Rising Demand for Portability

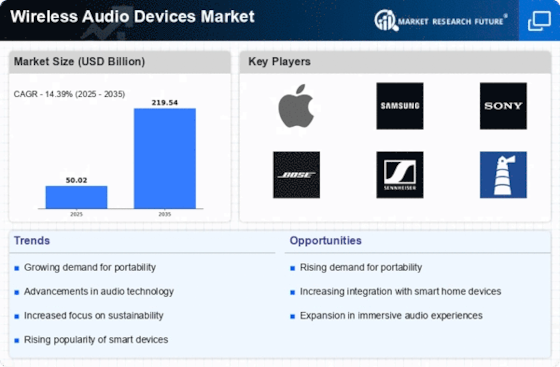

The Wireless Audio Devices Market experiences a notable surge in demand for portable audio solutions. As consumers increasingly prioritize convenience, the need for lightweight and compact devices has become paramount. This trend is particularly evident among younger demographics, who favor wireless headphones and earbuds for their on-the-go lifestyles. According to recent data, the market for portable audio devices is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by advancements in battery technology, which enhance the usability of wireless devices. Furthermore, the proliferation of mobile devices has created a symbiotic relationship, as users seek audio solutions that complement their smartphones and tablets. Thus, the emphasis on portability is likely to remain a key driver in the Wireless Audio Devices Market.

Advancements in Audio Technology

Technological innovations play a crucial role in shaping the Wireless Audio Devices Market. The introduction of high-resolution audio formats and improved Bluetooth codecs has significantly enhanced sound quality, attracting audiophiles and casual listeners alike. Recent advancements in noise-cancellation technology have further elevated the user experience, making wireless devices more appealing. Market data indicates that the segment of high-end wireless headphones is witnessing substantial growth, with sales expected to increase by over 15% in the coming years. This trend suggests that consumers are willing to invest in premium audio experiences, driven by the desire for superior sound quality and functionality. As manufacturers continue to innovate and integrate cutting-edge technology into their products, the Wireless Audio Devices Market is poised for continued expansion.

Expansion of E-commerce Platforms

The Wireless Audio Devices Market is experiencing a transformation due to the expansion of e-commerce platforms. As online shopping becomes increasingly prevalent, consumers are more inclined to purchase wireless audio devices through digital channels. Recent statistics indicate that e-commerce sales in the electronics sector have risen by over 20% in the past year, reflecting a shift in consumer purchasing behavior. This trend is particularly beneficial for niche audio brands that may not have a strong presence in physical retail stores. E-commerce platforms provide these brands with the opportunity to reach a broader audience, thereby driving sales growth. Additionally, the convenience of online shopping, coupled with competitive pricing and customer reviews, enhances the overall consumer experience. As e-commerce continues to evolve, it is likely to play a pivotal role in shaping the future of the Wireless Audio Devices Market.

Growing Interest in Fitness and Wellness

The Wireless Audio Devices Market is significantly influenced by the rising interest in fitness and wellness. As more individuals engage in physical activities, the demand for wireless audio devices tailored for exercise has increased. Fitness enthusiasts often seek headphones that offer comfort, durability, and sweat resistance, leading to a surge in sales of sports-oriented wireless audio products. Market Research Future suggests that the segment of fitness-focused audio devices is expected to grow by approximately 12% annually. This growth is fueled by the integration of health-tracking features in audio devices, allowing users to monitor their performance while enjoying music. As the fitness trend continues to gain momentum, the Wireless Audio Devices Market is likely to benefit from this growing consumer interest.

Increased Adoption of Streaming Services

The proliferation of streaming services has a profound impact on the Wireless Audio Devices Market. As more consumers subscribe to platforms offering music and audio content, the demand for compatible wireless audio devices has surged. Data indicates that the number of streaming subscribers has doubled in recent years, leading to a corresponding increase in the sales of wireless headphones and speakers. This trend is particularly pronounced among younger consumers, who prefer to access music on-demand rather than through traditional media. Consequently, manufacturers are focusing on creating devices that seamlessly integrate with popular streaming services, enhancing user convenience. The synergy between streaming platforms and wireless audio technology is likely to drive further growth in the market, as consumers seek devices that enhance their listening experiences.