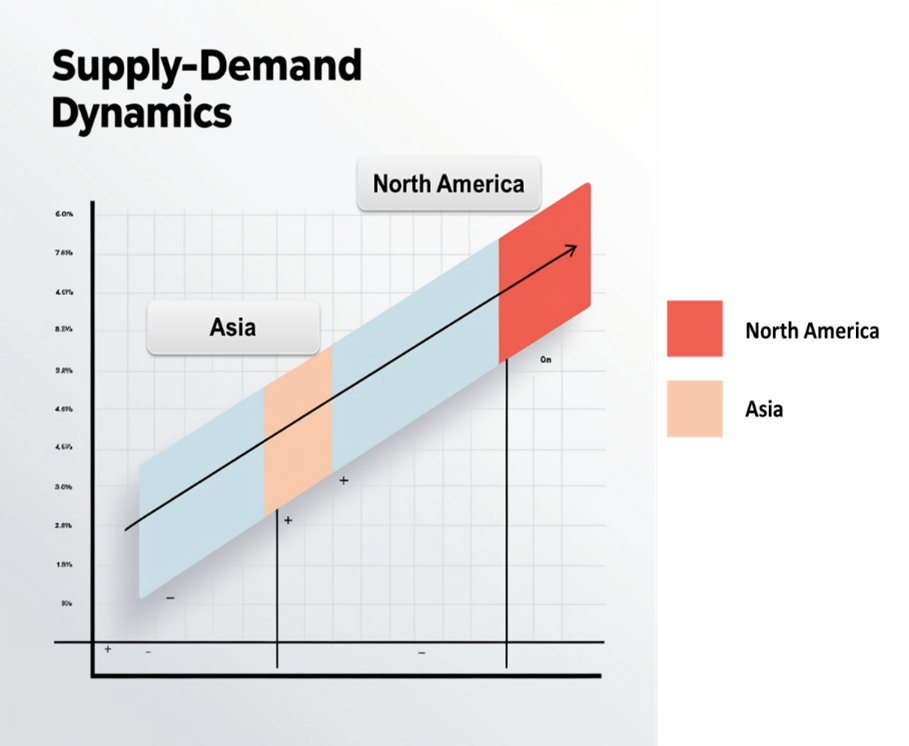

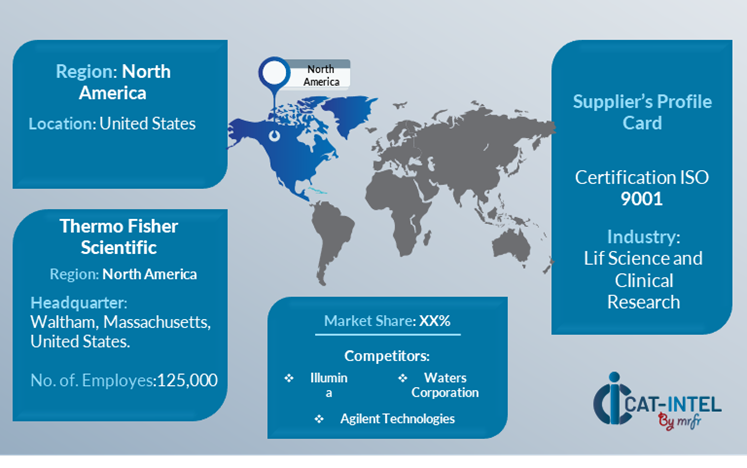

The global acetic acid market is experiencing notable growth, driven by advancements in production technologies, rising demand across industries, and increased investment in R&D. This market serves diverse applications, including chemical manufacturing, textiles, and food preservation. Our report provides an in-depth analysis of procurement trends, with a focus on cost-saving strategies through partnerships and efficient sourcing practices. We also address procurement challenges and highlight the role of digital tools in accurate demand forecasting to keep clients competitive in this dynamic market. Strategic sourcing and procurement management are essential for streamlining the procurement process as competition intensifies. Companies are leveraging market intelligence and procurement analytics to optimize supply chain efficiency in the acetic acid sector. The outlook for the acetic acid is optimistic key trends projections indicating 2032. Growth Rate: 6.8% Key Trends and Sustainability Outlook: Growth Drivers: Overview of Market Intelligence Services for the Acetic Acid Market: Recent analyses indicate that the acetic acid market is facing challenges due to rising raw material costs and fluctuating demand across industries such as chemicals, food, and textiles. Market reports provide detailed cost forecasts and insights into procurement savings, enabling companies to manage price volatility while securing quality supplies. By utilizing these insights, stakeholders can implement cost-effective procurement strategies, ensuring operational efficiency and stability in a dynamic market environment. Procurement Intelligence for Acetic Acid: Category Management and Strategic Sourcing To stay competitive in the acetic acid market, companies are enhancing procurement strategies by using spend analysis tools to track vendor expenditures and improving supply chain efficiency through market insights. Effective category management and strategic sourcing are key to achieving cost-effective procurement and ensuring the consistent availability of acetic acid, which is crucial for maintaining high-quality production processes. Price Outlook for Acetic Acid: Spend Analysis The acetic acid market is currently facing a challenging pricing environment marked by a consistent rise in costs. This upward trend is driven by increasing raw material prices, heightened demand across various industries, and ongoing investments in production technology and infrastructure. Additionally, potential supply chain disruptions caused by geopolitical tensions or trade policies may exacerbate volatility in the market. Analysts predict that while prices may stabilize in the short term, long-term trends will largely depend on advancements in production technologies and shifts in global demand patterns. The Grap shows the general upward trend in pricing for acetic acid, likely due to rising costs, increased complexity, and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and dynamics. The Acetic Acid market is expected to experience significant price fluctuations driven by various factors, including supply-demand dynamics, production costs, and geopolitical influences. In recent years, increasing demand from end-use industries such as textiles, food and beverage, and pharmaceuticals has supported higher acetic acid prices. However, the rising costs of feedstock materials, particularly natural gas and methanol, are putting upward pressure on production costs, which could lead to further price increases. Cost Breakdown for the Acetic Acid Total Cost Ownership (TCO) and Cost Saving Opportunities: Cost Saving Opportunities: Negotiation Lever and Purchasing Negotiation Strategies In the acetic acid industry, optimizing procurement processes can lead to significant cost savings and improved leveraging online platforms for procurement can