Growth of Home Theater Systems

The Audio Amplifier Market is experiencing growth due to the rising popularity of home theater systems. As consumers seek to replicate the cinematic experience at home, the demand for high-quality audio amplifiers is increasing. This trend is particularly pronounced in regions where home entertainment systems are becoming a staple in households. Market analysis indicates that the home theater segment is projected to grow at a rate of approximately 7% annually, driven by advancements in audio technology and the increasing availability of affordable home theater solutions. Consumers are increasingly investing in multi-channel amplifiers that enhance their audio experience, leading to a surge in sales for manufacturers. Consequently, the Audio Amplifier Market is adapting to meet this demand, with a focus on developing amplifiers that provide superior sound quality and compatibility with various home entertainment devices.

Rising Demand for High-Quality Audio

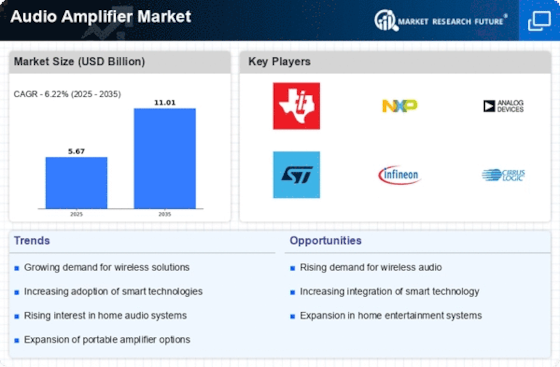

The Audio Amplifier Market experiences a notable surge in demand for high-quality audio solutions. As consumers increasingly seek superior sound experiences, the market for audio amplifiers is expanding. This trend is particularly evident in sectors such as home entertainment and professional audio systems, where the need for enhanced audio fidelity is paramount. According to recent data, the audio amplifier segment is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years. This growth is driven by advancements in audio technology and the proliferation of high-definition audio formats, which necessitate the use of sophisticated amplifiers to deliver optimal sound quality. Consequently, manufacturers are focusing on developing innovative products that cater to this demand, thereby propelling the Audio Amplifier Market forward.

Increased Adoption of Portable Audio Devices

The Audio Amplifier Market is witnessing a shift due to the increased adoption of portable audio devices. As consumers gravitate towards mobile and wireless audio solutions, the demand for compact and efficient amplifiers is on the rise. This trend is particularly relevant in the context of personal audio devices such as smartphones, tablets, and portable speakers, which require high-performance amplifiers to deliver quality sound. Market data suggests that the portable audio segment is expected to grow by approximately 10% over the next few years, driven by the popularity of streaming services and the need for on-the-go audio solutions. Manufacturers are responding to this trend by developing smaller, lightweight amplifiers that do not compromise on sound quality. As a result, the Audio Amplifier Market is evolving to accommodate the changing preferences of consumers, emphasizing portability and performance.

Technological Advancements in Amplifier Design

Technological advancements play a crucial role in shaping the Audio Amplifier Market. Innovations in amplifier design, such as the integration of digital signal processing and Class D amplification, are revolutionizing the way audio is amplified. These advancements not only improve sound quality but also enhance energy efficiency, making amplifiers more appealing to environmentally conscious consumers. Recent studies suggest that the adoption of Class D amplifiers is expected to increase by over 20% in the coming years, driven by their compact size and lightweight nature. Furthermore, the introduction of wireless technologies and smart features in amplifiers is likely to attract a broader consumer base. As manufacturers continue to push the boundaries of technology, the Audio Amplifier Market is poised for significant growth, with innovative products that cater to diverse consumer preferences.

Expansion of the Music and Entertainment Industry

The Audio Amplifier Market is significantly influenced by the expansion of the music and entertainment sector. As live performances, concerts, and events become more prevalent, the demand for high-performance audio amplifiers is on the rise. This trend is underscored by the increasing number of music festivals and live shows, which require robust audio systems to ensure an immersive experience for audiences. Market data indicates that the live sound reinforcement segment is expected to witness substantial growth, with a projected increase in revenue of around 8% annually. This growth is attributed to the need for reliable and powerful amplifiers that can handle large venues and diverse audio requirements. As a result, manufacturers are investing in research and development to create amplifiers that meet the evolving needs of the entertainment industry, thereby enhancing the Audio Amplifier Market.