Market Analysis

In-depth Analysis of Utility Vehicles Market Industry Landscape

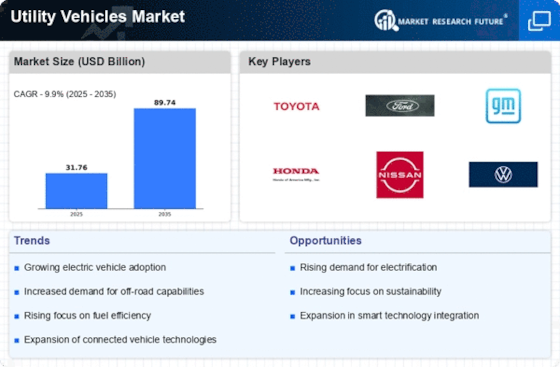

The market for utility vehicles is recognized by its dynamic and consistently evolving climate, which is affected by shopper tendencies, mechanical advancement, and administrative variables. Utility vehicles (SUVs, crossovers, as well as pickup trucks) have seen substantial growth in lately reflecting consumers' shifting inclinations and lifestyles.

The impact of purchaser inclinations available elements of utility vehicles is vital. The developing buyer inclination for flexible and multipurpose vehicles has prompted an uplifted interest in utility vehicles because of their reasonableness and usefulness. SUVs have encountered a flood in ubiquity essentially owing to their extensive lodges, expanded ground freedom, and the impression of further developed security. Right now, there is an outstanding change in the market from traditional car models to utility vehicles that offer more significant space and a directing driving position. This pattern is persuaded by the interest for a vehicle that can adjust to various way of life needs and wants.

Also, innovative improvements have added to the market's essentialness for utility vehicles. Motor productivity progressions, availability functionalities, and security advancements have arisen as basic separating factors among auto makers. Producers are in a serious scramble to consolidate state of the art highlights, including infotainment frameworks, data and correspondence frameworks, and eco-friendly impetus frameworks, as customers look for vehicles furnished with the latest innovations. The consolidation of electric and crossover innovations is adding to the continuous change of the market, as purchaser inclinations are progressively impacted by ecological manageability and oil economy.

Government strategies and guidelines likewise considerably affect the elements of the utility vehicle market. The quest for eco-friendliness guidelines and the alleviation of emanations have provoked makers to research elective power sources, like half breed and electric other options. In some areas, the adoption of eco-friendly utility vehicles has been accelerated by regulatory incentives and subsidies for electric vehicles. Furthermore, producers try to meet or outperform industry prerequisites, which thusly drives the persistent development of vehicle plan and designing because of security guidelines and emanations guidelines.

The utility vehicles market is portrayed by savage rivalry, as both deeply grounded makers and arising players endeavor to get a piece of the market. The not entirely set in stone by brand picture, valuing, and promoting methodologies notwithstanding item credits. To separate their items in a blocked commercial center, automakers are unendingly enhancing, with an accentuation on creating cars that enticement for a wide assortment of purchasers. There is a rising predominance of vital joint efforts and associations, both inside and outside the car business, as associations endeavor to gain by their corresponding abilities and speed up the course of development.

Financial elements, including however not restricted to loan costs, customer buying power, and worldwide monetary circumstances, apply an impact on market elements. The interest in utility vehicles might be affected by customer certainty and optional spending during monetary slumps. In actuality, a flood in vehicle deals might result from expanded purchaser use animated by monetary development.

The market for utility vehicles is set apart by a mind-boggling collaboration of serious powers, mechanical advancement, administrative effects, and customer tendencies. Considering the continuous changes in the auto area, utility vehicles are expected to keep up with their status as a focal area of development and change, obliging the fluctuated requests and desires of customers on a worldwide scale. The market dynamics of utility vehicles will always have an impact on the automotive industry. These dynamics could be brought about by changes in consumer preferences, technological advancements, or regulatory changes.

Leave a Comment