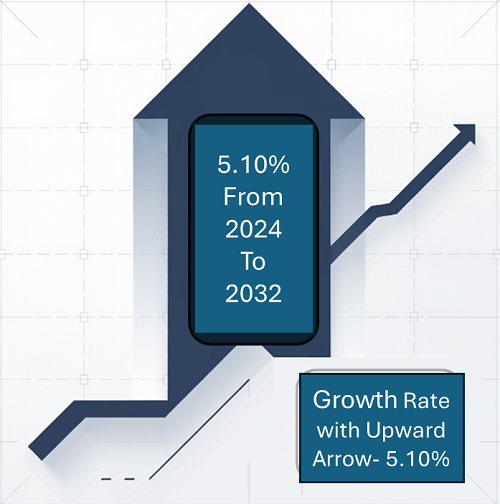

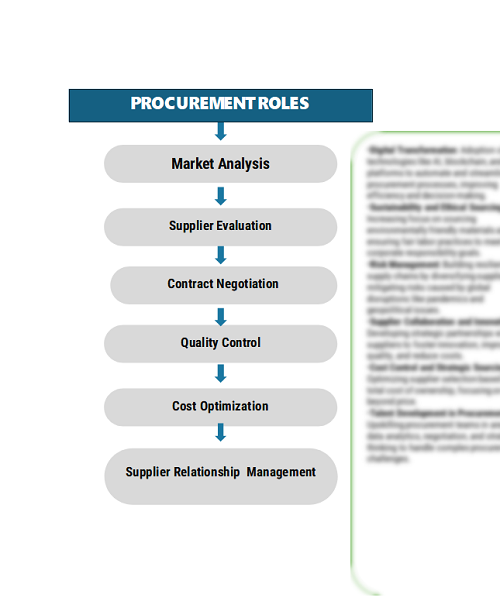

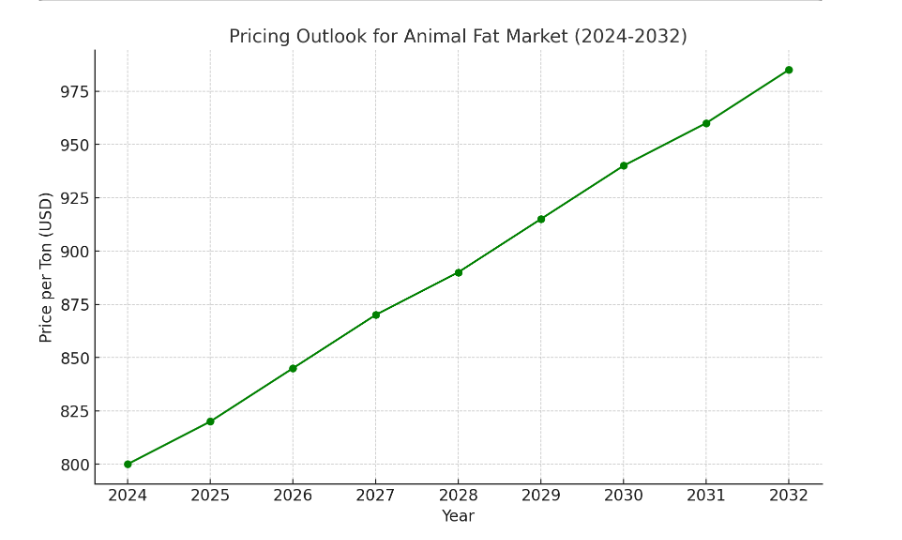

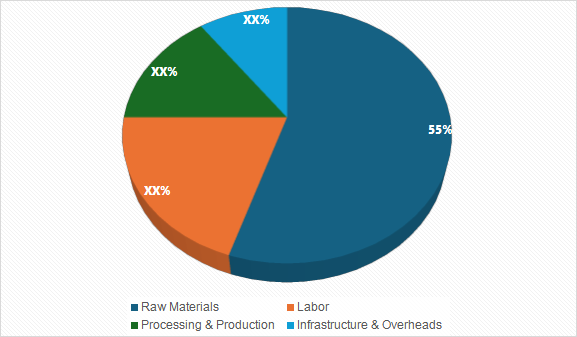

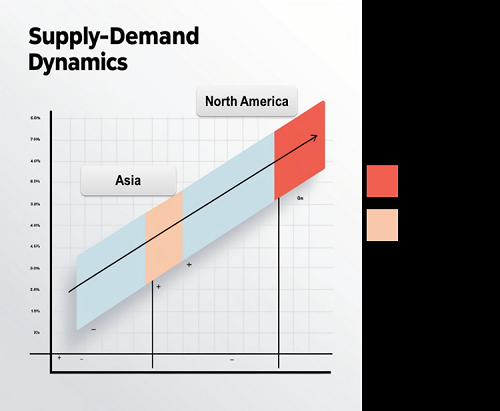

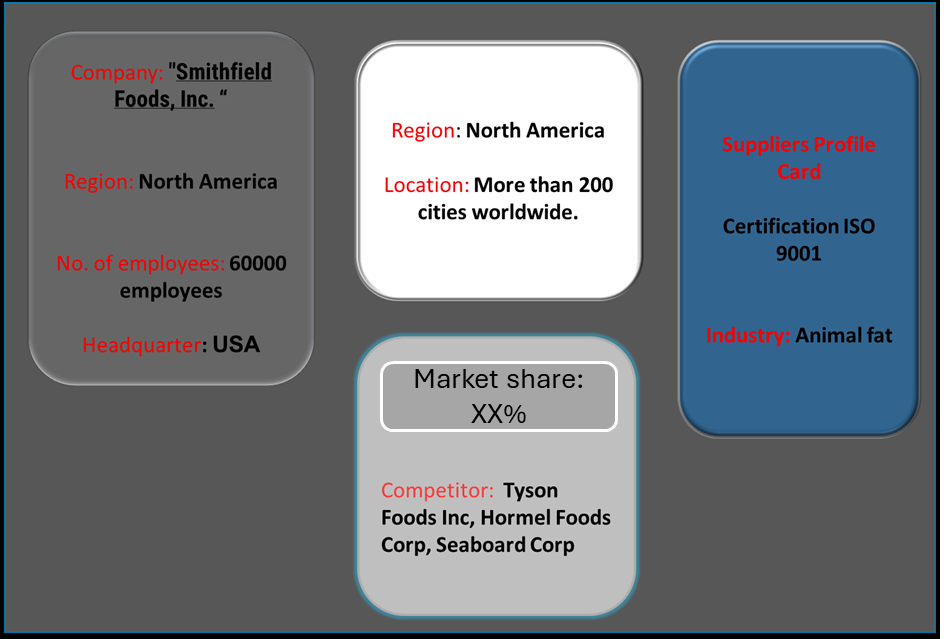

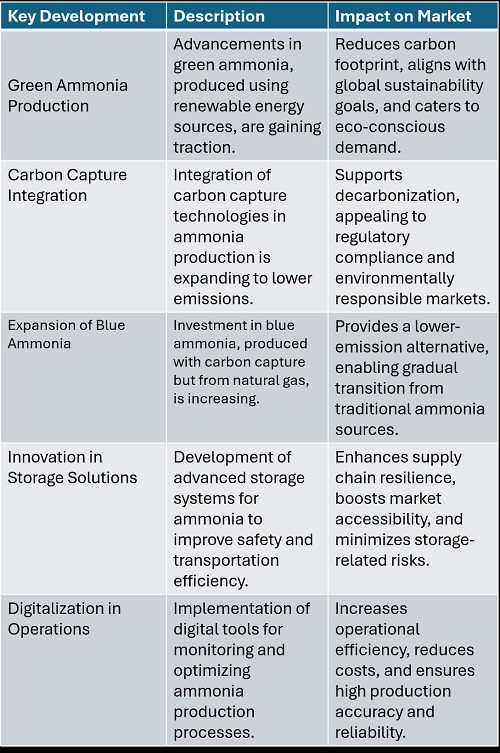

The global ammonia market is seeing steady growth, fuelled by rising demand in agriculture, industrial applications, and the production of fertilizers. This market is increasingly focused on efficiency and sustainability, driven by innovations in production technologies and environmental regulations. Our report highlights key procurement trends, focusing on cost-saving strategies through supplier partnerships and the adoption of digital tools to optimize operations. Future procurement challenges include improving supply chain resilience, accurately forecasting demand, and navigating fluctuating raw material costs. Strategic sourcing and effective procurement management are crucial for ensuring stable ammonia supply and maintaining compliance with regulatory standards. As competition intensifies, companies are leveraging procurement analytics and market intelligence to enhance supply chain efficiency and maintain their market position. The outlook for the ammonia market is positive, with robust growth anticipated through 2032, driven by several key factors: Market Size: The global ammonia is projected to reach approximately USD 83.29 billion by 2032, with an expected compound annual growth rate (CAGR) of around 5.10% from 2024 to 2032. Growth Rate: 5.10% Sector Contributions: Growth in the ammonia market is primarily driven by: Fertilizer Production: The agriculture sector is seeing a significant rise in ammonia demand due to its essential role in producing nitrogen-based fertilizers, which are critical for enhancing crop yields. Chemical Manufacturing: Ammonia is increasingly utilized as a building block in the production of chemicals, including urea and nitric acid, further propelling market growth. Funding Initiatives: Companies are heavily investing in advanced ammonia production technologies and processes to enhance efficiency, reduce emissions, and meet stringent environmental regulations. This includes the adoption of more sustainable production methods that lower the carbon footprint. Regional Insights: The Asia-Pacific region is experiencing rapid growth in ammonia demand, driven by increased agricultural activity and industrial applications. On innovative production techniques and environmentally sustainable practices to comply with evolving regulatory standards and improve product quality. Sustainable Production Methods: There is a growing emphasis on developing greener ammonia production technologies, such as using renewable energy sources and carbon capture, to reduce the environmental impact of ammonia manufacturing. Digital Transformation: The ammonia industry is increasingly adopting digital tools and automation to enhance operational efficiency, optimize supply chain management, and improve monitoring and control processes. Increased Focus on Fertilizer Efficiency: Innovations in ammonia fertilizers, such as slow-release and enhanced efficiency formulations, are gaining traction as farmers seek to maximize crop yields while minimizing environmental runoff. Regulatory Pressure: Stricter environmental regulations and sustainability initiatives are pushing ammonia producers to implement cleaner technologies and practices, aligning with global efforts to combat climate