Market Share

India Electric Vehicle Market Share Analysis

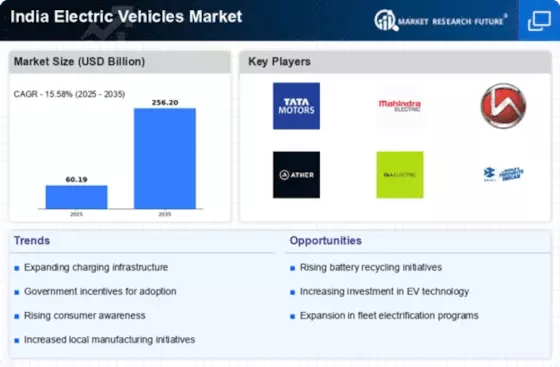

The Indian electric vehicle (EV) market is experiencing significant growth, and companies are adopting various market share positioning strategies to gain a foothold in this evolving landscape. Differentiation is a prominent strategy, where manufacturers strive to distinguish their EVs through unique features and capabilities. This may include advanced battery technology, innovative design, or enhanced performance to attract consumers looking for cutting-edge and reliable electric vehicles. By offering something distinct from competitors, companies aim to capture the attention of a specific segment of the market and build brand loyalty.

Pricing plays a crucial role in market share positioning within the Indian EV market. Some companies opt for a cost leadership strategy, focusing on providing affordable electric vehicles to appeal to a broader customer base. Achieving economies of scale, optimizing production processes, and sourcing materials efficiently allow manufacturers to offer competitive prices without compromising on quality. This strategy is particularly relevant in a price-sensitive market like India, where affordability often influences purchasing decisions.

Partnerships and collaborations are instrumental in shaping the market share positioning of India's electric vehicle manufacturers. By forming alliances with other industry players, companies can pool resources, share expertise, and collectively address challenges. Collaborations may involve partnerships with technology companies for advanced features, tie-ups with infrastructure providers for charging solutions, or joint ventures with government bodies to navigate regulatory landscapes. Such strategic alliances not only enhance the overall value proposition but also contribute to the growth and sustainability of the electric vehicle ecosystem.

Sustainability and environmental consciousness are gaining prominence in the Indian market, and electric vehicle manufacturers are strategically positioning themselves as eco-friendly alternatives. Companies invest in research and development to improve the environmental credentials of their EVs, emphasizing reduced carbon emissions, energy efficiency, and recyclability. This strategy aims to resonate with environmentally conscious consumers and align the brand with the larger sustainability movement, contributing to a positive perception of electric vehicles in the Indian market.

Market segmentation is a key element of market share positioning in India's electric vehicle sector. Recognizing the diverse needs of consumers, manufacturers develop EVs tailored for specific segments such as urban commuting, long-distance travel, or commercial applications. By understanding and addressing the unique requirements of different market segments, companies can optimize their product portfolios and effectively cater to the varied demands of the Indian consumer base.

Government incentives and policies also play a pivotal role in market share positioning for electric vehicle manufacturers in India. With the Indian government actively promoting electric mobility through subsidies, tax benefits, and other supportive measures, manufacturers strategically align their offerings to leverage these incentives. Companies that align their products with government initiatives can gain a competitive edge, making their electric vehicles more appealing to cost-conscious consumers and fostering a favorable market environment.

Effective marketing and communication strategies are essential for successful market share positioning in the Indian electric vehicle market. Manufacturers invest in building brand awareness, advertising, and education campaigns to communicate the benefits of electric vehicles to a diverse audience. Clear communication about features, performance, and the overall value proposition helps build trust and influence consumer perceptions. By effectively conveying the advantages of electric vehicles, manufacturers can position themselves positively in the minds of Indian consumers, contributing to the broader adoption of electric mobility in the country.

The Indian electric vehicle market is witnessing dynamic growth, and companies are employing diverse strategies to position themselves strategically. Through differentiation, pricing, partnerships, sustainability emphasis, market segmentation, and effective communication, manufacturers navigate the competitive landscape to capture market share and contribute to the ongoing transformation of the Indian automotive industry towards sustainable and electric mobility.

Leave a Comment