eliminate intermediary fees and enhance supplier visibility. Implementing digital tools for inventory management streamlines administrative tasks and improves productivity, allowing companies to track performance metrics and optimize resource allocation effectively. Additionally, adopting energy-efficient production practices can lower utility expenses, while outsourcing non-core operations, such as logistics and maintenance, can reduce staffing costs. Virtual collaboration tools can help minimize travel expenses for global teams, and strategically aligning procurement with production capabilities can further alleviate financial pressures. Overall, these strategies not only foster innovation within the acetic acid sector but also empower companies to enhance their market competitiveness while managing budgets more effectively. Supply and Demand Overview for Acetic Acid: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM) The acetic acid market is witnessing growth driven by rising demand across industries like chemicals, food, and pharmaceuticals. This demand is fuelled by its essential role in production processes, supported by partnerships between manufacturers, suppliers, and regulatory bodies. Demand Factors: Supply Factors: Regional Demand-Supply Outlook: Acetic Acid Images shows growing demand for acetic acid in both North America and Asia, with potential price increases and competition. North America: Dominance in the Acetic Acid North America, particularly the U.S. and Canada, asserts unparalleled dominance in the acetic acid, characterized by: Supplier Landscape: Supplier Negotiations and Strategies: The supplier landscape in the acetic acid market is diverse, with several global and regional suppliers involved in production and distribution. These suppliers play a crucial role in shaping market dynamics, influencing pricing, production quality, and availability. The market is competitive, featuring large chemical manufacturers as well as specialized firms focusing on niche applications and advanced production methods. Currently, the supplier landscape shows consolidation among major manufacturers, but smaller and emerging players are gaining traction by targeting specific industries and improving efficiency. Key suppliers in the acetic acid market include: Acetic Acid Attribute/Metric Details Market Sizing The acetic acid is expected to reach approximately to grow to USD 29.05 billion by 2032 reflecting a compound annual growth rate (CAGR) of about 6.8% from 2024 to 2032. Acetic Acid Technology Adoption Rate Around 60% of manufacturers are adopting innovative production techniques to enhance efficiency and product quality. Top Acetic Acid Strategies for 2024 Focus on improving production methods, ensuring supply chain stability, enhancing product purity, and reducing costs. Acetic Acid Process Automation 35% of companies have automated key processes, including production and quality control, to improve operational efficiency. Acetic Acid Process Challenges Major challenges include fluctuating raw material prices, supply chain disruptions, and increasing environmental regulations. Key Suppliers Leading suppliers include Sinopec, BP Chemical, Dow Chemical, LyondellBasell, and Eastman Chemical, providing high-quality acetic acid. Key Regions Covered North America, Europe, and Asia-Pacific, with key markets in the U.S., China, and India due to strong industrial demand. Market Drivers and Trends Growth driven by increased use in chemical manufacturing, food preservation, and pharmaceutical applications, along with innovations in production techniques.Acetic Acid Market Overview:

Frequently Asked Questions (FAQ):

Our procurement intelligence services provide in-depth analysis of the acetic acid supplier landscape, identifying key providers. We offer spend analysis, supplier performance reviews, and market insights to help source high-quality, cost-effective acetic acid.

