Increased Focus on Safety Features

Safety remains a paramount concern for consumers, significantly influencing the All-Wheel Drive Market. All-wheel drive systems are often associated with enhanced safety, particularly in challenging driving conditions such as rain, snow, and off-road scenarios. The integration of all-wheel drive technology is seen as a proactive measure to mitigate accidents and improve vehicle control. Recent statistics suggest that vehicles equipped with all-wheel drive systems can reduce the likelihood of accidents by up to 30% in adverse weather conditions. As safety regulations become more stringent and consumers demand higher safety standards, the adoption of all-wheel drive systems is expected to rise. This trend indicates a strong correlation between safety features and consumer purchasing decisions, further propelling the all-wheel drive market.

Growing Popularity of Electric and Hybrid Vehicles

The All-Wheel Drive Market is witnessing a transformation with the increasing popularity of electric and hybrid vehicles. Many manufacturers are now incorporating all-wheel drive systems into their electric and hybrid models to enhance performance and traction. This trend is particularly relevant as consumers seek environmentally friendly options without compromising on performance. Data shows that the market for electric vehicles with all-wheel drive capabilities is projected to grow by over 25% in the next five years. As automakers continue to innovate and develop all-wheel drive technologies for electric and hybrid vehicles, the market is likely to expand, catering to a new segment of environmentally conscious consumers who prioritize both sustainability and performance.

Expansion of All-Wheel Drive Offerings by Automakers

The All-Wheel Drive Market is experiencing a significant expansion as automakers broaden their all-wheel drive offerings across various vehicle categories. This strategic move is driven by the increasing consumer demand for all-wheel drive capabilities in a wider range of vehicles, including compact cars, sedans, and luxury models. Recent market analysis indicates that nearly 50% of new vehicle models introduced in the past year feature all-wheel drive options, reflecting a shift in manufacturer strategy to meet evolving consumer preferences. As competition intensifies, automakers are likely to invest more in all-wheel drive technology, enhancing their product lines to attract a diverse customer base. This expansion not only caters to consumer demand but also positions manufacturers to capitalize on the growing trend towards all-wheel drive vehicles.

Technological Innovations in All-Wheel Drive Systems

Technological advancements play a crucial role in shaping the All-Wheel Drive Market. Innovations such as electronic torque vectoring, adaptive all-wheel drive systems, and improved drivetrain technologies are enhancing the performance and efficiency of all-wheel drive vehicles. These advancements not only improve handling and stability but also contribute to better fuel efficiency, which is increasingly important to consumers. Recent studies indicate that vehicles equipped with advanced all-wheel drive systems can achieve up to 15% better fuel economy compared to traditional systems. As manufacturers invest in research and development to create more sophisticated all-wheel drive technologies, the market is likely to witness a surge in demand for vehicles that offer both performance and efficiency, thereby driving growth in the all-wheel drive segment.

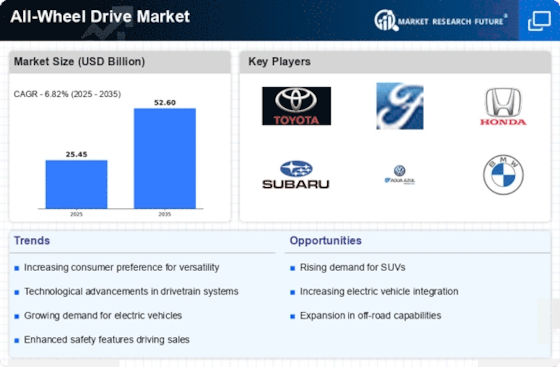

Rising Consumer Preference for All-Wheel Drive Vehicles

The All-Wheel Drive Market is experiencing a notable shift in consumer preferences, with an increasing number of buyers favoring vehicles equipped with all-wheel drive systems. This trend is largely driven by the desire for enhanced safety and performance in various driving conditions. According to recent data, approximately 40% of new vehicle sales now feature all-wheel drive capabilities, reflecting a significant rise in consumer awareness regarding the benefits of such systems. As consumers prioritize versatility and reliability, manufacturers are responding by expanding their all-wheel drive offerings across multiple vehicle segments, including sedans, SUVs, and trucks. This growing inclination towards all-wheel drive vehicles is expected to propel the market forward, as more consumers seek vehicles that can provide superior traction and stability, particularly in adverse weather conditions.