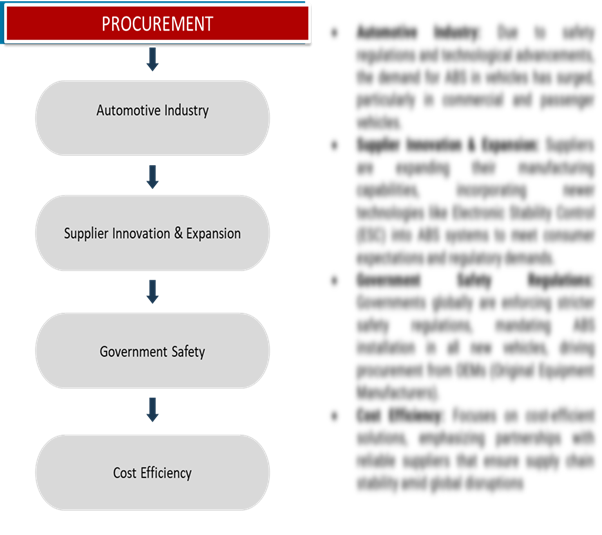

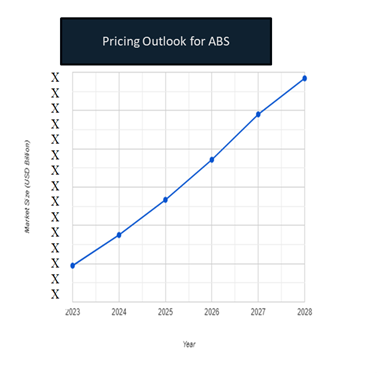

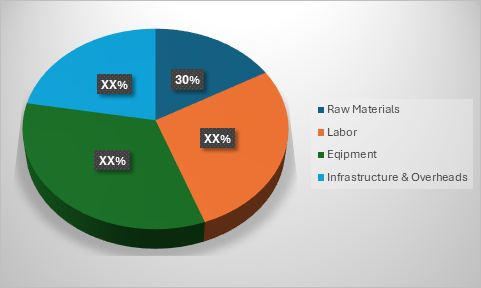

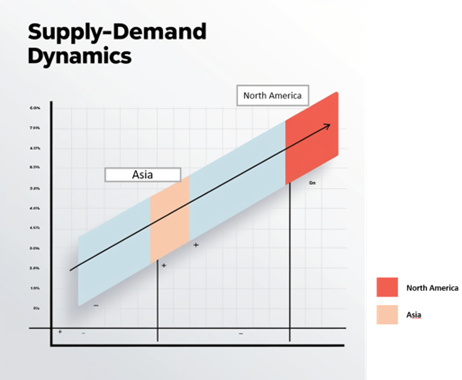

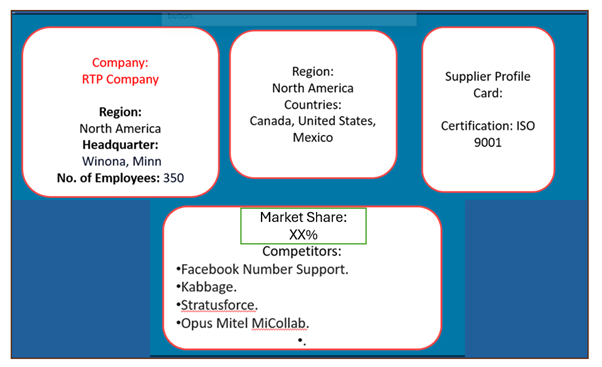

The global ABS (Acrylonitrile Butadiene Styrene) market is experiencing steady growth, driven by increasing demand from automotive, electronics, and consumer goods industries. This market includes a wide range of applications such as automotive parts, household products, and electrical components. Our report provides a comprehensive analysis of emerging procurement trends, highlighting cost-saving strategies through supplier partnerships and the adoption of digital tools to streamline production processes. Future procurement challenges include the need for accurate demand forecasting and supply chain resilience, supported by digital procurement solutions to improve responsiveness. Strategic sourcing and effective procurement management are crucial for optimizing ABS production and maintaining quality standards. As competition intensifies, companies are leveraging market intelligence and procurement analytics to improve supply chain efficiency and sustain their competitive advantage. The market outlook for Acrylonitrile Butadiene Styrene (ABS). Growth Rate: 6.0% Key Trends and Sustainability Outlook: Growth Drivers: Overview of Market Intelligence Services for the ABS Market Recent analyses indicate that the ABS market faces challenges with fluctuating raw material costs and growing demand across industries like automotive and electronics. Market reports provide detailed cost projections and identify procurement savings opportunities, helping manufacturers manage cost fluctuations while maintaining product quality. By utilizing these insights, stakeholders can adopt cost-effective strategies and optimize procurement processes, ensuring efficiency and competitiveness in a rapidly evolving market. Procurement Intelligence for ABS: Category Management and Strategic Sourcing To stay competitive in the ABS market, companies are enhancing procurement strategies by using spend analysis tools to track vendor costs and improving supply chain efficiency with market intelligence. Effective category management and strategic sourcing are key to achieving cost-effective procurement and ensuring the timely availability of essential materials needed for high-quality ABS production. Pricing Outlook for ABS: Spend Analysis The pricing model for Acrylonitrile Butadiene Styrene (ABS) typically consists of base material costs, processing fees, and implementation expenses. Base costs cover the raw ABS material, while processing fees relate to melding, extrusion, and other manufacturing steps. Additional costs may be incurred for customization, such as colouring or special finishes, depending on the end-use application. The graph shows a general upward trend in pricing for ABS, likely due to rising costs, increased complexity, and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, competitive dynamics. The growing need for sustainable, high-performance plastics is driving investment in research and innovation within the ABS sector. Much like other industries, manufacturers face rising costs for raw materials and production technologies. However, companies can manage these costs through strategic procurement approaches such as bulk buying, securing long-term supplier agreements, and capitalizing on economies of scale. By investing in more efficient production technologies and automation, businesses can reduce operational costs while enhancing product quality and meeting industry demands effectively. Cost Breakdown for the ABS Total Cost of Ownership (TCO) and Cost Saving Opportunities: Cost Saving Opportunities: Negotiation Lever and Purchasing Negotiation Strategies In the Acrylonitrile Butadiene Styrene (ABS) market, optimizing procurement offers significant opportunities for reducing costs and improving efficiency. Automating production processes can help lower labor costs and increase accuracy in manufacturing. Collaborative purchasing arrangements with other companies allow for bulk buying of ABS materials, reducing the cost per unit. Data analytics can be used to track material usage and identify potential areas for savings, such as minimizing waste or optimizing production runs. Outsourcing non-core functions like logistics or packaging