We help assess TCO by considering production, transportation, storage, and regulatory compliance costs. Our services allow you to understand the long-term financial impact of acetic acid procurement.

Our risk management framework addresses supply chain disruptions, raw material price fluctuations, and regulatory compliance, helping you mitigate risks in acetic acid sourcing.

Our Supplier Relationship Management (SRM) services focus on building strong partnerships with acetic acid suppliers, emphasizing collaboration, favourable contract terms, and consistent product quality.

We provide a guide to best practices in acetic acid procurement, covering supplier categorization, pricing models, and contract management to make informed, strategic sourcing decisions.

Digital transformation enhances acetic acid procurement through automation and analytics, allowing real-time tracking of supplier performance and market trends for optimized procurement strategies.

Our supplier performance management solutions help monitor acetic acid suppliers, ensuring they meet quality, delivery, and compliance standards, aiding better procurement decisions.

We assist in negotiations by providing market insights, helping secure better pricing, volume discounts, and flexible payment terms through data-driven strategies.

We offer market analysis tools that provide insights into global trends, supplier market share, and price forecasts, empowering informed procurement decisions.

Our solutions guide you in ensuring that suppliers comply with industry regulations, safety standards, and environmental guidelines for acetic acid procurement.

We provide strategies to manage disruptions, such as identifying backup suppliers and developing contingency plans, ensuring steady acetic acid supply.

Our supplier performance tracking tools help you monitor supplier quality, delivery, and compliance, providing insights for future procurement decisions.

We help identify suppliers with sustainable practices, assessing their environmental and ethical standards to ensure eco-friendly acetic acid sourcing.

Our pricing analysis services compare costs across suppliers, analysing market trends and negotiation opportunities to secure the best value for acetic acid.

Table of Contents (TOC)

Executive Summary: Market Overview, Procurement Insights, and Negotiation Leverage

Acetic Acid Market Overview

Key Highlights

Supply Market Outlook

Demand Market Outlook

Category Strategy Recommendations

Category Opportunities and Risks

Negotiation Leverage and Key Talking Points

Impact of Macroeconomic Factors (e.g., COVID-19, Inflation)

Research Methodology: Procurement Intelligence, Market Analysis, and Spend Analysis

Tools

Definition and Scope

· Research Objectives for the Acetic Acid Market

· Data Sources and Approach

· Assumptions and Limitations

· Market Size Estimation and Forecast Methodology

Market Analysis and Category Intelligence

Market Maturity and Trends

· Industry Outlook and Key Developments

· Drivers, Constraints, and Opportunities

· Regional Market Outlook within the Acetic Acid Market

· Procurement-Centric Five Forces Analysis

· Mergers and Acquisitions (M&As)

· Market Events and Innovations

Cost Analysis, Spend Analysis, and Pricing Insights

Cost Structure Analysis

· Cost Drivers and Savings Opportunities

· Total Cost of Ownership (TCO) Analysis

· Pricing Analysis and Expected Savings

· Billing Rate Benchmarking

· Factors Influencing Pricing Dynamics

· Contract Pointers and SLAs

· Market Cost Performance Indicators

· Risk Assessment and Mitigation Strategies

· Spend Analytics and Cost Optimization

Supplier Analysis and Benchmarking

Acetic Acid Supply Market Outlook

· Supply Categorization and Market Share

· Acetic Acid Market Supplier Profiles and SWOT Analysis

· Supplier Performance Benchmarking

· Supplier Performance Evaluation Metrics

· Disruptions in the Supply Market

Technology Trends and Innovations

Current Industry Technology Trends

· Technological Requirements and Standards

· Impact of Digital Transformation

· Emerging Tools and Solutions

· Adoption of Standardized Industry Practices

Procurement Best Practices

Sourcing Models and Strategies

· Pricing Models and Contracting Best Practices

· SLAs and Key Performance Indicators (KPIs)

· Strategic Sourcing and Supplier Negotiation Tactics

· Industry Sourcing Adoption and Benchmarks

Sustainability and Risk Management: Best Sustainability Practices

Supply Chain Sustainability Assessments

· Corporate Social Responsibility (CSR) Alignment

· Risk Identification and Assessment

· Contingency Planning and Supplier Diversification

· Holistic Risk Mitigation Strategies

Category Strategy and Strategic Recommendations

Market Entry Strategies

· Growth Strategies for Market Expansion

· Optimal Sourcing Strategy

· Investment Opportunities and Risk Analysis

· Supplier Innovation Scouting and Trends

· Cross-Functional Collaboration Frameworks

Future Market Outlook

Emerging Market Opportunities

· Predictions for the Next Decade

· Expert Opinions and Industry Insights

Appendices: Procurement Glossary, Abbreviations, and Data Sources

Glossary of Terms

· Abbreviations

· List of Figures and Tables

· References and Data Sources