Expansion of E-Commerce Platforms

The rapid expansion of e-commerce platforms in the GCC is significantly influencing the web analytics market. With online retail sales projected to reach $25 billion by 2025, businesses are increasingly investing in web analytics to monitor and enhance their online performance. This trend is particularly pronounced in the UAE and Saudi Arabia, where digital shopping is becoming the norm. Web analytics tools enable e-commerce companies to track user interactions, conversion rates, and sales funnels, providing critical insights that inform marketing strategies. Consequently, the growth of e-commerce is likely to propel the demand for sophisticated web analytics solutions, further solidifying their role in the web analytics market.

Integration of Advanced Technologies

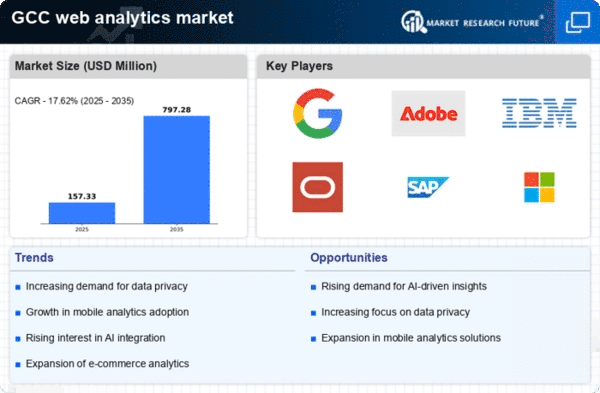

The integration of advanced technologies such as artificial intelligence and machine learning is reshaping the web analytics market in the GCC. These technologies enable more sophisticated data analysis, allowing businesses to derive actionable insights from vast amounts of data. Companies are increasingly adopting predictive analytics to forecast trends and customer behavior, which enhances their strategic planning. The market is witnessing a shift towards automated analytics solutions, which can process data in real-time and provide immediate feedback. This technological evolution is expected to drive a growth rate of around 18% in the web analytics market as organizations seek to leverage these innovations for competitive advantage.

Increased Focus on Customer Experience

In the GCC, there is a growing emphasis on enhancing customer experience, which is driving the web analytics market. Organizations are increasingly aware that understanding customer journeys and preferences is vital for retention and satisfaction. By utilizing web analytics, businesses can gather data on user interactions, identify pain points, and tailor their offerings accordingly. This focus on customer-centric strategies is reflected in a 20% increase in the adoption of analytics tools aimed at improving user experience. As companies strive to create personalized experiences, the web analytics market is likely to see continued growth, as these tools become integral to customer engagement strategies.

Regulatory Compliance and Data Governance

As data privacy regulations become more stringent in the GCC, the web analytics market is adapting to meet compliance requirements. Organizations are increasingly prioritizing data governance to ensure that their analytics practices align with legal standards. This shift is prompting businesses to invest in web analytics solutions that offer robust data protection features. The market is likely to see a rise in demand for tools that facilitate compliance with regulations such as the General Data Protection Regulation (GDPR) and local data protection laws. Consequently, the focus on regulatory compliance is expected to drive growth in the web analytics market, as companies seek to mitigate risks associated with data breaches and non-compliance.

Rising Demand for Data-Driven Decision Making

data-driven decision-making In the GCC region, businesses are leveraging web analytics tools to gain insights into customer behavior, preferences, and trends. This shift is evidenced by a reported growth rate of approximately 15% in the adoption of analytics solutions among enterprises. As companies strive to enhance their competitive edge, the integration of web analytics into their strategic frameworks becomes essential. The ability to analyze web traffic and user engagement allows organizations to optimize their marketing strategies and improve customer experiences, thereby driving growth in the web analytics market.