can also help reduce operational expenses. Additionally, using digital communication tools minimizes the need for in-person meetings, cutting travel-related costs. These strategies allow businesses to streamline operations and manage their budgets more effectively while maintaining high-quality production standards. Supply and Demand Overview for ABS: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM) The ABS market is experiencing growth, driven by increased demand from industries such as automotive, electronics, and consumer goods. Demand is particularly high due to the need for durable, high-performance materials, supported by strong industry investments and technological advancements. Demand Factors: Supply Factors: Regional Demand-Supply Outlook: ABS: The image shows growing demand ABS in both North America and Asia, with potential price increases and increased competition. North America: Dominance in the ABS. North America, particularly the U.S. and Canada, asserts unparalleled dominance ABS characterized by: North America remains like a hub for ABS Growth Supplier Landscape: Supplier Negotiations and Strategies The supplier landscape in the ABS market is diverse, with several global and regional players involved in the production and distribution of ABS. These suppliers play a key role in shaping market dynamics, influencing pricing, production technologies, and supply chain efficiency. The market is highly competitive, with major chemical manufacturers and specialized firms driving innovation in ABS production. Currently, the supplier landscape features consolidation among leading manufacturers, but smaller and emerging companies are growing by focusing on niche applications and sustainable production methods. Key suppliers in the ABS market include: Key Developments Procurement Category Significant Development: Key Developments Description Sustainability Focus Increasing emphasis on recycled and eco-friendly ABS formulations to meet consumer demand for sustainable products. Technological Advancements Adoption of advanced manufacturing technologies to enhance efficiency and improve product quality. Market Expansion Growth driven by rising demand in sectors such as automotive, consumer electronics, and construction. Supply Chain Resilience Efforts to strengthen supply chains in response to global disruptions, ensuring consistent material availability. Regulatory Compliance Adaptation to evolving regulations concerning chemical safety and environmental standards. Innovation in Applications Development of specialized ABS grades for niche markets, enhancing versatility across industries. Collaborative Partnerships Formation of alliances between suppliers and manufacturers to foster innovation and improve material performance. ABS Attribute/Metric Details Market Sizing The global ABS market was valued at around USD 32.4 Billion in 2023 to USD 47.9 Billion by 2032.CAGR is 6% from 2023 to 2032. ABS Technology Adoption Rate Approximately 60% of manufacturers are adopting advanced production techniques to enhance material properties and efficiency. Top ABS Strategies for 2024 Focus on improving material strength, cost reduction, and enhancing sustainability in production processes. ABS Process Automation 35% of companies have implemented automation in ABS production to optimize efficiency and reduce waste. ABS Process Challenges Key challenges include fluctuating raw material costs, environmental concerns, and maintaining product quality. Key Suppliers Leading suppliers include INEOS, LG Chem, BASF, SABIC, and Styrolution, offering high-quality ABS products for various industries. Key Regions Covered North America, Europe, Asia-Pacific, with significant markets in China, the U.S., and Germany due to high manufacturing and demand. Market Drivers and Trends Growth is driven by the increasing demand in automotive lightweighting, consumer electronics, and sustainability efforts.ABS Market Overview:

Frequently Asked Questions (FAQ):

Our procurement intelligence services provide in-depth analysis of the ABS supplier landscape, identifying key manufacturers. We offer spend analysis, supplier performance reviews, and market insights for cost-effective sourcing

We help assess TCO for ABS by analysing raw material costs, production expenses, logistics, and maintenance, ensuring a comprehensive understanding of financial impacts.

