Expansion of Streaming Services

The expansion of streaming services is a pivotal driver for the wireless audio-devices market. With platforms like Spotify, Apple Music, and Tidal gaining immense popularity, consumers are increasingly seeking devices that can seamlessly connect to these services. The market data suggests that the number of streaming subscribers in the US has surpassed 100 million, creating a substantial demand for compatible audio devices. This trend encourages manufacturers to enhance connectivity features, such as voice assistant integration and multi-device pairing, to cater to the evolving needs of consumers. As a result, the wireless audio-devices market is likely to witness sustained growth as more users adopt streaming as their primary source of music.

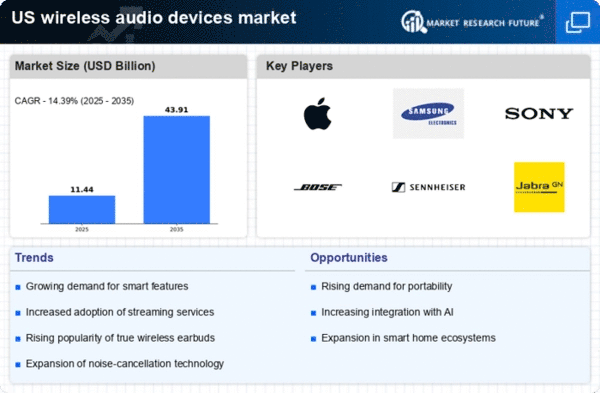

Growing Demand for Smart Features

The wireless audio-devices market is driven by the growing demand for smart features. Consumers are now looking for devices that offer more than just audio playback; they desire functionalities such as voice control, integration with smart home systems, and personalized audio settings. The market data indicates that approximately 40% of consumers are willing to pay a premium for smart audio devices that enhance their lifestyle. This trend is prompting manufacturers to innovate and incorporate advanced technologies, such as artificial intelligence and machine learning, into their products. As a result, the wireless audio-devices market is likely to expand as more consumers seek devices that align with their tech-savvy lifestyles.

Increased Focus on User Experience

The wireless audio-devices market witnesses a heightened focus on user experience, which is becoming a critical differentiator among brands. Companies are investing in features that enhance usability, such as touch controls, customizable sound profiles, and noise cancellation technologies. This emphasis on user-centric design is reflected in consumer feedback, with surveys indicating that 70% of users prioritize ease of use and comfort when selecting audio devices. As competition intensifies, brands that successfully integrate these features are likely to capture a larger market share. This trend suggests that the wireless audio-devices market will continue to evolve, driven by the demand for products that offer not only superior sound quality but also an exceptional user experience.

Rising Consumer Preference for Portability

The wireless audio-devices market is influenced by the growing consumer preference for portability. As lifestyles become more mobile, individuals are seeking audio solutions that are easy to carry and use on the go. This trend is evident in the increasing sales of wireless earbuds and portable speakers, which have seen a rise of over 20% in unit sales in recent years. The convenience of wireless devices, coupled with advancements in battery technology, allows users to enjoy high-quality audio without the constraints of wires. Consequently, manufacturers are focusing on creating lightweight and compact designs, which is likely to further propel the wireless audio-devices market.

Technological Advancements in Audio Quality

The wireless audio-devices market is experiencing a surge in demand due to rapid technological advancements in audio quality. Innovations such as high-resolution audio codecs and improved Bluetooth technologies are enhancing the listening experience. For instance, the introduction of aptX HD and LDAC codecs allows for higher fidelity sound transmission, appealing to audiophiles and casual listeners alike. This trend is reflected in the market data, which indicates that the segment for high-end wireless audio devices is projected to grow by approximately 15% annually. As consumers increasingly seek superior sound quality, manufacturers are compelled to invest in research and development, thereby driving growth in the wireless audio-devices market.