change. Rising Demand from Emerging Economies: Rapid industrialization and urbanization in emerging economies, particularly in the Asia-Pacific region, are driving up ammonia demand for agricultural and industrial applications. Growth Drivers: Expanding Agricultural Sector: The need for high-quality fertilizers to support food production and ensure food security is a primary driver of ammonia demand in agriculture. Chemical Industry Expansion: Ammonia's role as a key feedstock in the production of various chemicals, including urea and nitric acid, supports its sustained demand within the chemical manufacturing sector. Investment in Infrastructure: Increased investments in ammonia storage, transportation, and distribution infrastructure facilitate market growth and improve supply chain efficiency. Technological Advancements: Continuous improvements in ammonia synthesis technologies, such as the Haber-Bosch process, enhance production efficiency and reduce costs. Global Population Growth: The rising global population drives the demand for food and, consequently, for ammonia-based fertilizers, fuelling growth in the ammonia market. Overview of Market Intelligence Services for the Ammonia Market Recent analyses indicate that the ammonia market is facing challenges due to fluctuating raw material prices, environmental regulations, and the growing demand in agriculture and industrial sectors. Market reports provide valuable insights into cost projections and procurement opportunities, helping companies manage price volatility while ensuring a stable supply. By leveraging these insights, stakeholders can implement cost-saving strategies, improve procurement processes, and maintain efficiency in a competitive and evolving market Procurement Intelligence for Ammonia: Category Management and Strategic Sourcing To stay competitive in the ammonia market, companies are refining procurement strategies by using spend analysis tools to track supplier expenses and enhance supply chain efficiency with market intelligence. Effective category management and strategic sourcing are crucial for securing cost-efficient procurement and ensuring the timely availability of ammonia, which is vital for industries like agriculture and chemicals. Pricing Outlook for Ammonia: Spend Analysis The pricing landscape for ammonia is expected to remain relatively stable in the near term, with potential slight increases influenced by key cost factors. One primary driver of these potential price hikes is the rising cost of operational inputs for ammonia production, including natural gas prices, energy consumption, and compliance with stricter environmental regulations. As demand for ammonia continues to grow across various sectors—especially agriculture, industrial applications, and refrigeration—these rising input costs may create upward pressure on ammonia prices. Graph shows general upward trend pricing for ammonia and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic. Long-term improvements in production technology, such as more efficient synthesis processes and sustainable energy sources, could contribute to more competitive pricing for ammonia in the future. Additionally, strategic partnerships within the ammonia supply chain, such as collaborations with energy providers and logistics companies, may help stabilize costs and promote efficient procurement, allowing producers to better manage price volatility while ensuring supply reliability. Cost Breakdown for the Ammonia: Total Cost of Ownership (TCO) and