Top Industry Leaders in the Utility Vehicles Market

*Disclaimer: List of key companies in no particular order

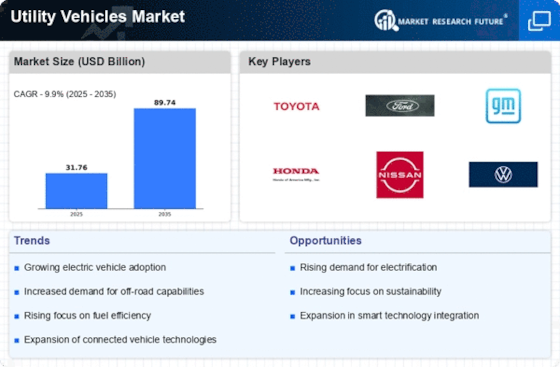

The utility vehicle market is experiencing dynamic growth, catering to various sectors such as commercial, agricultural, recreational, and personal use. Intense competition characterizes this market, with both established players and an increasing number of newcomers, particularly in the electric segment. Here, we explore the key players, strategies adopted, factors influencing market share, insights into emerging companies, and the overall competitive scenario. Additionally, we delve into the challenges and opportunities faced by the utility vehicle market and provide recent updates from prominent companies in the industry.

Key Players and Strategies:

The utility vehicle market boasts key players like BRP Inc., CFMOTO, Deere & Company, Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., KUBOTA Corporation, Mahindra & Mahindra Limited, Polaris Inc., Textron Inc., Yamaha Motor Co., Ltd., among others. These companies employ various strategies to gain a competitive edge:

Product Differentiation

Manufacturers are keen on developing innovative features and technologies to set their products apart. Electric powertrains, autonomous driving capabilities, and advanced safety features are among the areas receiving significant attention.

Brand Building

Heavy investments in brand building and marketing campaigns are made to enhance brand image and increase consumer awareness, reflecting the importance of consumer perception in this competitive landscape.

Geographic Expansion

Established players are expanding operations into new markets, particularly in Asia-Pacific and South America. This strategic move aligns with the anticipation of significant demand growth in these regions.

Mergers and Acquisitions:

Strategic mergers and acquisitions are employed to gain market share, access new technologies, and expand product portfolios. This approach helps companies stay ahead in a rapidly evolving market.

Partnerships:

Collaborations with technology companies, research institutions, and other stakeholders are pivotal for driving innovation and accelerating product development. Partnerships provide access to expertise and resources that enhance competitiveness.

Market Share Analysis:

This comprehensive analysis aids in identifying popular vehicle segments, growth regions, and potential customer segments, allowing companies to tailor their strategies accordingly. The utility vehicle market's competitiveness is shaped by a blend of innovation, strategic alliances, and brand strength. Key players navigate challenges and capitalize on opportunities, while new entrants contribute to the market's dynamism. The industry's future promises continued growth, marked by technological advancements and evolving consumer preferences.

New and Emerging Companies:

The entry of new players, particularly in the electric UTV segment, intensifies competition. These agile and innovative entrants leverage emerging technologies and disruptive business models, challenging established players. The industry's competitive landscape is further diversified by these newcomers.

Overall Competitive Scenario:

The utility vehicle market's competitive landscape is highly dynamic and fragmented. Established players face pressure from new entrants and the rapid pace of technological change. Continuous competition is expected, with a focus on innovation, brand building, and strategic partnerships to gain a competitive edge.

Challenges and Opportunities:

Despite challenges such as rising raw material costs, supply chain disruptions, and evolving regulations, the utility vehicle market presents opportunities for companies that can adapt and innovate. The increasing demand for electric vehicles and the popularity of outdoor activities open new avenues for market growth and expansion.

Company Updates:

Recent updates from key players highlight ongoing developments in the utility vehicle market:

- BRP Inc. (November 2023) announced a partnership with a leading battery manufacturer to develop electric powertrains for its utility vehicles.

- CFMOTO (October 2023) launched a new line of utility vehicles with upgraded engines and features.

- Honda Motor Co., Ltd. (August 2023) introduced a new electric utility vehicle concept targeting the agricultural market.

- Deere & Company (September 2023) disclosed plans to invest USD 1 billion in the development of new and autonomous utility vehicles.

- Kawasaki Heavy Industries, Ltd. (July 2023) partnered with a leading technology company to develop autonomous driving technology for utility vehicles.