Market Analysis

In-depth Analysis of Wastewater Treatment Services Market Industry Landscape

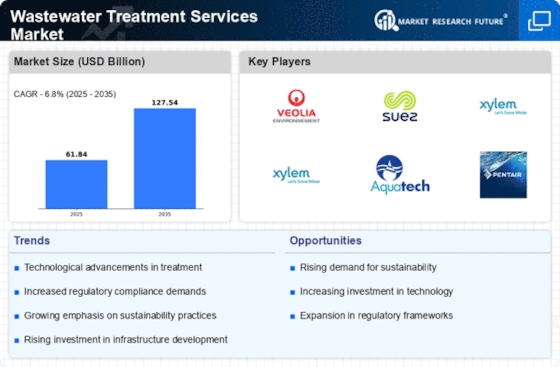

The wastewater treatment services market is influenced by various market dynamics that shape its growth and development. One key factor driving this market is increasing concerns about water pollution and the need for effective wastewater management solutions. With rapid urbanization, industrialization, and population growth, the volume of wastewater generated has been on the rise, necessitating the implementation of advanced treatment technologies and services.

Government regulations and policies play a significant role in driving the demand for wastewater treatment services. Stringent environmental regulations aimed at protecting water bodies from contamination have compelled industries and municipalities to invest in wastewater treatment infrastructure. Compliance with these regulations often requires upgrading existing treatment facilities or implementing new ones, thereby driving the demand for wastewater treatment services.

Technological advancements also drive market dynamics in the wastewater treatment services sector. Innovations in treatment technologies, such as membrane filtration, biological treatment processes, and advanced oxidation processes, have improved the efficiency and effectiveness of wastewater treatment. As a result, there is a growing demand for services related to the installation, operation, and maintenance of these advanced treatment systems.

Furthermore, increasing awareness about the importance of water conservation and sustainability has led to the adoption of more eco-friendly and energy-efficient wastewater treatment solutions. Companies offering wastewater treatment services are increasingly focusing on developing sustainable practices and solutions that minimize energy consumption, reduce chemical usage, and maximize water recovery.

Market competition is another key dynamic shaping the wastewater treatment services market. With the growing demand for these services, numerous companies are entering the market, leading to increased competition. This competition drives innovation and pushes companies to offer better services, technologies, and pricing options to attract customers.

Moreover, market consolidation is a significant trend observed in the wastewater treatment services sector. Larger companies are acquiring smaller firms to expand their service offerings, geographic presence, and customer base. This consolidation allows companies to achieve economies of scale, improve operational efficiency, and strengthen their market position.

The COVID-19 pandemic has also impacted the wastewater treatment services market dynamics. While the pandemic initially led to disruptions in supply chains and project delays, it also highlighted the importance of resilient and reliable wastewater infrastructure. As a result, there has been increased investment in upgrading and expanding wastewater treatment facilities to enhance resilience against future crises.

Global economic factors also influence market dynamics in the wastewater treatment services sector. Economic growth, industrial output, and infrastructure development directly impact the demand for wastewater treatment services. As economies grow and industries expand, the volume of wastewater generated increases, driving the need for wastewater treatment solutions.

Leave a Comment