Cost Saving Opportunities: Research Materials (70%) Description: : Natural gas accounts for around of the total cost in ammonia production, as it serves as both a feedstock and an energy source in the synthesis process. Trends: Recent trends indicate a growing emphasis on reducing dependency on traditional natural gas sources by exploring alternative feedstocks and renewable energy opt Fluctuations in global natural gas prices and supply chain disruptions are pushing producers to consider green ammonia, which uses renewable hydrogen. Labor (XX) Description: XX Trends: XX Publishing Services (XX%) Description: XX Trends: XX Infrastructure & Overheads (XX%) Description: XX Trends: XX Cost Saving Opportunities: Negotiation Lever and Purchasing Negotiation Strategies In the ammonia production sector, optimizing procurement strategies offers significant opportunities for cost savings and improved operational efficiency. By establishing collaborative partnerships with suppliers and industry stakeholders, ammonia producers can leverage shared resources and collective purchasing power, effectively lowering individual costs. These alliances can enhance negotiation positions with suppliers, resulting in more favorable terms and pricing for raw materials and equipment. The adoption of innovative technologies in ammonia production processes can greatly improve efficiency while reducing waste. Investing in advanced production methods, such as energy-efficient synthesis technologies and automation, streamlines workflows and enhances output accuracy, leading to lower operational costs over time. Additionally, embracing sustainable practices within the supply chain can help lower raw material expenses and appeal to a growing market of environmentally conscious customers. For instance, sourcing alternative feedstocks, such as renewable hydrogen for green ammonia production, can reduce dependency on traditional natural gas and mitigate price volatility. Supply and Demand Overview for Ammonia: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM) The ammonia market is witnessing strong growth driven by the increasing demand from agriculture, especially for fertilizers, and the industrial sector. Demand is particularly high due to the need for ammonia in various applications such as food production, chemicals, and energy, supported by collaborations between agricultural businesses, industrial companies, and regulatory bodies. Demand Factors: 1. Rising Consumer Demand: There is an increasing focus on the quality and reliability of ammonia as a key ingredient in fertilizers and industrial applications, driving higher demand across agricultural and chemical sectors. 2. Regulatory Compliance: Stricter environmental regulations related to emissions and sustainability are fuelling the need for cleaner ammonia production processes, necessitating compliance with updated standards. 3. Technological Advancements: Innovations in ammonia synthesis technologies, such as the development of green ammonia production methods, are expanding the market and attracting clients seeking environmentally friendly solutions. 4. Growth in End-Use Industries: The expansion of industries such as agriculture, pharmaceuticals, and energy are propelling the demand for ammonia, particularly in fertilizer production and energy storage applications. Supply Factors: 1. Raw Material Availability: The availability of essential raw materials, such as natural gas, can fluctuate, impacting both the production capacity and cost of ammonia. 