier Performance Benchmarking

• Supplier Performance Evaluation Metrics

• Disruptions in the Supply Market

6. Technology Trends and Innovations

• Current Industry Technology Trends

• Technological Requirements and Standards

• Impact of Digital Transformation

• Emerging Tools and Solutions

• Adoption of Standardized Industry Practices

7. Procurement Best Practices

• Sourcing Models and Strategies

• Pricing Models and Contracting Best Practices

• SLAs and Key Performance Indicators (KPIs)

• Strategic Sourcing and Supplier Negotiation Tactics

• Industry Sourcing Adoption and Benchmarks

8. Sustainability and Risk Management: Best Sustainability Practices

• Supply Chain Sustainability Assessments

• Corporate Social Responsibility (CSR) Alignment

• Risk Identification and Assessment

• Contingency Planning and Supplier Diversification

• Holistic Risk Mitigation Strategies

9. Category Strategy and Strategic Recommendations

• Market Entry Strategies

• Growth Strategies for Market Expansion

• Optimal Sourcing Strategy

• Investment Opportunities and Risk Analysis

• Supplier Innovation Scouting and Trends

• Cross-Functional Collaboration Frameworks

10. Future Market Outlook

• Emerging Market Opportunities

• Predictions for the Next Decade

• Expert Opinions and Industry Insights

11. Appendices: Procurement Glossary, Abbreviations, and Data Sources

• Glossary of Terms

• Abbreviations

• List of Figures and Tables

• References and Data Sources