Market Trends

Key Emerging Trends in the Beverage Cans Market

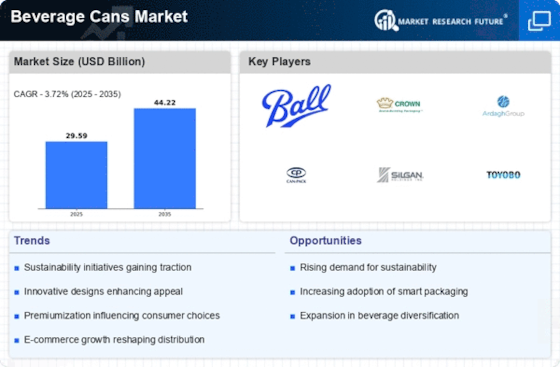

The beverage cans industry has been observing some notable trends lately due to changing consumer tastes and environmental considerations. One such trend is the growing demand for environmentally friendly and sustainable packaging solutions. Another key trend observed in this market pertains to innovative can designs with functional capabilities. In order to make their products stand out from others on shelves and attract customers, soft drink companies have started investing in unique-looking cans. These might include resealable lids, temperature-sensitive inks, or interactive packages that improve overall consumer experience at a large scale. Through these major technological advances, brand recognition has become easy while focusing on changing consumer needs. Additionally, there has been an increase in low-calorie drinks and functional beverages, leading to a surge in demand for healthier beverage choices, which are associated with lower calorie counts. Therefore, because of their lightweight nature, which makes transportation easy, these health-centered beverages are usually packaged using beverage cans. Moreover, there has been a shift towards e-commerce and online sales channels resulting from the COVID-19 pandemic, which significantly affected market dynamics. While consumers increasingly shop online for all their wants, makers of beverages need revolutionary packing techniques that suit the unique requirements of e-commerce, like durability during shipping space efficiency, among other examples. This shift has led to a greater focus on packaging options like beverage cans designed for enhanced strength and ease of e-commerce supply chains. Furthermore, there are more distinct regional differences in market trends. Moreover, emerging markets, particularly those in the Asia-Pacific and Latin America regions, are experiencing increasing urbanization and a growing middle class, which have resulted in increased consumption of packaged beverages. As such, these regions have witnessed an upsurge in demand for beverage cans as they provide a cost-effective and convenient packaging option for both non-alcoholic and alcoholic drinks. Furthermore, on the regulatory front, there is a greater focus on sustainability and recycling initiatives. Governments, together with environmental agencies, have come up with strict measures that promote the use of recyclable materials to reduce the environmental impact caused by packaging. Beverage cans are highly recyclable; hence, they resonate well with these regulatory trends, making them a favorite for soft drink manufacturers as well as eco-conscious consumers.

Leave a Comment