2. Production Capacity: The ability of ammonia producers to scale operations efficiently affects the overall supply of ammonia in the market, particularly during peak demand periods. 3. Technological Advancements: Improvements in production processes and automation technologies can enhance efficiency, thereby influencing the supply dynamics and overall output of ammonia. 4. Regulatory Environment: Changes in regulatory standards and safety requirements can impose new operational guidelines, affecting the supply of ammonia by increasing compliance costs for producers. Regional Demand-Supply Outlook: Ammonia The Image shows growing demand for ammonia in both North America and Asia, with potential price increases and increased Competition. North America: Dominance in Ammonia North America particularly the U.S. and Canada, continues to lead in the ammonia characterized by: 1. High Consumer Demand: There is an increasing demand for ammonia driven by the agricultural sector, particularly for its use in nitrogen-based fertilizers. 2. Established Industry Infrastructure: North America has a well-developed infrastructure for ammonia production, including numerous manufacturing plants and distribution networks. 3. Regulatory Support: Strong regulatory frameworks in North America, particularly concerning environmental sustainability and emissions control, are influencing ammonia production. 4. Innovation and Technology Adoption: Ammonia producers in North America are increasingly investing in innovative technologies, such as green ammonia production processes, to enhance sustainability and reduce carbon footprints. North America Remains a key hub Ammonia services Innovation and Growth. Supplier Landscape for Ammonia: Supplier Negotiations and Strategies Currently, major ammonia producers dominate the market, but smaller and emerging companies are expanding by targeting niche applications and adopting innovative production techniques. Key suppliers in the ammonia market include: Mosaic Yara International CF Industries Nutrient BASF SABIC Koch Fertilizer ICL Group Euro Chem OCI Nitrogen Key Developments Procurement Category Significant Development: Ammonia Attribute/Metric Details Market Sizing Global ammonia is projected to reach approximately USD 83.29 billion by 2032, with an expected compound annual growth rate (CAGR) of around 5.10% from 2024 to 2032. Ammonia Technology Adoption Rate Around 40% of ammonia producers are adopting advanced technologies to enhance production efficiency and reduce environmental impact. Top Ammonia Strategies for 2024 Focus on improving production processes, investing in sustainable methods, enhancing supply chain management, and reducing operational costs. Ammonia Process Automation 35% of ammonia producers have automated key production processes to optimize efficiency and reduce human error. Ammonia Process Challenges Key challenges include fluctuating raw material costs, environmental regulations, and energy-intensive production processes. Key Suppliers Leading suppliers include Yara International, CF Industries, Nutrient, BASF, and Koch Fertilizer, providing a range of ammonia products and solutions. Key Regions Covered North America, Europe, and Asia-Pacific, with major markets in the U.S., China, India, and Russia due to strong industrial demand. Market Drivers and Trends Market growth driven by rising demand for fertilizers, adoption of cleaner production technologies, and increased industrial applications.Ammonia Market Overview

