Top Industry Leaders in the Beverage Cans Market

The beverage can market, a familiar fixture in supermarkets and refrigerators worldwide, is far from stagnant. This seemingly simple container is the battleground for fierce competition. Let's crack open the insights on the players, strategies, and recent developments shaping this dynamic market.

The beverage can market, a familiar fixture in supermarkets and refrigerators worldwide, is far from stagnant. This seemingly simple container is the battleground for fierce competition. Let's crack open the insights on the players, strategies, and recent developments shaping this dynamic market.

Market Masters: Major Players Shaping the Global Sip

A diverse range of aluminum and tin-plated steel giants carve up the global beverage can market share. Some of the top contenders include:

-

Crown Holdings Inc.: This American giant boasts a global reach and a broad portfolio of can designs, catering to various beverage categories.

-

CCL Industries Inc.: A Canadian leader, CCL Industries caters to both North American and international markets with its innovative can solutions.

-

CPMC Holdings Inc.: This Chinese powerhouse dominates the Asian market with its efficient production capabilities and cost-effective offerings.

-

Ardagh Group S.A.: A Luxembourgian player with a strong European presence, Ardagh Group focuses on sustainability and lightweight can designs.

-

Toyo Seikan Co., Ltd.: This Japanese giant specializes in aluminum cans and caters primarily to the Asian market.

Strategies for Stealing the Fizz: How Players are Gaining an Edge

To stay ahead in this competitive market, players are adopting diverse strategies:

-

Material Mastery: Investing in research and development for lighter, stronger, and more sustainable aluminum and steel alloys helps reduce costs and cater to environmental concerns. -

Customization Conquers: Providing innovative can designs, shapes, and sizes allows players to stand out from the crowd and meet specific beverage requirements. -

Technological Triumphs: Advanced printing technologies enable eye-catching graphics and branding to boost shelf presence and consumer appeal. -

Partnerships for Progress: Collaborations with beverage companies, distributors, and recycling facilities foster innovation and expand market reach. -

Sustainability Savvy: Investing in recycling infrastructure and developing closed-loop production processes aligns with environmental regulations and resonates with eco-conscious consumers.

Market Share Magnets: What Makes Consumers Pop the Tops?

Market share in this competitive landscape is influenced by several factors:

-

Material diversity and sustainability: Offering lightweight, reusable, and recyclable cans aligns with environmental regulations and consumer preferences. -

Performance prowess: Cans with excellent barrier properties, extended shelf life, and tamper-evident seals ensure product quality and safety, appealing to both brands and consumers. -

Cost-effectiveness: Compared to glass or plastic alternatives, cans offer a cost-effective packaging solution for both manufacturers and consumers. -

Convenience crown: Lightweight, portable, and easily recyclable cans provide on-the-go convenience and cater to busy lifestyles. -

Aesthetic allure: Sleek designs, vibrant colors, and innovative finishes enhance brand recognition and shelf presence, driving consumer purchase decisions.

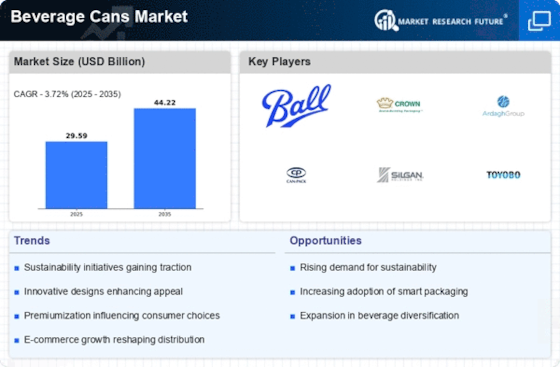

Key Players

- BWAY Corporation (U.S.),

- Kian Joo Can Factory Berhad (Malaysia),

- Toyo Seikan Group Holdings, Ltd. (Japan),

- CPMC Holdings Ltd. (China),

- Orora Packaging Australia Pty Ltd (Australia),

- HUBER Packaging Group GmbH (Germany),

- Crown Holdings Incorporated (U.S.),

- Ball Corporation (U.S.),

- Ardagh Group (Luxembourg),

- Silgan Holdings Inc. (U.S.), and

- Can-Pack SA, (Poland)

Recent Developments

-

August 2023: Crown Holdings and Ardagh Group partner to develop a fully recyclable aluminum can liner, addressing concerns about plastic waste. -

October 2023: CCL Industries unveils a new line of high-barrier can coatings that extend shelf life, reducing food waste and optimizing logistics. -

December 2023: CPMC Holdings announces plans to expand its production capacity in Southeast Asia, aiming to capitalize on the region's growing beverage market. -

In 2023, AkzoNobel Packaging Coatings has developed a new BPA non-intent (BPA-NI) internal coating for beverage can end that represents an alternative to bisphenol A (BPA). Manufacturers of cans and coil coaters who are phasing out use of bisphenol A (BPA) now have an alternative: the new BPA non-intent (BPA-NI) internal coating for beverage can ends by AkzoNobel Packaging Coatings.

CPMC Holdings is a major Chinese company. It is a success because it invested heavily in research and development. Thus, it was able to remain profitable and develop a sustainable competitive advantage by developing and marketing innovative new products.

Marlish Waters Ltd, a UK-based drinks company, launched a new 150 ml can format for its tonics and mixers beverage range in June 2023. This fresh packaging is aluminum-made without glass.