We offer risk management solutions to address supply chain disruptions, price volatility, and quality issues, ensuring reliable procurement.

Our Supplier Relationship Management (SRM) services focus on fostering partnerships with ABS suppliers through effective collaboration, favourable contracts, and quality assurance.

We guide you in adopting best practices, including strategic sourcing, supplier segmentation, price benchmarking, and efficient contract management.

Digital tools enable real-time tracking of supplier performance, market trends, and procurement optimization, streamlining ABS sourcing processes.

Our tools monitor supplier performance on quality, delivery, and compliance, helping you make informed procurement decisions.

We provide market insights to support negotiations, securing competitive pricing, volume discounts, and flexible terms.

Our market analysis tools deliver insights on global trends, supplier market shares, and price forecasts for strategic decisions.

We offer guidance to ensure suppliers meet regulatory and quality standards, ensuring compliant and safe procurement practices.

We recommend contingency planning, backup suppliers, and risk assessments to maintain supply continuity.

Our tracking tools monitor supplier metrics like quality, delivery, and consistency for better procurement planning.

We identify suppliers using sustainable production methods and ensure they align with environmental and ethical standards.

Our pricing analysis compares supplier rates and identifies negotiation levers to secure cost-efficient procurement deals.

Table of Contents (TOC)

1. Executive Summary: Market Overview, Procurement Insights, and Negotiation Leverage

• ABS (Acrylonitrile Butadiene Styrene) Market Overview

• Key Highlights

• Supply Market Outlook

• Demand Market Outlook

• Category Strategy Recommendations

• Category Opportunities and Risks

• Negotiation Leverage and Key Talking Points

• Impact of Macroeconomic Factors (e.g., COVID-19, Inflation)

2. Research Methodology: Procurement Intelligence, Market Analysis, and Spend Analysis

Tools

• Definition and Scope

• Research Objectives for the ABS (Acrylonitrile Butadiene Styrene) Market

• Data Sources and Approach

• Assumptions and Limitations

• Market Size Estimation and Forecast Methodology

3. Market Analysis and Category Intelligence

• Market Maturity and Trends

• Industry Outlook and Key Developments

• Drivers, Constraints, and Opportunities

• Regional Market Outlook within the ABS (Acrylonitrile Butadiene Styrene) Market

• Procurement-Centric Five Forces Analysis

• Mergers and Acquisitions (M&As)

• Market Events and Innovations

4. Cost Analysis, Spend Analysis, and Pricing Insights

• Cost Structure Analysis

• Cost Drivers and Savings Opportunities

• Total Cost of Ownership (TCO) Analysis

• Pricing Analysis and Expected Savings

• Billing Rate Benchmarking

• Factors Influencing Pricing Dynamics

• Contract Pointers and SLAs

• Market Cost Performance Indicators

• Risk Assessment and Mitigation Strategies

• Spend Analytics and Cost Optimization

5. Supplier Analysis and Benchmarking

• ABS (Acrylonitrile Butadiene Styrene) Supply Market Outlook

• Supply Categorization and Market Share

• ABS (Acrylonitrile Butadiene Styrene) Market Supplier Profiles and SWOT Analysis

• Supplier Performance Benchmarking

• Supplier Performance Evaluation Metrics

• Disruptions in the Supply Market

6. Technology Trends and Innovations

• Current Industry Technology Trends

• Technological Requirements and Standards

• Impact of Digital Transformation

• Emerging Tools and Solutions

• Adoption of Standardized Industry Practices

7. Procurement Best Practices

• Sourcing Models and Strategies

• Pricing Models and Contracting Best Practices

• SLAs and Key Performance Indicators (KPIs)

• Strategic Sourcing and Supplier Negotiation Tactics

• Industry Sourcing Adoption and Benchmarks

8. Sustainability and Risk Management: Best Sustainability Practices

• Supply Chain Sustainability Assessments

• Corporate Social Responsibility (CSR) Alignment

• Risk Identification and Assessment

• Contingency Planning and Supplier Diversification

• Holistic Risk Mitigation Strategies

9. Category Strategy and Strategic Recommendations

• Market Entry Strategies

• Growth Strategies for Market Expansion

• Optimal Sourcing Strategy

• Investment Opportunities and Risk Analysis

• Supplier Innovation Scouting and Trends

• Cross-Functional Collaboration Frameworks

10. Future Market Outlook

• Emerging Market Opportunities

• Predictions for the Next Decade

• Expert Opinions and Industry Insights

11. Appendices: Procurement Glossary, Abbreviations, and Data Sources

• Glossary of Terms

• Abbreviations

• List of Figures and Tables

• References and Data Sources