Key Trends and Sustainability Outlook:

The ammonia market features a diverse range of global and regional suppliers. These suppliers significantly influence market dynamics, including pricing, production technologies, and distribution networks. The market is competitive, with large industrial players and specialized firms focusing on ammonia production for various applications like fertilizers, chemicals, and energy.

Table of Contents (TOC)

Executive Summary: Market Overview, Procurement Insights, and Negotiation Leverage

. Ammonia Market Overview

. Key Highlights

. Supply Market Outlook

. Demand Market Outlook

. Category Strategy Recommendations

. Category Opportunities and Risks

. Negotiation Leverage and Key Talking Points

. Impact of Macroeconomic Factors (e.g., COVID-19, Inflation)

Research Methodology: Procurement Intelligence, Market Analysis, and Spend Analysis

Tools

. Definition and Scope

. Research Objectives for the Ammonia Market

. Data Sources and Approach

. Assumptions and Limitations

. Market Size Estimation and Forecast Methodology

Market Analysis and Category Intelligence

. Market Maturity and Trends

. Industry Outlook and Key Developments

. Drivers, Constraints, and Opportunities

. Regional Market Outlook within the Ammonia Market

. Procurement-Centric Five Forces Analysis

. Mergers and Acquisitions (M&As)

. Market Events and Innovations

Cost Analysis, Spend Analysis, and Pricing Insights

. Cost Structure Analysis

. Cost Drivers and Savings Opportunities

. Total Cost of Ownership (TCO) Analysis

. Pricing Analysis and Expected Savings

. Billing Rate Benchmarking

. Factors Influencing Pricing Dynamics

. Contract Pointers and SLAs

. Market Cost Performance Indicators

. Risk Assessment and Mitigation Strategies

. Spend Analytics and Cost Optimization

Supplier Analysis and Benchmarking

. Ammonia Supply Market Outlook

. Supply Categorization and Market Share

. Ammonia Market Supplier Profiles and SWOT Analysis

. Supplier Performance Benchmarking

. Supplier Performance Evaluation Metrics

. Disruptions in the Supply Market

Technology Trends and Innovations

. Current Industry Technology Trends

. Technological Requirements and Standards

. Impact of Digital Transformation

. Emerging Tools and Solutions

. Adoption of Standardized Industry Practices

Procurement Best Practices

. Sourcing Models and Strategies

. Pricing Models and Contracting Best Practices

. SLAs and Key Performance Indicators (KPIs)

. Strategic Sourcing and Supplier Negotiation Tactics

. Industry Sourcing Adoption and Benchmarks

Sustainability and Risk Management: Best Sustainability Practices

. Supply Chain Sustainability Assessments

. Corporate Social Responsibility (CSR) Alignment

. Risk Identification and Assessment

. Contingency Planning and Supplier Diversification

. Holistic Risk Mitigation Strategies

Category Strategy and Strategic Recommendations

. Market Entry Strategies

. Growth Strategies for Market Expansion

. Optimal Sourcing Strategy

. Investment Opportunities and Risk Analysis

. Supplier Innovation Scouting and Trends

. Cross-Functional Collaboration Frameworks

Future Market Outlook

. Emerging Market Opportunities

. Predictions for the Next Decade

. Expert Opinions and Industry Insights

Appendices: Procurement Glossary, Abbreviations, and Data Sources

. Glossary of Terms

. Abbreviations

. List of Figures and Tables

. References and Data Sources