In May 2023,

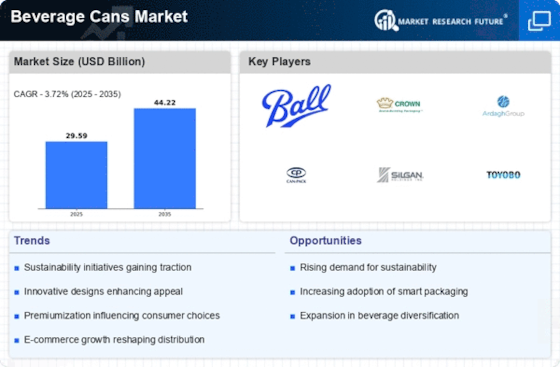

Ball Corporation, a leading beverage can manufacturer, announced plans to invest $1 billion in new can manufacturing capacity in the United States. This investment is being driven by the growing demand for beverage cans, particularly in the beer and hard seltzer categories.

In June 2023,

Crown Holdings, another leading beverage can manufacturer, announced plans to acquire Rexam PLC, a British beverage can manufacturer. This acquisition will create the world's largest beverage can manufacturer.

In July 2023,

Coca-Cola announced that it would be switching to 100% recyclable beverage cans in all of its markets by 2025. This is a major step towards reducing the environmental impact of beverage cans.

In August 2023,

Anheuser-Busch announced that it would be launching a new line of canned cocktails in the United States. This is a growing trend in the beverage industry, as canned cocktails are seen as a convenient and portable way to enjoy alcoholic beverages.

In July 2022

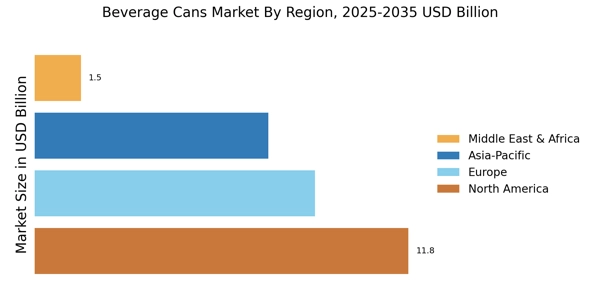

, Canpack S.A., a subsidiary of the Canpack Group, announced plans to build a new aluminum can manufacturing facility in Poços de Caldas, Minas Gerais, Brazil. The initial total capacity at the new plant will be around 1.3 billion cans per year at a cost of $140 million approximately.

In October 2020

, Ball Corporation entered into a partnership with Kroenke Sports & Entertainment, advancing sustainability through aluminum beverage packaging

Crown Embalagens Metálicas da Amazônia has teamed up with local beverage producer Socorro Bebidas from Brazil to launch Socorro’s new range of flavored mineral waters in CrownSleek cans (Stilwell, 2022). Acquíssima Sabor flavored mineral water contains no calories and is available in a 350ml CrownSleek can be supplied by Acquíssima’s parent company, Crown Holdings’ affiliate firm, Crown Embalagens Metálicas da Amazônia.

Currently being sold at various restaurants as well as Acquíssima stores and supermarkets across Brazil, these recently launched products were meant for the health concerned customers and came in two flavors: Lychee and Green Apple, according to Socorro commercial director Maurício Cruz. “With this latest addition to our Acquíssima portfolio,” said Socorro commercial director Maurício Cruz.

Meanwhile, Aurora Cannabis Inc., which trades on NASDAQ: ACB TSX: ACB stock exchanges, has a presence in Canada and international markets as one of the leading medical cannabis businesses worldwide. In its operations, the company is focusing on launching three new cannabis-infused beverages that would be exclusively available to veterans first. In order to help patients who are seeking alternative ways of using marijuana for health reasons such as taste or strength, this release of drinks was made.

For instance, Neon Rush, Strawberry Pineapple Tropical Fizz, and Pineapple Coconut Fizz are among three fruity flavors of these Vacay- and Versus-produced offerings that can be purchased at Aurora Medical; three cannabis-infused products produced by Vacay and Versus (Tatham & Ochieng’, 2022) respectively. The new cannabis-infused beverages have been crafted with SōRSE® emulsion technology for little to no cannabis aroma or taste and may be bought in 355ml cans.