Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Wastewater Treatment Services Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Wastewater Treatment Services industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Wastewater Treatment Services industry to benefit clients and increase the market sector. In recent years, the Wastewater Treatment Services industry has offered some of the most significant advantages to medicine.

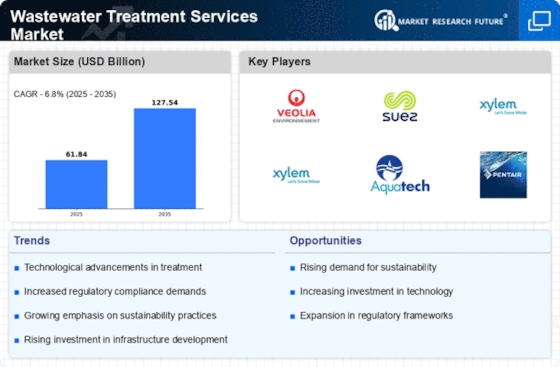

Major players in the Wastewater Treatment Services Market, including Veolia (France), SUEZ Worldwide (France), DuPont (U.S.), 3M (U.S.), Xylem (U.S.), Kemira (Finland), Evoqua Water Technologies LLC (U.S.), Pentair PLC (U.K.), Ecolab (U.S.), American Water (U.S.), Acciona (Spain), Hydro International (U.K.), Aquatech International LLC (U.S.), Trojan Technologies (Canada), BioMicrobics Inc. (U.S.), Kurita Water Industries Ltd. (Japan), ASIO (Czech Republic) and others, are attempting to increase market demand by investing in research and development operations.

Environmental management services are offered by Veolia Environnement SA (Veolia). The business provides services for the treatment and distribution of drinking water, wastewater treatment options, waste collection, waste-to-energy processing, dismantling, and the processing of hazardous material. It provides energy solutions across the whole conversion cycle, from acquiring energy sources into an industrial site to constructing new facilities or updating older ones to reselling the electricity generated on the open market. In Europe, Asia, North America, Latin America, Africa, the Middle East, and Oceania, the corporation provides services to public agencies, local authorities, industrial and commercial service clients, and private persons.

The head office of Veolia is located in Paris, Ile-de-France, France.

Manufacturer and distributor of industrial goods and services is 3M Co. The company's product line also includes advanced materials, display materials and systems, stationery and office supplies, home care, home renovation, roofing granules, closure and masking systems, and other items. Additionally, 3M provides a range of services, including medical, dental, consumer health, food safety, and health information systems. Customers from a variety of industries, including automotive, electronics, health care, safety, energy, and consumer, are served by it. Asia Pacific, Europe, the Middle East, Africa, and the Americas are all regions where the corporation has manufacturing and converting operations.

The US city of St. Paul, Minnesota, is home to 3M.