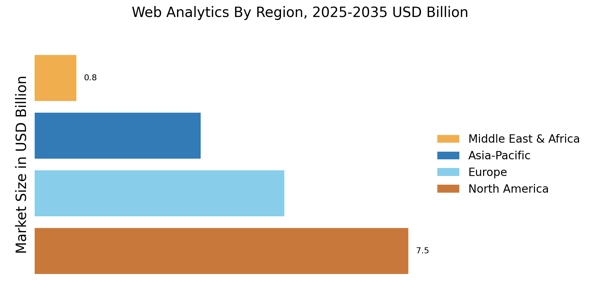

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American web analytics market is anticipated to expand at a significant CAGR during the study period, accounting for USD 1.68 billion in 2021. North America is projected to dominate the market in the coming years owing to the wide adoption of advanced and latest technology among various organizations to enhance their websites publishing about services and products. The presence of key players especially in the US acts as a key driving factor for the market growth in the region.

The region has witnessed favorable conditions for market growth due to the implementation of data management technologies, government regulations, established player presence, and interest from enterprises to apply ML and BI solutions. Leading technology players such as Google, AWS, Salesforce, Microsoft, and IBM have been investing significantly in R&D activities for developing new AI-based solutions.

These companies target higher revenue due to the increasing competition across North America. Apart from these established players, startups also receive funding from various bodies for their innovative ideas and products. Moreover, the major countries covered in the market report include the United States, Germany, Canada, France, the United Kingdom, Italy, Spain, India, Japan, Australia, China, South Korea, and Brazil.

Figure 3: WEB ANALYTICS MARKET SHARE BY REGION 2022 (%)

The European web analytics market is the world's second-largest owing to the rise in adopting cloud and IoT technologies and high rate of implementation of the analytics solutions as the IT infrastructure in this region is well developed. Elements like the strong presence of major web analytics providers and well-established technology development centers drive the market growth. Moreover, the region's increasing investments in AI and machine learning are integral to future marketing automation products. Companies like Amazon and Apple leverage artificial intelligence to conduct voice-based marketing through devices like Alexa and Siri.

This is further expected to enhance the development of the market. Further, the German web analytics market held the largest market share, and the France web analytics market was the fastest-growing market in the European region.

The Asia Pacific web analytics market is expected to grow at the fastest rate of CAGR during the forecast period. This is because of the increasing number of analytics outsourcing activities and increased adoption of analytics solutions by the various end user industries. Moreover, increasing marketing services and social media presence in this region is a key driver for the regional market growth.

Besides, some of the significant factors, such as the growing adoption of SaaS cloud services, increasing demand for data integration services, and expanding 5G network coverage, are estimated to provide a massive scope for the market studied in the region. Furthermore, China’s web analytics market held the largest market share, and the Indian web analytics market was the fastest-growing market in the Asia-Pacific region.