Market Share

Beverage Cans Market Share Analysis

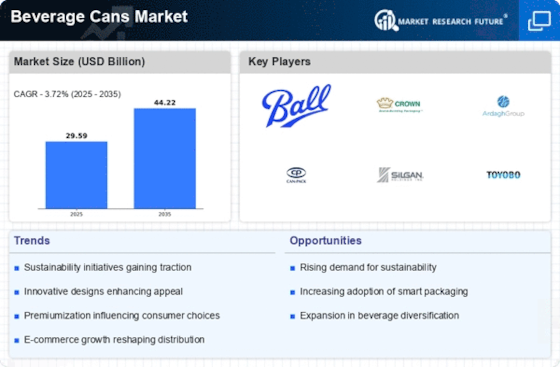

The beverage cans market is one of the most dynamic areas within the packaging industry, and it adopts various strategies aimed at gaining a competitive advantage and meeting diverse consumer needs, thereby enhancing market shares. Companies primarily use product differentiation to define their beverage cans from others in order to make them unique, either through their characteristics, designs, or functionalities. Product uniqueness helps brand recognition while at the same time addressing customer wants. Market share positioning by pricing strategy is another important area to consider in the beverage cans market. Different firms apply different pricing models, which are determined by such factors as costs, target markets, and perceived quality. Some brands may choose to identify themselves as premium products when they stress good materials as well as modern manufacturing processes, thus raising prices. On the other hand, some prefer cost leadership, whereby they want many customers to buy their cheap but quality canned drinks. Besides using product differentiation and pricing strategies, companies in the Beverage Cans Market concentrate on creating strong distribution channels. In the process of gaining market share, it is important to have good coverage in retail outlets, online platforms, supermarkets, and also at convenience stores. Within the Beverage Cans Market, brand positioning determines market share more than anything else. Developing a strong and positive brand image builds a rapport between companies and consumers, consequently leading to brand loyalty among consumers. The beverage cans' unique selling points are emphasized by ineffective marketing campaigns while also communicating the company's values on their different platforms. Social media has grown to be a very important tool for businesses when targeting their clients whose feedback is required. Sustainability serves as an important factor in shaping market share for beverage cans today. This can be attributed to higher environmental awareness among consumers, which allows firms to incorporate environmentally friendly practices into their manufacturing operations. Using recycled materials, reducing carbon emissions, and promoting recycling drives not only attract eco-aware customers but also help build up positive corporate images. Lastly, strategic alliances play significant roles in terms of how market shares are placed within the Beverage Cans Market. Partnerships with beverage manufacturers, like promotional tie-ins or co-branding, may increase the visibility and attractiveness of a particular beverage can to its target groups. Companies come together through such collaborations so that they leverage each other's customer bases, creating synergies that benefit all parties involved.

Leave a Comment